Well, what a pleasant surprise The Bernank threw our way this morning, and just in time. The LBMA goons had attacked and the stage was set for a nasty Monday. Instead, we got a rally and growing confidence that the bottom is definitely "in" for gold, and probably silver, too.

If you missed all of the hubbub back at about 8:00, here's a link to help you catch up:

There will undoubtedly be all sorts of chartreaders and analysts who will parade forth today to proclaim the thisses and the thats as to why The Bernank said what he said. Believe who you want but I laid it all out for your right here last week:

https://www.tfmetalsreport.com/blog/3555/keep-watching-bond-market

Again, interest rates cannot be allowed to rise. Not short-term rates, not intermediate rates and not long-term rates. Any rise in rates accelerates the unraveling of The Great Ponzi and simply cannot be allowed. What do you think this is all about anyway? Growth? Well, kinda. Growth kind of matters in the faint, Keynesian hope that we can "grow our way out of this mess". It's not going to happen but rates must be kept low, just in case. Nope, the low rates are about the perpetuation of the Ponzi. Fiscal 2011 already saw $454 B in debt service for the U.S. government and that was with an average maturity of about 4 years and an average rate under 4%. Please do the math and you'll see that interest rates cannot be allowed to rise. No way, no how.

So, in response, you get days like today. Look, there will always be "hawkish" and "dovish" statements by The Bernank and the assorted Fed governors. No doubt, after this speech by The Bernank today, later this week we'll get Fisher or KosherDakota rolled out to try to proclaim a counter message. All of this is simply MOPE and SPIN and means absolutely nothing long term. Someone/something must buy the $1.4T in new debt that the U.S. issues each year. Normally, rates would rise to a point where buyers would get interested. But, interest rates cannot be allowed to rise. So, who buys the bonds and supplies the necessary funding for the continual deficit spending of the U.S government? THE FED, silly. And when The Fed openly and overtly buys U.S. government debt, what do we call it? Quantitative Easing. And how long will quantitative easing continue? Until an infinite amount of useless, valueless, paper currency has been created.

All of this has had the necessary effect of pumping up the PMs today. I say necessary as The Turd was as nervous as a long-tailed cat in a room of rocking chairs over the weekend. It's more than a little unnerving to loudly proclaim a bottom in gold when seemingly everyone from CNBS to the WSJ is telling you otherwise. But, I had to go with what I knew and everything was screaming "BOTTOM" on Thursday and Friday. From here, let's just hope it all hold up.

As you can see on the charts, gold just looks great. It has formed a very nice, rounded bottom in the charts and, today, has broken up and out through horizontal and technical (200-day MA) resistance near 1680. With 45 minutes to go on the Comex, we are still hanging in there at 1686 and any close above 1680 would be a very good sign. "Winston" emailed me on Friday and mentioned that he thought Thursday had cleaned out all of the nervous put sellers in the April gold. With that gold now in weak "short" hands, he was looking for a rally but that gold would likely be held under 1700 through option expiry. Today's action clearly caught most everyone by surprise but I do think Winston is right on the money here. Let's look for a further rally and then consolidation until expiry at the close tomorrow. Then, with those shenanigans behind us, maybe gold can hit the gas a bit later this week and begin an assault on 1700 and then 1720.

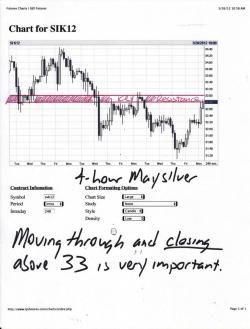

Silver is looking good, too, but it continues to lag behind gold in the confidence area. The critical thing for silver is to retake 32.80 and then 33.00. You can expect EE resistance at 33 because, well, they always put resistance there. Anyone who considers themself a long-term Turdite will know what I mean. That said, if gold keeps chugging along, silver will invariably follow. The two charts below lay out this scenario quite well. A close today, first above 32.80 would be very constructive. IF silver can then move through and close above $33 later this week, we can all get very confident that the bottom for silver is "in", too.

That's all for now. It's been a crazy day. LT#1 woke up yesterday with a sore throat and today has been diagnosed with Strep Throat. LT#2 is now complaining about similar symptoms and yours truly is feeling a little dicey, too. Ugh. Oh well, whaddayagonnado? We're gonna blast this stuff higher and take delivery...that what we're going to do! The Cartels can win the occasional battles but, in the end, they will lose the war. The only chance they have at saving themselves would to surrender (move net positive). They haven't done this yet, obviously, but their day is coming. Surrender or be defeated. Those are their only options.

TF