For the sake of everyone's sanity, I thought it best to update and re-release this post from July 10, 2013.

Before reviewing this post from July, here's all you need to know:

So, now, here we are. Another Comex delivery month where JPM is the primary issuer and Comex price is declining. We are also seeing a renewed raid on the alleged "inventory" of the GLD. Today saw the brutal, summary dumping of over 5,000 Comex contracts in an obvious attempt to suppress and manipulate price (https://www.zerohedge.com/news/2013-10-11/stop-logic-gold-slam-was-so-furious-it-shut-down-cme-trading-again). And, finally, a quick check of the calendar reveals that today is what?...It's the 11th of the month!

The moral of the story? We must expect more weakness in the short term, followed by continued drawdowns of the GLD to meet global physical demand. Price will then recover later this month and into November.

OK, so here's the post from July 10....

A Pattern Emerges (https://www.tfmetalsreport.com/blog/4827/pattern-emerges)

By Turd Ferguson | Wednesday, July 10, 2013 at 11:14 am

Because I'm still adjusting to the time change coming off of my vacation, I found myself tossing and turning last night when I suddenly came to this realization. Though not on the level of Dr. Emmett Brown after hitting his head on his bathroom sink, I think you'll find this interesting, nonetheless.

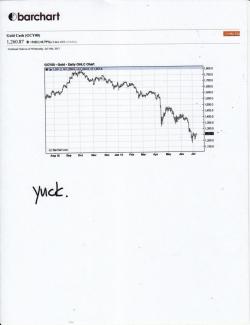

As you know, The Bullion Banks have engaged in a relentless campaign to lessen their exposure and potential liability in paper precious metal. Since the announcement of QE∞ last September, price has counter-intuitively fallen by over a third from near $1800 to below $1200. All the while, The Bullion Banks have decreased their total net short position in paper gold from 737 metric tonnes to less than 70 metric tonnes (from the CoT survey of 7/2/13). From a chart perspective, it looks like this:

Now, look closely. See anything? No? Look again, even closer. Do you see anything now? Do you see any type of pattern?? I must admit that, prior to last evening, I hadn't seen it, either. But it's there, waiting for you to discover it.

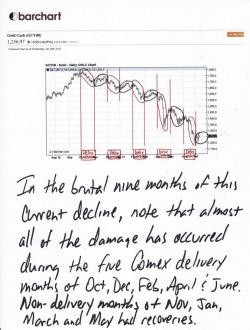

OK. What if now I gave you this? Take a look at the chart below with some notes made upon it. Now what do you think?

Hmmm. Well that's interesting, isn't it? Yes, price is down by over 30% from last September. However, almost all of the decline has taken place during the five calendar months of October, December, February, April and June. In fact, as you'll see below, the vast majority of the decline has occurred during the middle of those months. Hmmm. That's interesting, too.

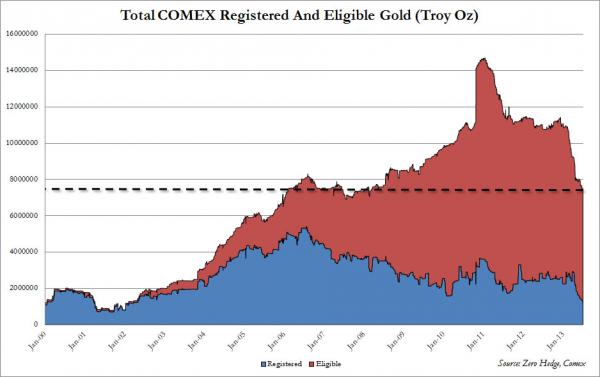

Now before we dig further, what if I gave you these two charts?

So, now, let's go back to the current decline. What is so special about the months of October, December, February, April and June? I'll give you a few moments to think about that before we continue...

.....

.....

If you guessed, "They're Comex delivery months, Turd!", then you win today's prize! Yes! Those months are, in fact, "delivery" months for The Comex. Recall that the active futures contract is always the front month for delivery. Currently, this is the August13 contract. As of Monday, it had a total open interest of 206,000 contracts and it will stop trading and have it's First Notice Day on July 31. Anyone holding a contract after that date must show their intent for delivery by providing 100% margin in their account. Deliveries to eligible contract holders will then take place through the month of August.

Still with me? Good.

This same process occurred back in September for the October12 contract. First Notice Day was at the end of September and deliveries took place through October. The price of gold peaked at $1796 on October 5 but managed to hang in there for another week or so. But then look what happened and note the exact date:

DATE PRICE GLD TONNAGE

10/12/12 $1773 1,340.52

10/24/12 $1699 1,336.90

10/30/12 1,336.30

So, what do we see here? Near the middle of the delivery month, price began to drop rather steeply and a little bit of gold was shaken out of the GLD "inventory". Then, after a decent rally in November, price began to decline again once we flipped the calendar to the delivery month of December. Look what happened and, again, note the date:

DATE PRICE GLD TONNAGE

12/12/12 $1723 1,351.42

12/20/12 $1635 1,350.52

12/28/12 1,350.82

And now you're thinking, "OK, Turd. What's the deal?". Well, let's continue, shall we? Again, please note the date:

DATE PRICE GLD TONNAGE

2/11/13 $1669 1,326.89

2/21/13 $1555 1,290.31

2/25/13 1,272.85

Well, that's interesting. This time, the mid-delivery-month decline shook out over 50 tonnes of gold from the GLD. "Hmmmm. I wonder what would happen if we tried that again?"

DATE PRICE GLD TONNAGE

4/12/13 $1564 1,158.56

4/16/13 $1321 1,145.92

4/29/13 1,080.64

"Wow. This is awesome!", the Evil Ones said. "We hit price in February and shook out 50 tonnes. Then, even while price was stable from 2/21 - 4/12, we were able to grab 114 more. Finally, by breaking price down through the floor at $1525, we got 75 tonnes in April! What a deal!!"

Once again, price was relatively stable mid-April to mid-June, while no Comex deliveries were taking place. Then look what happened, again paying special attention to the date:

DATE PRICE GLD TONNAGE

6/12/13 $1394 1,009.85

6/28/13 $1181 969.50

7/9/13 939.75

So, what is the lesson here?

- The Bullion Banks have utilized the manufactured price drop to lessen their exposure and potential liability in paper gold by over 90%.

- This resulting "discount" in paper price has led to a surge in global physical demand. For example, see here: https://www.mineweb.com/mineweb/content/en/mineweb-gold-news?oid=197040&...

- However, Registered and Eligible Comex inventories are dangerously low. As of yesterday, The Comex showed 224 tonnes of Eligible and just 35 tonnes of Registered (ready for delivery).

What to do, what to do? The plan is clear! Raid price during the delivery month!! Create the selling and panic necessary to shake loose tonnage from the GLD. Use this gold to settle delivery obligations, not only in New York but London, too. Once the current delivery "crisis" has passed, leave gold alone to wallow and flounder, only acting to cap price whenever necessary to keep the downtrend in place. Once the next delivery month arrives: Wash, rinse and repeat.

Going forward, this likely means that we're "safe" for about another month. Besides, it's summer and we're in the middle of vacation season. Aside from the occasional short squeeze or price plunge, the pattern suggests that gold will be stable between $1250 and $1350 until early August. But then....watch out!

Forewarned is forearmed.

TF