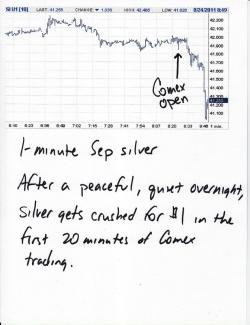

In what can only be considered option expiry shenanigans, a pleasant overnight was abruptly ended by the monkeys and the algos this morning as trading opened on the Comex.

Check out these amazing charts below. They are like chalklines left on the ground at a crime scene. The gold Comex opened on schedule at 8:20. Note the the first five minutes were actually positive. Then, as soon as the silver Comex opened at 8:25, the wrath of God (or Blythe) was brought down upon the gold pit. Gold was smashed for $20 in 20 minutes. Silver hung in there for 6 minutes before succumbing to peer pressure. It proceeded to drop a full dollar in 15 minutes. Selling in both pits climaxed at 8:48.

Again, this is no coincidence. Someone or something wanted out of gold this morning and was convinced to hold off on hitting bids until the silver Comex opened. With option expiry tomorrow, The EE will use every trick available to suppress price. Harvey mentioned last night that he thought the target of EE affection was the $42 level in silver. He may be right. I mean, look at this chart and look where the price was when the beatdown began.

So, if there is a direct, coordinated, manipulated takedown going on (and I think there is), what would be the goal?

After all the fear and hysteria yesterday, there were no margin hikes last night. In the end, I guess that's not surprising. Remember, the C/C/C uses volatility as their excuse to raise margins. Plant a few rumors around that margin hikes are imminent and you get an $80 selloff. How about that? There's the volatility the C/C/C needs in order to execute their diabolical scheme. I wrote on Monday night that I expected the criminals to time their next hike in order to get the biggest "bang for their buck". Optimal timing would still be Thursday or Friday, ahead of the assuredly "disappointing" Jackson Hole Hoedown. Another possibility would be to wait for Monday and use the weakness and volatility that a Hoedown letdown would create. Either way, I still think that gold margins are going up and that prices are going down, at least in the very short term.

So, Turd, what do you expect then? Let's see if, by later today, gold can trade down to initial strong support near 1820. It would take silver down with it, let's say to somewhere near 40.50. At that point, Blythe takes her stilleto off of our collective jugular and let's prices rise from the canvas. The metals rally the remainder of the week but in a muted sense. Gold recovers to 1840 or so. Silver bounces back 41.50-42. If the paragraph above then plays out, I could see gold falling next week all the way back to 1725-1740. This would be a near perfect 10% correction from the highs of Monday night and it would set the stage for the next leg up.

Silver would be taken along for the ride, of course. If you look at the chart below, you can clearly see that a drop to 38.50-39 is entirely possible. Again, this would not indicate the end of the world. It would, however, give us all an excellent point at which to begin building or rebuilding positions.

Let me wrap up with this disclaimer. The above fairy tale is an attempt to predict the future. It should not be taken as seriously as "Turd's Bottom", "1600 by 6/10/10" or "44 by Labor Day". Instead, it is The Turd trying to make some sense of the current situation. It should either be treated as a short-term planning tool or simply as the entertaining ramblings of a delusional megalomaniac.

Have a fun day! TF