Yes, the past 24 hours have indeed been hot and explosive. Is it THE hot and explosive? Maybe.

As you know, I've been waiting for a "hot, explosive and historic" rally to begin. I'm sure most everyone is wondering whether or not this is the beginning of that move. In all honesty, I can only say "maybe". Let's talk about another option, first.

As you know, The Fed last met for an OMC meeting three weeks ago. At the conclusion of the meeting, the "Fedlines" were released, giving us all some idea of the things The Goon Squad discussed between steak dinners and trips to Cheetahs. Tomorrow, after a 3-week delay, we get the release of the official minutes of the meeting. As you also know, we have already had five or six occasions in 2012 where prices ran up ahead of a Fed/Bernank announcement, only to be summarily beaten back immediately following said Fedlines/press conference. This could be just another occurrence of the SpecSheep being led to the shearing barn. Could. It also might not be.

As we discussed last Friday and over the weekend, the CoT last week was very, very interesting. At 47,797, the gross commercial long position in silver is the highest I ever recall seeing it. Additionally, Uncle Ted suspected that the 4,752 increase in the gross commercial short position came almost entirely from JPM. From there, I began to wonder if we were about to witness a "civil war" in silver.

I used an analogy with Mister Hyde this morning that I think I'll use again here. Currently, the commercials in silver act collusively to crush the specs. In a way, this is similar to a pack of hyenas on the Serengeti. The pack works together to accomplish the kills but there is usually a leader, a bigger male dog that leads the pack. This is all well and good until and unless the the leader ages, becomes weaker and distracted, and becomes vulnerable. At that point, members of the pack may begin to collude to oust the leader. The remainder of the pack may begin to act collusively against the leader and, when the day comes that their confidence rises to the point where they are ready to attack, the pack turns on the leader for their own selfish, potential gain.

So, the question is: Is the silver "leader" vulnerable? Has "the pack" begun to sense the leader's vulnerability? Does the pack know something that you and I don't about the leader's health and viability and, sensing this weakness, have they turned upon the leader?

Here's that word again: Maybe. Though I am supremely confident that the metals, particularly silver, are about to charge off into uncharted territory, I cannot be certain that this is happening right now. This is coming, however, and it is coming very soon. Perhaps the leader will survive and even play along? Maybe. In the end, it doesn't mater. Prices are going much, much higher whether they like it or not.

The metals are almost certainly getting some support from crude. As we identified last week, once crude broke out of its latest consolidation spot, it was likely to head toward $98-99, perhaps as soon as late this week. Well, we're already there, all the Iran v Israel grumblings giving things another shove higher this morning. The next short-term top and consolidation looks to come in just below par, near $99 or so. Let's see what happens from there but anyone trading might ring the cash register a little if give the opportunity to take some off near $100.

Finally, our pal Ned was on with Max earlier today and he did an outstanding job of discussing unallocated/allocated and a number of other items. I strongly suggest that you take the time to watch this video. Perhaps an admin could embed it below so that you don't have to leave the site to watch.

https://rt.com/programs/keiser-report/episode-330-max-keiser/

I also traded emails with Ned this morning and he asked me to alert everyone to the falling gold:silver. Ivars has been doing a great job of keeping us up-to-date on this and I hope he'll post another chart of the ratio soon. A drop below 55 would seem to be something for which you should keep a look out.

And one more thing...I am going to begin to actively remove political and other content that is posted to the main threads that doesn't promote the wider discussion. Everyone already knows that O'bomney is guaranteed to win in November so we don't need a daily barrage of left-wing and right-wing propaganda/marketing. If you want to start your own site and publish all of that stuff, go right ahead. (Be prepared, though, as it is way more expensive than you might think) This is my site and I decide what stays and what goes, what gets published and what does not. This site is not your personal political propagandizing tool. It is a site that I have built for all of us to discuss the precious metals and our personal preparations for the end of The Great Keynesian Experiment. The "Main Street" thread our primary "front door" and I will not allow personal political agendas to slow or otherwise harm the growth of this site. Any registered Turdite has the ability to begin a forum where he/she can discuss anything on their mind. That person can then invite everyone else to stop by and share their views. This is the way we shall conduct business here moving forward. The American election is less than 90 days away and if we don't correct this now, I fear our site will be destroyed by mindless, partisan infighting.

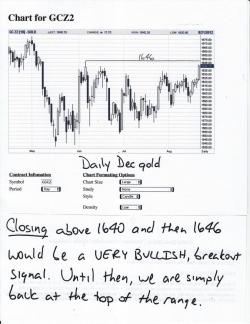

That is all for now. As I go to publish, I see that the metals are hanging in there. This is good. One step at a time. Today's goal should be to close above $29 in silver and above $1635 in gold. Let's worry about tomorrow tomorrow. Have a fun day.

TF

12:35 pm EDT UPDATE:

On the heels of he very impressive action this week, I am ready to declare that Battle Royale I has now finally been won by the good guys. Any attempts to raid price and dip it lower will now find support at the descending line. The next major battle will now be at Battle Royale II, the line connecting the 4/11, 9/11 and 2/12 peaks. This line currently resides near 30.50, which is the area where we also find the 200-day moving average.

I plan to write up a new post later this afternoon or early evening so please be sure to check back.

TF