I would imagine that most of you have already spent time last evening and today, digesting and learning from all of the information regarding the events of yesterday. Frankly, I have neither the time nor inclination to give you a full rehash of the events. So, for the sake of brevity, let's get right to it.

First of all, if you haven't yet listened to Santa's interview with Eric King yesterday, please do so now! Click the link below and keep the audio running while you examine the rest of this post. Be sure you listen to the entire thing. The last 3 minutes are extremely important!

https://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2012/3/1_Jim_Sinclair.html

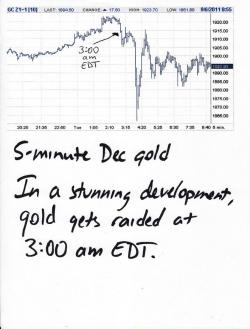

First of all, yesterday was nearly an exact repeat of 9/6/11. That day, gold was ruthlessly attacked in the minutes before the announcement by the Swiss National Bank that it was pegging the Swiss franc to the euro, effectively devaluing the franc by about 10%. At the time, the Swissie was considered to be the only "safe haven" on a level with gold and the devaluation should have resulted in a massive rally for gold, a rally that would have driven it to new all-time highs and toward $2000. Instead, we got this:

Yesterday, the ECB "loaned" another 530B euro to over 800 different "financial institutions". This is a huge amount of fresh liquidity (money) (cash) (QE). And from where does this money come? From the ECB. And from where does the ECB get their cash? Two places:

- Infinite "swap" lines with the U.S. Federal Reserve

- The IMF, which is partially funded directly by the U.S. Federal Reserve

All of this brand spanking new cash should have driven gold sharply higher, just as the Swiss announcement back in September should have done. Instead, gold was raided. Chairman The Bernank also conveniently used his scheduled House Financial Services testimony to mention that (paraphrasing) "because of a slightly improving U.S. economy, perhaps not so much QE will be needed in the future". This is bullshit.

- As noted above, just yesterday morning, the Fed provided over $600B in fresh money.

- The Bernank's economic optimism is based upon the fully-nonsensical, manipulated and distorted BLSBS report from last month, documented ad nauseam here and elsewhere on the internet.

But gold was perilously close to breaking out and through $1800. IF this had happened, algo dollars would have rushed into gold in a fashion similar to what occurred in silver on Tuesday. Gold would have soared and rolled immediately toward the old all-time highs. Silver, too, would have rallied. It would have left The Battle Royale in the dust and began an assault on $40. THIS COULD NOT BE ALLOWED TO HAPPEN!

The decision was made and the plan was executed. As we know through sources like Goldmania3000 and several others I won't list here, the initial attack came from JPM in the form of a 10,000 gold contract sell order that was initiated with complete disregard for effective price execution. The sole intent was to influence price lower and set off WOPR sell signals. Sadly, this tactic succeeded again and here we are.

All of that said (and the reason why JPM was the instigator in gold), I firmly believe that this was primarily about silver. As you know from reading the research of Ted Butler, JPM is currently short about 22,000 silver contracts, up from 13,000 in late December. By late Tuesday, they (JPM) were getting crushed and, with fundamental changes to the global silver market coming over the horizon, their only option was to attack in the hopes of driving price lower, forcing the new specs out in a panic and using this spec selling as cover to "buy" and exit as much of their short position as they could. That silver failed to fall $5 yesterday had to be amazingly frustrating and disappointing for them. You can be certain that they will attack again...and soon. Though next time, they won't attack silver indirectly, through gold. They will, instead, attack silver with a full-frontal assault and try to drive it lower. Will they be successful? Probably, but not to the extent to which they've grown accustomed.

Look at the action yesterday. Gold was driven lower and silver followed, in tandem. The attacks ended at about 11:30 EST and the dust was allowed to settle. After bottoming at $34.20, silver began to rebound and, by the close, it was back up to nearly $35. What happened next had to befuddle the EE. Gold was viciously attacked on the Globex at approximately 3:15 EST. However, silver barely budged. In fact, it again rebounded and, by last evening, was again trading over $35. In the words of MrsF to an LT: "This behavior will not be tolerated!". The EE will, undoubtedly, come for silver again. They may be successful in driving price marginally lower but all this will do is create a buying opportunity.

Again, silver is headed significantly higher from here. Maybe not tomorrow but definitely by later this spring. It will be higher still this summer. Even higher still this autumn. If The Forces of Darkness are successful in drivig price to $33, buy some. If they drive it to $31, buy some more. Keep buying it and take delivery. You will be rewarded but, more importantly, you will be insured against the further monetary destruction that is most assuredly coming, regardless of what The Bernank may have mumbled yesterday.

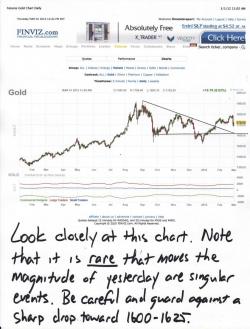

Just as further attacks on gold followed the initial attack of 9/6/11, you can anticipate that they will come for gold again, too. So far, gold stopped right on cue above 1680 yesterday. Beautiful, and that may continue to act as impenetrable support. However, as you can see below, gold may be about to form a massive, reverse head-and-shoulder bottom on the daily chart. Fine with me if it does. If gold were to actually fall another $100 from here, toward 1650 and 1600, it would present an extraordinarily wonderful buying opportunity. Please, Cartel. Please drive paper gold even lower for us. We'll be waiting for you!

OK, that's it. It's already 10:30 and I've got to get this published. More later. TF

p.s. A "shout out" and an "atta-boy" to all the regulars at Pailin's Trading Corner. Yesterday, they crossed the 1,000,000 pageview mark in their own little corner of Turdville. If you don't make reguklar stops there during your trips to this site, you are sorely missing out. They do fantastic work there and consistently share insightful and helpful information. Congratulations to you all for helping to make this such a great site!

https://www.tfmetalsreport.com/forum/pailins-trading-corner/242?page=606...

p.p.s. The February "Turd Hat" contest ended yesterday. Here are the results:

The April12 gold contract closed on the Comex at $1711.30. Pining4thefjords guessed $1711.10. WOW! He's as good with the crystal ball as he is with photoshop!

The May12 silver winner is Murphy who guessed $34.74 when the actual close was $34.64. Spectacular!

Please email me your mailing addresses, boys, and the hats will be sent on the way.

p.p.p.s. Look very closely at the chart below. You will see that previous drops on the order of magnitude seen yesterday were not stand-alone, singular events. They are almost always followed by additional attacks.

IF more attacks come tomorrow, your ultimate buy point will be the area near the two intersecting lines on this chart. Note that the area coincides with the potential reverse H&S targets, too.

Important: I'm not saying this will happen. I'm saying that it could, based upon Cartel history. Currently, I'd put the chances at 30%. If trading, be cautious of this dip. If stacking, be hopeful for this "sale"!