Look, we all know that gold and silver have been manipulated and suppressed for years. For traders and stackers, the ongoing manipulation has just become a simple fact of life. The suppression is so regular that it can be used as a sort solunar table for those only wishing to "hunt" at the optimal hour.

However, this regularity and predictability should gall you instead. At it's core, it is sheer lawlessness or, stated differently, an absolute indifference to the rule of law or the concept of free markets. In a "normal" course of events, one wouldn't dare attempt to manipulate a market for fear of being caught. This fear would undoubtedly cause someone attempting to manipulate a market to do so in darkness, so as to avoid detection and, ultimately, prosecution.

What are we to make, then, of blatant manipulation in broad daylight? The simplest answer, I believe, is that the manipulator has no fear of being caught. If the manipulator knows full well that he is acting on behalf of his sponsor and that his sponsor will never prosecute him, the manipulator will audaciously act in bright light and open spaces for he no longer has anything to fear. As an example, if you desire to rob a bank but fear the police and potential jail time, you might rob the bank late at night or over a long weekend. If, however, you have the police and the judge in your back pocket, you could just walk in during business hours and make off with the loot.

I point out all of this because of the two charts below. I posted the one on the left back on Friday afternoon. That The Cartel would "trim" price by $7, at 2:20 pm, two days in a row was audacious enough. However, you must also check out the chart on the right. Another $7 at exactly 2:20 pm today. Sickening.

Again, only a criminal with no fear of prosecution acts this brazenly and predictably.

So, what do we make of this. As a practical matter, the suppression has worked. Without three, consecutive days of $7 Globex raids, gold would be trading at $1790 instead of $1769. Every dollar counts, whether it's taken out on the Comex, the LBMA or the Globex. However, on the bright side, how close must we be to a breakout? If The Cartel feels so threatened that they have to resort to bald-faced Globex manipulation, how desperate must they be and how worried are they about gold moving to $1800+? This is The Battle Royale, everyone. Be prepared for more dirty tricks but do not be afraid. We are winning and they know it.

Gold found support overnight where where I'd hoped it would, namely 1765 or so. Now the question becomes will it hold that area overnight tonight? It's hard to say. I wouldn't be surprised by a dip to 1750 and, if it does, I'll be looking to add some.

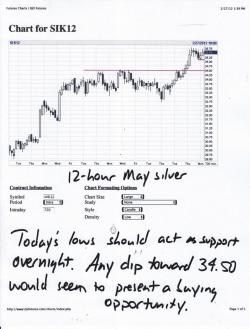

Amazingly, silver remains stronger than mustard gas. The area between 35.15 and 35.30 looks like pretty good support but a concerted raid could drive price all the way down toward 34.50. If that were to happen, I'd be an aggressive buyer. The only concern is the continued drop in 1-month lease rates, which appear to have fallen today to -0.46%, though I haven't seen anything "official" yet. Again, these plunging lease rates in silver are not a 100%-certain indicator of impending doom. They are just a warning flag. Additionally, while silver traded down 21 cents on Friday, open interest actually expanded by 2,300 contracts. More EE naked shorting in an attempt to keep silver below the Battle Royale level of 35.50- 36.00? I think so. Also, the March12 OI only fell by 1200 contracts on Friday and entered today at 20,160. This left today, Tuesday and Wednesday as the final three trading days where longs could be persuaded to dump March for May. Can't wait to see the numbers tomorrow!

Here are two charts of questionable value. On the left is a daily POSX but, as you know, my Forex TA ability is dubious, at best. On the right is a 2-hour crude. My TA in crude is a little better but, in a market that is primarily being driven by geo-political events, TA is almost useless. That said, if you're looking to join the crude "party", a dip toward $106 might be your opportunity.

Lastly, I traded a few emails today with Jim Quinn of The Burning Platform. I thought I'd blown a little time writing up my Saturday missive but it turns out the Jim took it even farther. He worked all day Saturday and most of Sunday on his latest post. Again, Jim does this out of passion and a genuine desire to make a difference. I encourage you to support his efforts by heading directly to his site to read his latest blog as soon as you are finished here.

https://www.theburningplatform.com/?p=29848

That's all for today. Keep an eye on things overnight and expect the usual 3:00 am London raid. Then, let's see what tomorrow brings ahead of the all-important, Wednesday LTRO expansion info. Keep the faith. TF