Another week in the barrel begins. There's a lot going on so come on in.

Jeez, where do we start on this fine Monday? Maybe we should start this week where last week ended? You'll recall that, back on Thursday, some hedge fund deltabravo whom nobody had ever heard of, posted a tweet that Jon "BernankButtBoy" Hilsenrath was about to release an article discussing how The Bernank might go about "tapering" QE∞. Though clearly the real object of this scam was to talk down an overheated stock market just a bit (think Mr. Andrea Mitchell and his "Irrational Exuberance" talk back in the 90s), the impact it had on gold was instantaneous. The Comex closed on Thursday at 1:30. The offending tweet came out at about 2:00. Before gold could re-open on the Comex at 8:20 on Friday, it was down over $40. Very nice. And then, of course, in order to not dampen the spirits of the HFTs too much, the ButtBoy article didn't actually get released until after the NYSE close on Friday. The impact? As I type, gold is still down about $35 from Thursday's close. Equities, of course, are about unchanged.

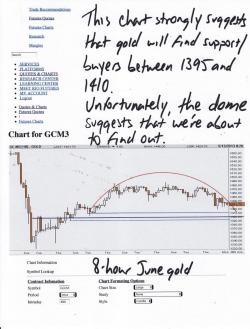

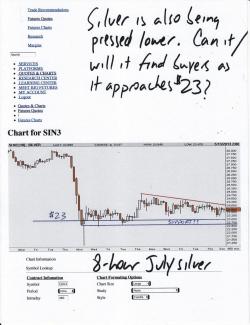

And this has once again emboldened the shorts to drive price lower as they rightly feel that all of the momentum is on their side. As we start the week, the metals look almost certain to test hoped-for support, gold around $1400 and silver near $23. From there, maybe CIGA BoPelini will be right and all of this madness will end. ( https://www.jsmineset.com/2013/05/10/update-on-gold-from-ciga-bo-polny/) That'd sure be nice but I'm not getting my hopes up too high.

If you missed my CoT summary from Friday, you can find it here: https://www.tfmetalsreport.com/comment/197039#comment-197039 There wasn't a lot of earth-shattering stuff in there this week but I want to re-emphasize some points I made toward the end of the comment. Look at these facts:

Finally, lets once again compare the Cartel net positions of last Tuesday with The Cartel net positions of 9/11/12, just two days before the announcement of QE∞.

And finally, here's the most interesting comparison. On 9/11/12, the Silver Commercials were:

- Long 32,206 and

- Short 79,478

Nearly eight months, $450B new QE dollars and $13 in silver later, the Silver Commercials are:

- Long 65,703 (+104%) and

- Short 80,159 (+0.85%)

Look, I am 100% convinced that everything that has happened since mid-September of last year has been completely designed by the Bullion Banks in order to reduce/eliminate their net short positions. After the HUGE rally of August into September 2012, where silver moved from $26 to $35 and gold from $1600 to $1800, The Bernank literally caught the banks with their shorts down, unprepared for the game-changer that is QE∞. Since then, in a increasingly desperate drive to reduce their liability, the banks have successfully moved paper prices lower, even in the face of the extraordinarily strong fundamentals, by convincing the Specs to sell through coordinated raids and chart-painting. Soon the fundamentals will overwhelm everyone but look again at what the banks have been able to accomplish.

They were net short an astounding 737 metric tonnes of paper gold at the time QE∞ was announced. As of last Tuesday, they've trimmed that liability by over 63%, all the way back to about 272 metric tonnes. Look at this another way. All the way down from $1800, the banks have been buying and covering. We're now told that the "bull market in gold is over" yet the banks continue to buy, not sell. Doesn't that tell you anything?

Now consider silver. Yes the picture looks the same. The banks have reduced their net short position by more than 2/3 from 30% of annual silver production back to 10%. But that's not the story, now is it? Look again at the gross numbers. At $36 silver, the banks (mainly JPM) were short 80,159 contracts. As of last Tuesday, with silver at $24, the banks were short 79,478. Virtually unchanged. But look at the "other commercials", the "everyone but JPM crowd", the "raptors" as Uncle Ted calls them. When silver was $36, they were long a gross total of 32,206. As of last Tuesday, the size of that position had more than doubled to 65,703! Again, I ask you:

- If silver is in a "bear market", why are these insiders buying?

- As silver has been beaten lower, why have these commercials been buying and not selling?

- Going forward, do you want to side with them or with the Large and Small Specs?

- Which side, the commercials or the specs, will be proven right in the end?

OK, moving on. Recall that there was much interest that the GLD had actually added metal back on Thursday. This caught nearly everyone by surprise as it was the first addition of metal since February. Well whaddayaknow. On Friday, nearly the exact same amount of metal came right back out of the GLD, leaving it with a 2-day net change of +0.18 metric tonnes. With the hammering that gold took on Friday, you can imagine that the "inventory" downtrend resume in earnest later today. For your reading pleasure, here's the latest from our pal Alasdair Macleod at GoldMoney. He has issues with GLD, too, and he cites a few of them here: https://www.goldmoney.com/gold-research/alasdair-macleod/the-role-of-gld-and-slv.html

And this is fun. I remember that not too long ago, folks like me were thought of as Loons and TinFoilHatters for suggesting that the days of dollar hegemony were numbered. Well, lookyhere. Even ole CNBS is now getting in on the act: https://www.cnbc.com/id/100726245 Of course, they still don't explain it as well as John Butler did a year ago: https://www.tfmetalsreport.com/podcast/3835/tfmr-podcast-22-john-butler-... And isn't the anti-gold bias just amazing? Nowhere in the article is it even postulated that perhaps the reason China is hoarding so much gold is because they are planning to back the yuan with gold as a fiat alternative. In a competitive global economy, wouldn't that make the yuan far more valuable than ever-devaluing fiat? And wouldn't that competitive edge be the impetus to establish the yuan as a World Reserve Currency much faster than without a gold backing? Ahhh...I digress. That type of out-of-the-box thinking is just craziness, isn't it? Well, we'll see.........

OK, that's all for today. Have a great Monday and let's just hope that we don't get the tests of support that appear to be coming.

TF