I was recording this week's podcast yesterday when it finally dawned on me. Frankly, I'm disappointed in myself that I didn't figure it out sooner. Take your eye off the ball and get a little distracted and this is what you get. No matter, at least now we know.

First, some history. Without a doubt, the $250 run in gold over five weeks in August and September was almost entirely caused by Cartel short-covering and we spent a considerable amount of time discussing this last fall. In summary, the gold CoT numbers told the tale. The CoT from Tuesday evening, August 2 was:

Spec long = 292,000

Cartel long = 155,000

Cartel short = 443,000 (Cartel net short almost 3:1)

Gold price = $1650

By Tuesday evening, September 6, the picture had changed rather dramatically:

Spec long = 248,000 down 15%

Cartel long = 174,000 up 12%

Cartel short = 402,000 down 9% (Cartel net short almost 2.5:1)

Gold price = $1900 up 15%

Again, this is why the reporting of a gold "bubble" was such utter nonsense and any reporter/blogger espousing that idea is to be permanently avoided because that person is either stupid or deliberately misleading you. Gold went up 15% in five weeks because The Cartel panicked and began to rapidly decrease their net short position. As you can see in the data above, the speculative (supposedly dumb) money was selling into the strength, undoubtedly locking in gains along the way.

So, now, put on your thinking cap. Try to recall what happened shortly after August 2, 2011. Anyone? Anyone?

After the close on Friday, August 5, S&P announced that they were downgrading the credit rating of the U.S. from AAA to AA+. I believe this singular event was the "final straw" for the banks that have been willfully manipulating gold and silver for decades. All of the market action since has been a reaction to the S&Ps move. The massive and deliberate takedown of gold and silver in late September was orchestrated to drive price lower so that The Cartel and The EE could continue covering their massive short positions but at a much more profitable, lower price. This effort continues to this day. Look at the latest CoT numbers:

Spec long = 166,000 (down 43% from early August)

Cartel long = 160,000 (flat from early August)

Cartel short = 327,000 (down 26% from early August) (Cartel net short now 2:1)

Anyway, the point of going through all of this again is to demonstrate that The Bullion Bank Cartel clearly got spooked and changed their modus operandi post the S&P downgrade announcement of 8/5/11. Getting back to current day, how does this affect current price and technical action. Well, my brothers and sisters, $1665 is exactly the opening level of gold on Sunday evening, August 7, when the metals resumed trading on the Globex. For the next several weeks, we speculated upon whether or not gold would ultimately fall back and "fill the gap". Nature abhors a vacuum and charts abhor gaps. Always have and always will.

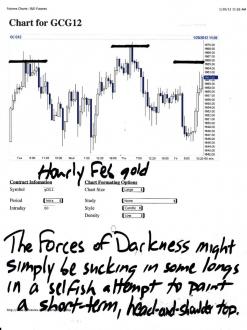

It didn't take too long, unfortunately, for us to have our answer. Here's a reprint of a chart from September 23 where we were watching the 1665 level very closely:

Clearly, by reviewing the action of this week, a line has been drawn by The Cartel. They do not want to see gold move back above 1665...at least not yet. They may soon get overwhelmed and lose the battle but, as we've seen on the charts and in the daily growth of open interest, The Cartel would like very much to keep gold under wraps for a little while longer. Do they want to get their gold net short position to 1:1., similar to the progress the EE has made in silver? Maybe, but the fundamentals in gold are so overwhelmingly strong that I don't think that they are going to have the time to pull this off. (It's taken The EE almost 9 months to move from the same 3:1 net short position to the current 1.5:1. It will be nearly impossible to hold gold in its current range for another 6 months.)

Anyway, now we know why 1665 is so important to The Cartel. Hopefully, near-term pressure will force gold higher and through that level. The Pig and DrC are helping its cause. However, next week is option expiry for Feb12 and first day notice, too. You've got to expect that The Cartel will try to keep gold down for a while longer.

By the way, you can bet your batooty that the next, major resistance for gold will be 1705. Longtime turdites will undoubtedly recall the significance of that level, too.

Lastly, here are three items that you need to check out, either today or over the weekend. First, another KWN interview of Santa. (I've tried to get Santa to do a podcast but he won't commit. I'll keep trying.)

Someone sent me this article that discusses the PAGE. The author claims that the exchange won't be open until June. Nuts. I've sent a few emails trying to confirm this. I'll let you know if I hear anything.

https://www.marketoracle.co.uk/Article32678.html

And, lest your heart despair with CNBS et al fawning over the "earnings" report of Bank of America, Dave in Denver knocks it out of the park with this analysis. Be sure to read:

https://truthingold.blogspot.com/2012/01/bank-of-america-earnings-comedy.html

That's all for now. Please check back later this afternoon as I will be posting TFMR podcast #11. As I mentioned above, I recorded it yesterday and it's a pretty good one. Thanks again for all of your support! TF

12:20 pm EST UPDATE:

Very, very nice FUBM rallies this morning, particularly in silver where the price is now $31.50, well clear of $31 and headed toward stout resistance near $33. (Do you recall the significance of that level, too?)

That said, we must watch things very closely here. The charts below are self-explanatory.

Stay vigilant. TF