Well, here we are. We've arrived at one of The Turd's favorite weeks of the year. Here in America, the third week of March means two things: Saint Patrick's Day and the beginning of the NCAA college basketball tournament. Turd is very excited. However, Turd is also nervous and agitated, too. To help me cope, I thought I'd cook up this quick post before the week gets started.

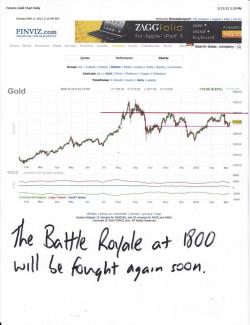

First of all, regarding the metals, everything looks great as we enter the week. The fundos continue to be profoundly positive. The CoTs took a dramatic turn toward a bullish sentiment. Even the charts looks great:

- Support held at roughly 1680 and 32.80.

- The FUBMs on Friday were very, very impressive.

- Gold even managed to close UP on the week.

The only thing WE DON'T KNOW is how the Greek CDS trigger will impact the market. Will it be almost a non-event or will liquidity "dominoes" begin falling, leading to a global margin call meltdown. At this particular time, I don't know. What I do know is this: I'm not selling any of my phyzz, not a single ounce, and I will simply use any extended weakness to add to my stack.

Here are your charts. They clearly show that we are on the edge of breaking back higher. Once this happens, the stage will be set for Battle Royale II.

One more thing, please take time to click the link below and read the article. The topic is something I plan to devote more energy toward in the coming weeks. The world is changing much faster than most folks (myself excluded) ever thought it could. You must be prepared for the consequences of these changes.

I hope you're rested and ready. This week sure has the potential to be a doozy. TF