Whew! I don't know about you but I am glad this week is over! I'm just glad I had all of you to share it with.

I made a couple of changes today within my trading account today. I guessed that a brief selloff would materialize around lunchtime and, luckily, I absolutely nailed it. I made a very quick and tidy little profit on some ES calls. I quickly rolled out of them and now I am in:

1) October gold call spreads 1700 vs 1800

2) December gold call spreads 1700 vs 1800

3) September silver call spreads 40 vs 45

Only the silver makes me nervous (time is short) and has me worried (didn't rally back today like everything else). Actually, it kind of pisses me off a little bit. The ES rallies 40 points. Gold rebounds $15. Crude bounces back $3. Silver...blechk. Oh well, I must be patient. Provided there are no overwhelmingly bad headlines over the weekend, we look to head into Monday with a general "risk ON" mindset. Maybe I'll catch a break.

Speaking of headlines, did you see this a few minutes ago?

https://blogs.abcnews.com/politicalpunch/2011/08/govt-official-us-expecting-sp-downgrade.html

If you were wondering why gold was so strong on the Globex, I guess you just got your answer! Personally, I still cannot believe that a U.S.-based ratings agency will be allowed to downgrade U.S. government debt. The implications for insurance companies, mutual funds and pension funds would be calamitous. I'll guess we'll see.

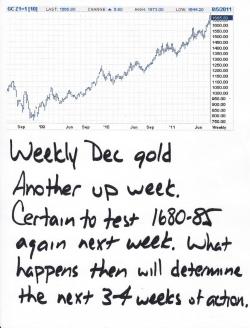

OK, onto the charts. First, let's take a look at gold. For all the craziness, the Dec gold contract finished UP another $34. Headline risk is everything at this point, however, gold looks certain to test the 1680-85 level again next week. After that, it's anyone's guess. IF it rallies another $40 next week and closes near or above $1700, all bets will come off. Gold will have the appearance of an accelerating uptrend as it would be breaking out and through its nearly three year uptrend. It's going to be a very exciting and consequential week.

Silver isn't nearly as exciting. You know I've been going on and on lately about lack of follow-through due to the meager 120,000 short interest. OI finally perked up this week as we headed toward 42+ and then, of course, came the smashdown. This weekly chart looks sickly and, frankly, gives me a feeling that 36 is in the cards before we ever go back and break through 42. In the very short-term, however, I can see an early-week rally next week that takes silver back up near $40 and maybe even $40.50. You can bet you arse I'll be dumping that spread when it gets there.

Lastly, I've received several requests for an opinion on crude. I had hoped that 88-90 would hold but, once that failed in the massive dump on Thursday, you had to figure that 84 was in the cards. You can see that on the chart below. That should do it. IF 84 fails, it looks like it could trade to 80. At 80, it would sure look to be one heckuva good buy. If anyone out there is trading crude, be sure to buy yourself plenty of time. It looks to go much higher but maybe not as soon as next week. Be patient and you'll be rewarded.

OK, that's all for now. I'm going to take a couple of days off so consider this your open thread for the weekend. I think we all found great value from this site this week. Go forth and convert as many new Turdites as possible.

TF

p.s. It's 10:00 pm EDT Friday night and I felt I had to chime in. I must admit that I am absolutely stunned and flabbergasted that S&P has officially downgraded U.S. debt to AA+ with a negative outlook. This is truly an historic event and one that will have repercussions for weeks and months to come. At first glance, I can't see how the PMs don't experience a huge rally on Monday but, who knows? One thing I do know, however, is that gold and silver will be higher in a month. They'll be higher still in six months and even higher a year from now. The Great Keynesian Experiment is ending. Do not, under any circumstances, sell you precious metal. They are your only financial protection.