The subscriber base reached a consensus over the weekend that important articles such as this one should always be made "public" within 24-48 hours. So here you go...

A doughnut. A cookie. A goose egg. Call it what you want and it's still the same. A big, fat zero. It's not often that I get all worked up on a Saturday but, when I noticed this, it was clear that I needed to write up a new post.

"What in the world are you talking about, Turd?'"

Comex August gold delivery notices. Would you like to know how many went out yesterday? Zero. Zilch. Nada. In other words...none.

And this is happening in the midst of an incredible surge of global demand for physical gold. To refresh your memory or in case you missed it, this data comes from a World Gold Council (not exactly our best friend) report that summarized global demand for the second quarter.

On the demand side we have:

- Demand from India and China alone in Q2 was 310 tonnes and 276 tonnes or 586 tonnes combined. This demand alone vastly outnumbers the ETF outflows.

- Globally, jewelry demand was up 37% in Q2 2013 to 576 tonnes (t) from 421t in the same quarter last year, reaching its highest level since Q3 2008. In China, demand was up 54% compared to a year ago; while in India demand increased by 51%.

- There were also significant increases in demand for gold jewelry in other parts of the world: the Middle East region was up by 33%, and in Turkey demand grew by 38%.

- Bar and coin investment grew by 78% globally compared to the same quarter last year, topping 500 tonnes in a quarter for the first time. In China, demand for gold bars and coins surged 157% compared with the same quarter last year, while in India it jumped 116% to a record 122t. Taking jewelry demand and bar and coin investment together, global consumer demand totaled 1,083t in the quarter, 53% higher than a year ago.

- For the tenth consecutive quarter, central banks were net buyers of gold, purchasing 71t, which reinforces the trend that began in Q1 2011

But on the supply side of the equation, we have this:

- On the supply side, recycling fell 21% in the quarter while mine production was 4% higher than a year ago, at 732t. In total, supply was 6% lower than a year ago.

I would also ask you to once again consider these charts. Thank you, Jesse! (https://jessescrossroadscafe.blogspot.com/2013/08/comex-gold-remains-at-...)

So, let me see if I've got this straight...

Global, physical demand is surging and even on The Comex we've seen this this trend influence things. How?

Last December, a month that is typically one of the biggest delivery months of the year for Comex gold, I was surprised to note that The Comex only delivered 3,253 contracts. Then, once February rolled around, got an even bigger surprise. For the February delivery month, The Comex delivered 13,070 contracts. Holy cow, that's a lot! The trend continued in April as The Comex delivered 11,632 contracts and June saw 9,869 delivered. But now in August....even though there have been no signs of decreased global demand....there have only been 2,965 deliveries? AND ZERO YESTERDAY? Seriously??

And what if I threw this next log on the fire???...

The cumulative total deliveries for the last four delivery months is 37,824 contracts. During that period, JPMorgan settled (stopped) a total of 2,162 contracts directly into their proprietary (house) account. That's 5.71% of all deliveries for the past four delivery months.

This month, of the 2,965 gold deliveries made through last Thursday, JPM had stopped into their house account 2,151 of them (72%). That's interesting, isn't it? Just this month alone, JPM has stopped as many contracts for themselves as they had in the previous four months combined.

But wait, there's more...Over the past nine days (8/5 - 8/15), The Comex has delivered just 1,003 contracts and the JPM house account has stopped 945 of them. That's 94%! And now yesterday, 8/16, The Comex has no deliveries at all? Seriously??

So now, suddenly, even though global demand does not seem to be falling off, The Comex is on a run rate of just 4,000 deliveries again. Hmmm. The average total deliveries for the previous three delivery months this year is 11,524 and yet this month is coming in 60% less? Seriously??

Does anyone else see and smell a very smoky fire here? Here are just some random dots. Feel free to connect them:

- The CoT and BPR reports show that JPM has flipped a 50,000+ contract net short Comex position into an 85,000+ net long position over the past eight months.

- Though they had shown very little interest in silver deliveries earlier this year, JPM's demand for silver deliveries into their house account rose to 2,824 of 3,444 total Comex deliveries for July. That's 82%.

- First Notice Day for the July silver contract was Friday, June 28. On that day, silver rose 92¢ from $18.60 to $19.52. By July 16th, it had risen to $20. Yesterday, it closed at $23.37.

- First Notice Day for the August gold contract was Wednesday, July 31. It was a very volatile day. Gold traded $15 higher before closing $20 lower at $1313. Yesterday, gold closed at $1371 and then traded even higher on The Globex with cash gold closing at $1376.

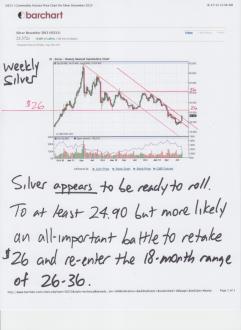

So, if you're like me and you think that this points to even higher prices ahead, you'd probably like some charts with a few mileposts for the road ahead. Here you go. The journey won't be easy but it certainly seems to be heading in one direction.

OK, I think I'll stop there. It's after noon on a Saturday and MrsF is calling. Go now and get some rest. I'm going to need you back here on Monday with your gameface on. It promises to be a very interesting week and remainder of the month...and year....and next year...

TF