It's hard to tell just who got squeezed first and the hardest. The equity shorts? The crude shorts? The gold shorts? Nope, those short the Euro are the ones really getting squeezed today.

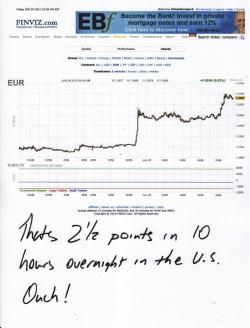

Take a look at this chart of the $/Euro. Yes, that's 2.5 points (2+%) in about 10 hours overnight, while the U.S. slept.

And once the ball got rolling, it was only a matter of time until it smashed into everything dollar-priced. As I type, crude is up $4.21 to $81.90. The S&P 500 is up 23 points to 1352. And, of course, our precious precious have jumped higher, as well.

And just in time, too! Yesterday in silver was pretty scary. Price hung on the edge of support for most of the day. Had the area between 26 and 26.25 failed to hold, silver would have fallen very quickly. There is still the possibility that a stop-clearing, vomit-inducing drop may materialize if the coming days but it doesn't necessarily have to. Just pay attention and don't panic IF it does.

This next chart shows you how tight things are getting in silver. There is a tendency among chartreaders to see "descending triangles" and think that they will lead to breakdowns in price. I've always thought it was a sort of optical illusion. The downward-sloping line simply has more "eye appeal" and makes you think that the downtrend will carry the day. Look, however, at the strength and duration of the horizontal base. It's much longer than the horizontal line and therefore more likely to win the day. We'll see.

One more silver chart. Here's a 12-hour which shows you the current $27-29 range. Yes, there was a foray above and the recent drop below but, for all intents and purposes, silver has been stuck in this range and basing for almost 2 months.

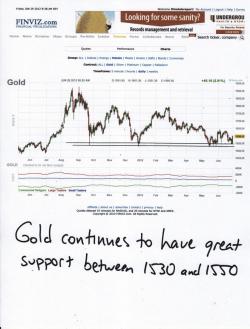

Gold continues in a similar, basing pattern between 1530 and 1630. If you look closely, the support for gold consistently comes in between 1530 and 1550 and yesterday was no exception. Considerable physical demand below 1550 is the key to this support level.

And just for fun, here are the 5-minute charts for gold and silver. Note two things:

- The initial caps for the day have been set. Gold just above 1600 near 1602 and silver near $28. Further note the significance of $28 on the daily silver chart posted back up this page.

- Rather than acting in tandem, silver peaked a full 20 minutes before gold. Interesting.

That's all for now. The rallies continue and isn't that fun?! Nice to end the week on a happy note for once. Again, this week's CoT will be quite interesting so please check back after 3:30 EDT as I'll be adding some comments then. Also, I recorded a very interesting podcast with John Williams of ShadowStats yesterday. I'll be posting it later today, too.

Thanks again for a great week. It has been stressful but fun. TurdTalksMetals is getting all of its kinks worked out and the initial reviews are positive so I want to thank everyone who is participating. Have a great weekend!

TF