Well, don't you wonder what the world will look like come Monday? So many unpredictable events are coming that it makes the job of being Turd significantly more challenging. However, The Turd is up to the task and willing, once again, to attempt to predict the unpredictable.

First up, the short term. As postulated late yesterday, the metals rallied overnight and are rapidly approaching the points from which their enemies will be able to proclaim any future decline as evidence of a head-and-shoulders top. This H&S top notion is almost as silly as the "gold in a bubble" nonsense but they're going to spout it anyway and CNBS will lap it up like hungry kittens. As The Turd's old man used to say: "Do you know what motel spelled backward is? Let om". In this case, that logic applies. Let the buffoons spout all the bubble and top nonsense that they want. It doesn't matter. The metals are still going significantly higher before year end and none of the top-calling douchebags will be held accountable for being wrong anyway.

For today, I predicted yesterday that gold could see 1790-1800 and that silver could see 41.80-42.20. Upon further review, I'd like to refine those numbers just a bit. Now, we may have already seen the highs and they are both close enough to those targets that they may not trade much higher. Gold touched 1798 and silver tapped 41.34. I don't think silver will trade much higher than 41.50 today but it could still reach up to the goals stated yesterday. Gold, on the other hand, still could see some upside. IF it can trade through 1800, it has a decent chance of making it all the way to 1820 or so. If it does, I will be looking to lighten some Oct calls before the weekend.

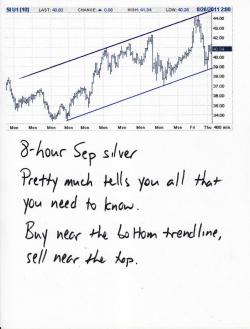

That said, the long term picture for both metals remains quite positive, regardless of the nonsense you hear on financial TV. Both of the charts below are very instructive and I plan on updating them frequently in the coming days and weeks as I believe they represent the true picture of what to expect for future price movements. Note that silver is in a very nice up channel. This is much appreciated as it is something that takes much of the complication out of trading. Gold, on the other hand, has a chart formation that you rarely ever see. Let's call it a "reverse pennant" and it is indicative of an uptrend that has an increasing level of volatility. IF this trend continues, we can use this chart to make a lot of fiat as the swings up and down are only going to get wider.

I'd like to close today with a couple of housekeeping items.

1) Civility. Please remember that we are trying to build a place here that is unlike other internet sites. We treat others the way we want to be treated. This leads me to...

2) The goal of this site is to help and educate as many as possible through our collective experience and wisdom. The site is used by people ranging in age from 13-93. If you would be uncomfortable using certain language, innuendo and images around you daughter or your grandmother, then don't bring it here. Use discretion.

3) Try to take it easy on poor, old Blythe. During work hours, she may be a heartless shrew who takes pleasure in the blatant manipulation of the metals. In her personal life, her bio paints a portrait of someone different. I guess my point is: It's beneath us to deride her with nasty slang on her personal sites. Let others do that if they feel they must. We here should be more concerned with surviving the disaster that is most assuredly coming.

4) I do, from time to time, delete things. This is not censorship. Censorship is an impairment of your right to free speech in the public arena. This is not a public arena. This is my website. I own it. I decide what gets viewed and what stays posted. That said, I've only deleted a handful of things in the first 60 days and most of it was copyrighted material that could not be allowed to stay.

Finally, be very careful as we head into the weekend. The current pattern in gold is frighteningly similar to the pattern of silver back in late April. The Sunday Night Massacre followed the first margin hike and occurred during a thinly-traded Globex session the preceded a London holiday. Gold has now seen two margin hikes and this Sunday's Globex session also precedes a London holiday. Throw in the fact that many market participants will be MIA Sunday evening due to what looks to be an ongoing hurricane and you get an almost ideal setup for the criminal C/C/C to unleash Sunday Night Massacre II. Not sayin...just sayin.

Have a great day. I'll try to update after the close. TF