A concerted effort was made this morning to smash gold through the bottom of its 18-month range. It failed. However, you can be certain that they will try again so you need to keep a few things in perspective.

First of all, perhaps you need a reminder that we've been discussing this possibility for weeks. If you missed any of these posts, perhaps today would be a good day to go back and review them.

https://www.tfmetalsreport.com/podcast/4619/turd-talks-metals

https://www.tfmetalsreport.com/blog/4618/increasing-likelihood

https://www.tfmetalsreport.com/blog/4551/forewarned-forearmed

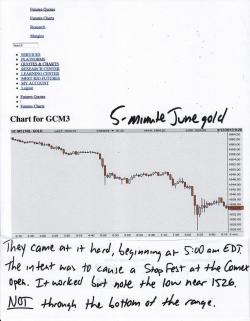

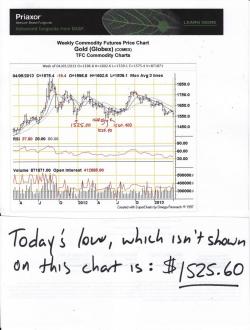

So, at 5:00 a.m. EDT this morning, the attack commenced. The plan was to drive prices down enough in the pre-market that, when the Comex opened at 8:20 a.m. enough sell-stops would be triggered that would break gold down through $1525 and then the thing would take on a life of its own. Below $1525 undoubtedly lay a veritable cornucopia of sellstops that, if/when triggered, will send price momentarily plunging. Earlier today, they failed. Price in the June13 gold bottomed at $1525.60. But don't worry, they'll be back. Maybe as soon as later today (after the PM fix?) or Monday. Will they fail again or will we get The Final Washout as we've been mentioning? We'll see...

Here's the 5-minute chart from earlier today where you can see the action in all its glory. Again, note the selling in the final 10 minutes before the open that lowered price from $1544 to $1536. This was the final attempt at mustering enough selling to prompt a washout at 8:20. It didn't work. Yes, price immediately fell $10 at the open but, again and significantly, it stopped at turned at $1525.60.

OK, so where are we on the long-term charts? I apologize for having to use these FTC charts but they're the only ones that I can access that show the "continuous" price. You should be able to click on them to expand them. NOTE THE LOWS IN RED.

Look, as stated above, I can't imagine that they're not going to try again soon. The Spec Momos might even get a little help from The Forces of Darkness. I mean, shoot, why not? All of the selling that will materialize below $1525 will allow The Cartels to cover all kinds of additional shorts. Again, we'll see. But you have to be prepared, both mentally and financially, for this to happen. Both gold and silver are historically oversold from a CoT perspective. To remind you of this and to prepare you for today's CoT, let's go back and look at the CoT structures from the lows on the charts above.

On 12/27/11, as gold was bottoming at $1525, the weekly Commitment of Traders Report looked like this:

On 5/29/12, the Commitment of Traders Report looked like this:

- LargeSpec longs 167,439. LargeSpec shorts 56,727. Net long ratio 2.95:1

- SmallSpec longs 49,856. SmallSpec shorts 29,859. Net long ratio 1.67:1

- Gold Cartel longs 170,208. Cartel shorts 300,917. Net short ratio 1.77:1

- Total open interest 419,991

Last week (and today's will be even more dramatic), the CoT looked like this:

- LargeSpec longs 202,634. LargeSpec shorts 82,428. Net long ratio 2.46:1

- SmallSpec longs 52,253. SmallSpec shorts 29,937. Net long ratio 1.75:1

- Gold Cartel longs 137,205. Gold Cartel shorts 279,727. Net short ratio 2.04:1

- Total open interest 417,176

So I ask you: What is different this time? Nothing! No, I take that back. The only real difference is the amount of disinformation and SPIN trying to convince you to sell your metal and convert it back to fiat. Other than that, NOTHING! And wait until we get the updated report today! I'll be sure to update this post and show the numbers in an identical format so that you can make an easy comparison over the weekend.

Let's move on to silver. On 12/27/11, the silver CoT looked like this:

- LargeSpec longs 24,026. LargeSpec shorts 17,171. Net long ratio 1.40:1

- SmallSpec longs 20,294. SmallSpec shorts 13,017. Net long ratio 1.56:1

- Silver Cartel longs 41,224. Silver Cartel shorts 55,356. Net short ratio 1.34:1

- Total open interest 103,993

Then, on 6/19/12, the CoT looked like this:

- LargeSpec longs 27,767. LargeSpec shorts 17,665. Net long ratio 1.57:1

- SmallSpec longs 21,704. SmallSpec shorts 14,852. Net long ratio 1.46:1

- Silver Cartel longs 47,447. Silver Cartel shorts 64,401. Net short ratio 1.36:1

- Total open interest 122,508

And last week (7 trading days ago and with OI 11,000 lower) look like this:

- LargeSpec longs 38,201. LargeSpec shorts 30,055. Net long ratio 1.27:1

- SmallSpec longs 27,211. SmallSpec shorts 16,854. Net long ratio 1.61:1

- Silver Cartel longs 57,847. Silver Cartel shorts 76,350. Net short ratio 1.32:1

- Total open interest 155,755

So, what's different in silver? A LOT! Well...not really that much. The net ratios are almost identical to where they were at bottoms in the past. But look at the size! The Specs are gross short 50% more contracts than at past lows and the Commercials are long more contracts than ever before. And this was last week! When open interest was 155,755! As of this Wednesday (2 days ago), the total OI had grown to 166,621! How do you suppose the ratios and the total look at this moment?? Perhaps more bullish than I ever conceived possible?!?! Again, we'll at least get an update through Tuesday later this afternoon and I'll post it into this thread once it's released.

As I go to hit "SEND" I see that "they" have finally succeeded in dropping price through $1525. Funny how this has happened immediately following the London PM fix. So, there you go. Look for a "V" bottom very soon and a sharp rebound by later today or Monday. This is it! This is what we've been waiting for...A final, capitulative, sell-stop running Washout. Let it run its course and then let's see what happens next.

TF

4:10 p.m. EDT UPDATE:

Well, I suppose I could go on all afternoon about what transpired today but much of that has been covered in the comments of this thread. Therefore, I'll just stick to two things. This afternoon's Globex action and your CoT update.

Here's a 1-minute chart of the sharp selloff this afternoon on the Globex. This looks like a margin liquidation to me. Why on earth would an actual person wait until 3:20 in the afternoon to sell into the low-liquidity Globex? Either way, it doesn't make anyone any more confident heading into Monday.

This week's CoT is out and it wasn't quite as interesting as I'd hoped. In gold, where price rose $11 on an OI change of just 663 contracts, I didn't expect much...and I received little in return. The LargeSpecs reduced their net long by 800 contracts. The SmallSpecs added 2100 net longs and The Cartel added 1300 net short.

The silver report was surprising, though, in that hardly any changes took place in the Spec category, even though price rose 63¢ for the week and OI rose by 6,486.

The silver LargeSpecs added 300 longs and also added 500 shorts. The SmallSpecs sold 1400 longs and covered 1100 shorts. THE REAL ACTION and, once again perhaps the brewing Civil War, was in the Commercial space. JPM and their two pals added 2,634 new shorts, bringing their total back up to 78,984. Why did they do that? Because the other commercials added 3,213 new longs, bringing their total to an astonishing 61,060! All of this buying and selling drops the Silver Cartel net short ratio back to 1.29:1.

Here's how silver looks when presented as it was earlier in this post:

- LargeSpec longs 38,492. LargeSpec shorts 30,577. Net long ratio 1.26:1

- SmallSpec longs 25,754. SmallSpec shorts 15,745. Net long ratio 1.64:1

- Silver Cartel longs 61,060. Silver Cartel shorts 78,984. Net short ratio 1.29:1

- Total open interest 162,241

Keep in mind that, as of Wednesday night, silver OI had surged to 166,621 before falling back yesterday to 164,393. Since it appears that The Specs were not adding additional shorts this week, it is unlikely that they became net short as a category. It is also not true that the silver commercials have moved net long. At least not yet.

However, DO NOT DISMISS the significance of the action pitting nearly everyone in the commercial space against JPM. The action since Tuesday is almost certainly related to the anger JPM must feel at the audacity shown by those who are seemingly attempting to challenge them.

If we survive the weekend, Monday and the rest of next week are certainly going to be...uhh...interesting. Get some rest and relaxation this weekend. You're going to need it.

TF