I hope you're sitting down because these charts are not pretty.

First of all, I'm not going to waste your time with 15-minute and 2-hour charts because, frankly, those charts aren't worth the paper they'd be printed on. In a global liquidation event, you can throw TA and the fundos out the window. Eventually, however, buyers will emerge to take advantage of the discounted prices. The question is, where? Maybe we can find some answers on the longer-term charts.

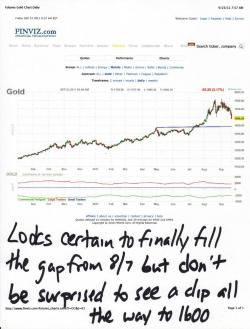

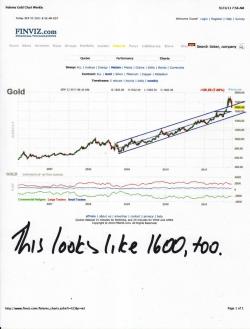

First up, gold. Of course, none of the fundos have changed. More on that in a minute. Technically, however, gold looks like it could drop another $100 or so. We've been following the 8/7 gap on the charts since it happened. Though there have certainly been moments when it looked like gold would not go down and fill that gap, it appears almost certain now. And don't expect it to stop there. The charts below certainly seem to indicate that gold could fall below 1600 before finding some substantial bids. Therefore, for now, I'm not buying anything. Not even any physical. I'm waiting, confident that I can save $100/ounce if I'm patient.

Silver is an absolute disaster but it is only doing what silver does. As I mentioned last night, if you elect to trade in an unregulated market that is dominated by an uber-short which has virtually unlimited financial and political backing to defend its position, you're going to get your ass kicked every once in a while. And I don't think that the current beating is over yet. Furthermore, if you're a believer in the whole "wynter benton" thing, then how can seriously expect JPM to go down without a fight? In fact, this kind of 24-hour destruction almost validates the entire WB "story". If JPM really is threatened by "60 days of silver over " or whatever it is, then wouldn't you expect them to hammer silver before the deadline? I mean, they're not going to go all Dylan Thomas on you and simply "go gentle into that good night". That said, if silver doesn't stop right here, at the lows of May, then it's going considerably lower, as the charts below show. Though I'd love to buy some more Maples here, I'm waiting on this one, too. At , I can buy 4 sleeves for the same amount of fiat that would get me 3 sleeves at .

One last thing, I may not know much but one thing I do know is that this whole "deflation is coming" stuff is bullshit. Yes, by failing to add additional QE this week, The Fed had set off a chain of events that will finish off any hope of economic recovery and, yes, the value of your house and your 401(k) is headed lower. However, deflation will not solve the current global debt crisis. That's not how it works. You cannot deflate your way out of debt. Period. End of story. Not open for discussion. The only way out is devaluation of the currency. Period. End of story. Not open for discussion.

What we are entering is the worst possible outcome and the worst of all worlds for the average, everyday person. Your fiat-based wealth is going to decline. Your wages will stagnate if not decline. But, the cost you pay for everything from milk to bread to gasoline is going to skyrocket. Eventually, this will lead to civil unrest, political instability and even revolutions. So let me state this again very clearly: THE ONLY FINANCIAL PROTECTION YOU HAVE AGAINST THIS COMING MADNESS IS PHYSICAL GOLD AND SILVER. Period. End of story. Not open for discussion.

OK, that's all for now. Hang in there and be patient. Help each other. Do not be small and/or petty. Use your brain. Do not panic like the sheep. Stay alert. Survive and prosper. TF

11:15 am EDT UPDATE:

The metals are catching some bids but don't allow yourself to get sucked in just yet. Dec11 gold bottomed at 1668 but that is still about $16 above the level it needs to fall to if it's going to close that gap on the daily chart. I can't imagine gold falling all this way and not closing the gap so look for at least a double-bottom soon, if not a dip toward 1650 and slightly below. Be patient. Contrary to previous Friday's, I doubt there will be much buying on the afternoon Globex. Probably more selling, instead, as weak hands head for the exits rather than stay long over the weekend.