As you know, we moved from blogspot to this dedicated site for many reasons. The primary reason, however, was to capitalize on the collective knowledge and wisdom of Turdtown. I, The Turd, can only take you so far. I knew we needed a platform through which we could more efficiently share information. To see the effectiveness, all you have to do is look below.

Let me just state this clearly and for the record. If you are coming this site only to read what The Great and Powerful Turd has to say, you are doing yourself a tremendous disservice. The information copied and pasted below proves the point. These three comments were all posted to the "So, What's Next?" column from Monday night, when gold was still between $1890 and $1910. If you'd taken the time to read through the comments, you'd have found this. Perhaps you would have taken action. Note the time stamp:

Shanghai Gold Exchange Raises Gold Trading Margin To 12%

SHANGHAI, Aug 23 (Reuters) - The Shanghai Gold Exchange (SGE) will raise trading margins on three of its gold spot deferred contracts to 12 percent from 11 percent starting from Aug. 26 to limit trading risk, it said in a statement on Tuesday.

The next morning, another Turdite even provided a translation of the text:

Yes, here is the link - https://gold.hexun.com/2011-08-23/1327314

从8月25日(星期四)日终清算时起,上海黄金交易所将调整黄金Au(T+D)、Au(T+N1)和Au(T+N2)合约的保证金比例至12%;

下一交易日起黄金Au(T+D)、Au(T+N1)和Au(T+N2)合约涨跌停幅度调整为9%。

It syas that Sahnghai Exchange will increase the margin for 3 type of paper gold contract (Au(T+D)、Au(T+N1)和Au(T+N2)to 12%. and will stop the gain and loss to 9% during the same day trading.

The Exchange also warns the investors to be prepared for the vulnerability of international Gold and silver market. Some investors had huge loss last time when silver price dropped 25% within a week.

This event is now being heralded by some as the seminal cause of this latest $150 correction in gold. The links and translation were posted here well before ZH or any other PM site.

Another warning of the impending disaster was provided by a different Turdite:

re: Gold smackdown coming...

look at the options activity on GLD...

$4,040,919 puts at 175 bought yesterday

$1,019,046 puts at 170 bought yesterday

$1,221,472 puts at 165 bought yesterday

Even a trend down to any of these numbers, for those unfamiliar, will likely make these options double, triple, or more. GLD doesn't have to get to 165 to make the trade at 165 worth the purchase.

Can the EE make money shorting "Gold" on the crimex? Don't forget, in bringing down Gold, Silver will follow, along with its options, as well as miners (and, of course, their options). So once you knock over the first domino, the rest will fall.

They may take a loss on shorting Gold this time, as the physical demand will be overwhelming on the way down AND back up (they won't cover all their Gold contracts at a gain... it will likely be a net loss) BUT they will more than make up any possible losses with covering the miner stocks sold short while they are down, closing the put positions, etc.

There is still a gap in the 1500 - 1600 range, isn't there? (Seems like last week... but LOOOOOONNNNNGGGGG ago price wise). I don't know if that gap will be filled.... (It may be a 'flash crash' that only WOPR can fill orders for the EE in that range.. taking out trader stops only).

Here's the relevant data (https://finance.yahoo.com/q/op?s=GLD&m=2011-09)

Again, my point is not to rub salt in the wound. My point is simple and clear:IF YOU'RE NOT TAKING THE TIME TO UTILIZE THIS ENTIRE SITE, YOU ARE SERIOUSLY MISSING OUT AND IT IS COSTING YOU MONEY. The Turd tips his hat to "Dogstar76", "The Freeman" and "silver foil hat". Very nice job. Thank you for your help.

OK, back to the disaster at hand. Everyone wants to blame today's collapse on the Chinese margins. OK. The volatility makes C/C/C margin hikes a fait accompli so everyone and their brother is rushing for the exits. In the end, I suspect that the actual margin hikes can be used as a "sell the rumor, buy the news" event. We'll see. Lets' just hope the volatility settles down next week, thereby denying the criminals the justification to raise 3 more times like they did in silver. Again, we'll see.

I suspect that the story below didn't help matters, either. Anyone with a brain and chimpanzee-level logic can deduce that the report is absolute nonsense. However, that matters little when the WOPRs are busy trying to front-run each other out the door.

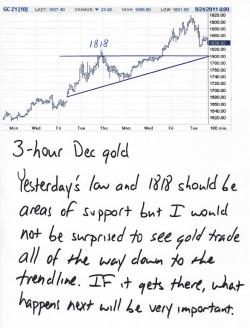

I could print some new charts for you but they wouldn't look much different from the ones I posted this morning so I'm giving you some re-prints. Gold now looks certain to test the 1725-1740 area. This would represent a nearly exact 10% correction so, anyone such as I that is interested in" catching the knife" might take a stab there. No pun intended. Silver is the same. I just betcha you get a look at 38.50-75 pretty soon. If you're going to nibble, that'd be the place to do it.

That's all for now. I hope you're hanging in there OK. If not, step away from your computer for a while and take a few deep breaths. Maybe go for a relaxing walk. None of this changes the fact the fiat money is headed down the drain and that the end of the Great Keynesian Experiment is upon us. Gold and silver will be higher again soon. You are doing the right thing by protecting yourself and your family. TF

5:45 EDT UPDATE:

In a stunning development that has caught everyone by surprise, the criminal C/C/C (CME/Comex/Cartel) just raised margins on gold by about 27%. In case you missed it, it's a development that was predicted here two days ago:

https://www.tfmetalsreport.com/blog/2155/so-whats-next

My mistake was that I thought that gold was going to be allowed higher in order to create the disorder that the C/C/C needed to justify their actions. I thought that they would want to suck in a few more latecomers before they put the hammer down. (But, as Ted Buter correctly points out, the last $300 or so of the gold rally was almost entirely all Cartel short-covering, so, there were no latecoming specs to add to the fold. If I'd remembered this on Monday night, the crash on Tuesday would have been more predictable.) In the end, it didn't really matter as the PMs were crushed on Tuesday before any of you could try to attempt to cash in on the last remaining upticks.

We need to dissect this, though, because there is a lot to be learned...and remembered...for next time. The primary rationale for raising margins (containing price) is volatility. However, by Monday night, gold was just $90 above the level where the C/C/C had raised margins on 8/11. Yes, it had rallied from a hike-induced bottom of 1725 but it had done so in an orderly manner and not in a way that made another margin hike necessary. But the CME desperately wanted to raise margins in an attempt to rescue their evil Cartel buddies who were trapped short in a market that looked to be headed to $2000 very soon. Hmmmm. What to do?

You start by letting word out to some select friends that margin hikes are on the horizon. You then catch a break as the Shanghai exchange raises margins, too. At about noon yesterday, just when it looked like the metals were recovering, you confirm to some EE and hedgie friends that a margin hike is coming. By the end of the day, gold is already down almost 5% and you're building a case for "volatility-managing" hikes. Uh-oh. Gold recovers overnight. It actually makes it back up to 1860 or so. Therefore, before the Comex open today, you sprinkle word around that margins are definitely being raised after the close. The selling begins at 8:30 and is relentless all the way through the session. Gold falls another 6% and...prestowhammo...you've got yourself all the volatility and justification needed to hike margins.

Next up, The Bernank will "disappoint" over the weekend which may further add to the selling pressure in the PMs. I'm not sure how much worse it can get as gold is already down almost 10% since Monday and 10% or so is the typical decline post a margin hike. As stated in the comments of this thread, I'm looking for a bottom in gold somewhere between 1700 and 1725. At this rate, though, I wouldn't be surprised if gold traded all the way down to fill the gap on the chart from two weeks ago when the U.S. downgrade announcement was made. A move that low would take gold all the way back to 1650 or so. The globex session finished at 1754 and we'll likely see some carryover selling in Asia and in Europe. Tomorrow will be interesting.

Lastly, don't forget that gold margin hikes are an indirect positive for silver. The C/C/C is unwittingly "leveling the leverage playing field" in the PMs. Much of the disparity in the relative performance of gold vs silver these past few weeks has been due to silver's much higher margin requirements. Higher gold margins flatten out this difference and make silver look more attractive than it did earlier this week. Combine this with the extraordinarily strong OI and CoT numbers for silver and you can clearly see where $50 silver is still a target before the end of the year.

Have a fun evening. TF