The all-seeing, all-knowing Bernank is playing with fire.

Bernank The Magnificent thinks he has things under control but the daily parade of Goon-speak MOPE is causing an acceleration of the selloff in treasuries. What the heck is going on here?

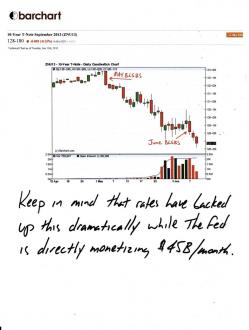

Take a look at this chart of the 10-year Tresury note September futures contract. The selloff in bonds began with the May BLSBS data and it continues today, six weeks later.

The yield on the 10-year note is now up to 2.23%. That may not seem like much but, when you consider that not too long ago is was yielding near 1.40%, you realize that rates have moved up by more than 50% in the past 8 months. That's a lot. The acceleration in the decline since early May suggests only two possibilities:

- The discussion of a "Fed taper" isn't just talk...it's actually happening. Right here and right now. The reduced demand from The Fed leaves more sellers than buyers and bond prices are falling.

- The Fed has not begun to "taper" and is, instead, still directly monetizing $45B/month, augmented with the $40B/month in

corporate welfareMBS purchases from the Primary Dealers. Selling by all of the other market participants is overwhelming The Fed's daily bid and driving prices lower.

Which is it? Well, here's a chart of The Fed's balance sheet from back in late January when Fed "assets" eclipsed $3T for the first time.

And in the five months since, the total has grown to $3.342T according to the latest weekly press release. (https://www.reuters.com/article/2013/05/30/us-usa-fed-discount-idUSBRE94T12L20130530) Let's see...a little, quick back-of-the envelope math...$85B x 4 months = $340B...so this $3.342T number looks about right.

So, if The Fed is still pumping out $85B/month, we can rule out #1 above. Hmmm...I guess that leaves us with #2 (no pun intended)...and this is where it gets interesting.

Even leaving out the $40B/month in MBS purchases, The Fed is still directly monetizing $45B/month in treasury debt. Regardless, in the past month alone, bond prices have fallen by 5 points and rates on the 10-year note have backed up from 1.6% to 2.2%. Jeez Louise! It's as if there is currently no other buyer of bonds in the U.S. Every other market participant is selling! They have to be in order to swamp and over-run the Fed's daily bid to this extent. So, who are these sellers?

Are they the dreaded "bond vigilantes"? Haven't heard that term for a while but do a quick Google search and you'll find plenty of new references.

Is it the Creditor Nations? Seeing the "QE∞ writing on the wall", are the Chinese and the Russians accelerating their divestment of treasuries?

Is it just everybody? The vigilantes, The Chinese, The Russians, the hedge funds, the pension funds..

Either way, ole Ben's got quite a problem on his hands. When you are the bid of last resort...when you are the market maker or specialist...the responsibility falls upon you to provide liquidity. You must be there to buy when everyone else is selling otherwise you risk a panic and a crash. Obviously, a tremendous amount of selling is currently taking place in the U.S. treasury market. At the same time, popular opinion and SPIN holds that The Fed is contemplating a "taper" of their bond purchases. OK, great. So instead of buying more bonds to support the market, The Fed is going to buy less? Seriously?? And someone thinks this is actually going to end well???

And this is what so many of us have been warning since overt QE began in 2009. Once The Fed decided to enter the market, they made themselves the "specialist", the buyer of last resort, and now they cannot exit...ever...without causing a catastrophic jump in interest rates. Think I'm crazy? Rates have moved from 1.6% to 2.2% (a 40% increase) in six weeks on simply the MOPE and SPIN of a "taper". Can you imagine the move if The Fed were to actually decrease their buying? At this point, they may be left with no choice but to increase their monthly purchases. Recall that that specific language was inserted into the latest FOMC minutes but hardly anyone seemed to notice. (https://www.federalreserve.gov/newsevents/press/monetary/20130501a.htm)

In the end, I'm simply not a believer that The Fed will soon "taper their asset purchases". How can they? Yes, 10-year note prices will likely fall even farther in the days and weeks ahead, dropping through 128 and heading toward 124-125. You can see it coming on the chart below:

At that point, I expect the MOPE to reverse. Some type of crisis will arise that will stem the selling of treasuries as "global investors seek the safe haven" of the U.S. dollar and U.S. treasuries. Maybe Europe will be shoved back to center stage? Perhaps war will finally break out in the Middle East? Something will happen to cause a return flight back into treasuries, of that you can be certain. However, if that effort then fails, The Bernank will be left with no choice but to increase QE, whether he wants to or not. Rates simply cannot and will not be allowed to move through 2.5%, toward 3% and beyond. The resultant economic slowdown will crush tax revenues and the rate increase will exacerbate debt service levels...a double whammy which would serve to rapidly accelerate the demise and unraveling of The Great Ponzi.

And, finally, this is where it gets really, really dangerous. If current holders of treasuries, treasury futures and treasury derivative contracts continue to sell regardless, the amount of QE needed to stem the tide and support the bond market will grow exponentially. This is where ole Ben is truly playing with fire. He may believe that he is all-seeing, all-knowing and all-powerful but...if the global market chooses to over-run him...panic, chaos and hyper-inflation will follow.

Still thinking about converting your physical metal back into fiat? I hope not.

TF