Though I've tried to swear off the short-term charts for the time being, the price action today and tonight drew me back in. Then, with the addition of a little of Mrs. F's white-out, look what I found.

Again, it's way too early to get excited. There's a lot of blood in the water so aqua-vermin are still circling. However, the charts below are just interesting enough to give us some optimism.

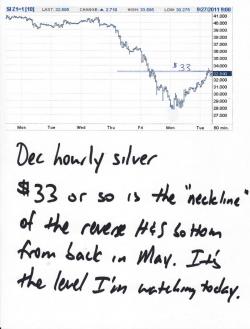

Longtime readers will recall that, after events of extreme and fishy volatility, I sometimes like to paint some white-out on the charts to see if it changes the look and feel of the situation. Tonight is one such time. By applying the white-out to remove the ridiculously sharp, LBMA-inspired drops of early this morning, an interesting pattern emerges on both the gold and silver charts.

Look at that! That almost looks like a bottom you can believe in!

Let's see where this takes us from here. IF 28-29 in silver and 1580-1600 in gold can hold a bit longer, confidence will grow. IF the lines I've drawn can be crossed to the upside, confidence will grow even stronger. The 1665 level in gold is particularly significant as you will recall that that is the area where the 8/7/11 gap on the chart was opened and then filled last week. A move back above 1665 that holds for a few days would be an extremely positive technical development.

OK, now I'd just like to take a second and complain a bit.

1) This blog and website was started last year was because, for some unknown reason, people wanted easy access to what I was thinking during the trading day and after hours. In keeping true to this theme, I update my thoughts, based on current events, regularly throughout the day. I have never gone back, after the fact, and edited or deleted anything, no matter how foolish something may look with the benefit of hindsight. So, what chaps my behind a bit is when folks comment or email me to point out what a fool I am because 10 days ago I thought gold at 1800 was a pretty good buy. First of all, it still is but it's an even better buy at 1600. That notwithstanding, to look back at old posts and then criticize them doesn't seem very fair. I did my best, at the time, to analyze the situation based upon current information. So, please, enough with the monday-morning-quarterbacking.

2) Let's talk about the previous blog post for a second. In the heat of the battle this morning, news of this "London Gold Exchange" company closing hit this site before anywhere else on the internet. Since the discussion of this seemingly important (at the time) item was being limited to the comments of the main blog, I feared it would go unnoticed by many regular readers. Thus, I elevated the "news" to its own post. Four to five hours later, the "news" is discovered to be no big deal. Amazingly, some of you have taken the time to email me and inform me that I'm a clueless dupe because I posted the story. Whatever. I'm a one-man show here and I'm simply trying my best to stay ahead of the curve.

3) And lay off my "guests" for the podcasts. I make it very clear in the introduction of the segment who the guest is. If you already are familiar with said guest and, for some reason, you don't like this person, then skip the podcast! No one is forcing you to listen. I just think it's tremendously rude for you to take to the comments section and belittle the feature without considering that others may have a different appreciation of the guest's points of view. Look, all I'm saying is: Don't be a jerk. If you don't like the current podcast, come back in two weeks time and check out the next one.

4) Please allow me to state this one more time: If you are trading gold and/or silver futures on the Comex, you are literally playing with fire. The ultra-criminal C/C/C still runs the show and they will screw you every chance they get. Your only option for long-term success is the consistent purchase and delivery of physical metal. Period. I will continue to try to keep this site updated with my thoughts regarding the short-term direction of prices but, when the time comes again that The Cartel decides to manipulate price lower to selfishly suit their purposes, don't come crying to me about all the fiat you've lost because you've leveraged yourself to infinity in the hopes of an early retirement. As the disclaimer below says: The Turd provides knowledge and direction but you are the one ultimately responsible for the decisions you make. Not me.

Alrighty, then, that's enough bitching for a Monday. Thank you for letting me rant. Let's see if we can hang in there overnight. IF we can avoid the 3:00 am LBMA beatdown, the metals are poised for a significant rebound tomorrow. Keep your fingers crossed. TF

10:20 am EDT UPDATE:

Simply amazing how quickly fear turns into greed and vice versa. All part of the fun, I suppose.