About a month ago, I was maligned and pilloried by some detractors for having the audacity to suggest that the reported Comex vault stock numbers were obviously dubious. Other bloggers suggested that the deposits in question were easily explained by the deposit of 99.99% pure, Asian kilobars. OK, maybe. For fun today, I thought we'd take these folks at their word and see where it leads us.

First, some histoire....

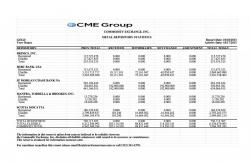

Back in the middle of October, some very odd and very precise deposits were made into the eligible vault of JPMorgan. Over three days, the total amount of gold booked in was exactly and precisely ten metric tonnes. It looked like this:

These oddly precise eligible deposits prompted me to write this: https://www.tfmetalsreport.com/blog/5182/more-deception-comex

The chagrin and malignment came about when it was suggested that, instead of being "bullshit", these deposits are simply the reflection of Kilobars of gold being deposited at The Comex. Of course, given that dealings on the Comex are so deliberately opaque that the CME Group itself "disclaims all liability whatsoever with regard to the accuracy or completeness" of these reports, there's no point in continuing to debate whether or not these are simple paper shenanigans or Kilobar deposits. We can't know for certain so, in the end, we are just arguing for arguments sake and getting nowhere.

So, today, I thought it'd be more fun to just simply take as fact and accurate the CME Group reports. Let's go ahead and presume that the deposits of late October really were perfect, one kilogram bars....and then let's see where that takes us. And, again, a disclaimer: I'm not claiming to have all of the answers here. This is just a thought experiment and I'm simply trying to lay out the information that I see every day and asking you for your opinion. What do you think?

POINT #1

Some have suggested a simple explanation for the 10 metric ton delivery in October. This addition was the gold that JPM stopped during the October Comex gold delivery process. Hmmm. OK. But here's the problem. JPM only stopped 1,054 contracts that month between their House and Customer accounts. That works out to be about 3 1/3 metric tonnes, yet JPM booked in 10 metric tonnes over the three days in question. Again, hmmm.

JPM also stopped 3,414 contracts in August and that's a little more than 10 tonnes. Could the October bookings simply be the delivery to their vaults of the August metal? That seems plausible, I guess, but more likely just leads us to...

POINT #2

Here's how the Comex math works. According to the CME Rulebook (https://www.cmegroup.com/rulebook/NYMEX/1a/113.pdf), this is how deposits and deliveries are accounted:

The contract for delivery on futures contracts shall be one hundred (100) troy ounces of gold with a weight tolerance of 5% either higher or lower. Gold delivered under this contract shall assay to a minimum of 995 fineness and must be an Approved Brand.

Gold meeting all of the following specifications shall be deliverable in satisfaction of futures contract delivery obligations under this rule:

Either one (1) 100 troy ounce bar, or three (3) one (1) kilo bars.

Gold must consist of one or more of the Exchange’s approved brand marks, as provided in Chapter 7, current at the date of the delivery of contract.

Each bar of Eligible gold must have the weight, fineness, bar number, and brand mark clearly incised on the bar. The weight may be in troy ounces or grams. If the weight is in grams, it must be converted to troy ounces for documentation purposes by dividing the weight in grams by 31.1035 and rounding to the nearest one hundredth of a troy ounce. All documentation must illustrate the weight in troy ounces.

Each Warrant issued by a Licensed Depository shall reference the serial number and name of the Approved Producer of each bar.

Each assay certificate issued by an Approved Assayer shall certify that each bar of gold in the lot assays no less than 995 fineness and weight of each bar and the name of the Approved Producer that produced each bar.

Upon receipt of the gold bar by the Licensed Depository who must also qualify and be designated a Licensed Weighmaster for gold, each gold bar shall be weighed in the lot measured to 1/100 of a troy ounce (two decimal points). In accomplishing such measurement, each bar shall be weighed to the nearest 1/1000 of a troy ounce (three decimal points); weights of 4/1000 of a troy ounce or less shall be rounded down to the nearest 1/100 of a troy ounce and weights of 5/1000 of a troy ounce or more shall be rounded up to the nearest 1/100 of a troy ounce.

OK, now this is getting interesting. There are several things to note here.

POINT #3

Let's get back to the "fineness" issue. If we're dealing in Kilobars, it is very likely, given all of the reports of Asian demand and refinery backlogs, and given the method through which they were booked in, that the Kilobars allegedly deposited into JPM's eligible vault are of the 999 fineness variety. IF THAT'S THE CASE, these bars are not, and will not, ever be switched to registered. Why? Because the owner would be crazy to do so. If the minimum Comex standard is 995 then, as stated in Point #2 above, wouldn't it seem foolish to sell your 999 bars in New York? Therefore, the only likely way that a 999 bar would ever be registered and sold is if The Comex changes their purity rules. (Hold onto that thought. We'll get back to that in a minute.)

Perhaps here we have actually stumbled upon our answer to this entire riddle:

POINT #4

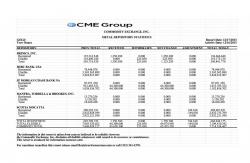

Last Wednesday, JPM booked in another perfect and precise, two metric tonnes of eligible gold. But that wasn't the only day...the four days since have all seen identical deposits. This makes five, consecutive days of exact and precise, two metric ton deposits. It looks like this:

(As rounding errors go, now we're really getting somewhere. 20 metric tonnes X 0.7726 troy ounces/ton = 14.452 troy ounces. Misplacing/disregarding 14.452 troy ounces equals almost $18,000 at current prices.)

Again, some might suggest that this is simply the gold that JPM has stopped during the December delivery month. As we've painstakingly noted each day, JPM has now stopped exactly 5,000 of the total 5,207 December deliveries or 96%. Five thousand contracts is 500,000 ounces and, as shown above, over the past five days JPM has taken delivery of about 643,000 ounces.

But now what do you make of this? Below is the CME Gold Stocks report for November 29, right before the December delivery period began. Note the inventory levels of HSBC and Scotia. Why? Since this report was generated, the House account of HSBC has issued/delivered 2,939 contracts (293,900 ounces) and the House account of Scotia has delivered another 1,225 (122,500 ounces). Here's the 11/29 report:

And here's another look at the report from yesterday:

Note the changes. The amount of gold in the vaults of each have gone UP, not down. In fact, if you go back to the report of 12/9, you'll see that HSBC even got in on the 32,150.000 act:

POINT #5

And I guess this is the main point...These "markets" are broken. The futures markets were set up as a place where producers could hedge and manage risk. Speculators were free to take the other side of these trades if they felt they could profit. Underlying these exchanges was the promise to actually deliver the physical commodity. Without this promise and process, you have an empty shell...a "market" comprised of nothing but paper derivatives and deliveries made with book-entries and the shuffling of warrants and warehouse receipts. The Comex was not designed to "discover price" but that's exactly what it does, and it does so at the whim of HFT speculators and bullion banks. And this has real world consequences.

Look at the past two weeks of market activity. There has been tremendous volatility with price swings from day-to-day of 2-4%. The CFTC-generated CoT reports demonstrably show that all of this price action was due to the squeezing of Spec shorts one day, only to have them and replaced and put back on the next. Nowhere in this price action were the real world, supply and demand fundamentals of the producers ever in play. You tell me, did the fundamentals for silver mining production suddenly improve on December 10th, when price surged 62¢ or 3%? If so, then the fundamentals must have immediately turned back around two days later when price fell by 90¢ on December 12th.

The global pricing mechanism for precious metal is now almost entirely the domain of speculating hedge funds and bullion banks. They do this through The Comex where rarely, if ever, anyone has to deliver against a paper short obligation. By rigging and momo-chasing prices lower, the banks and hedgies are forcing mining companies out of business and real jobs are being lost, often in places where there is no alternative employment. Lives and families are ruined, all to prop up confidence in The Great Ponzi and enrich and fatten some banker bonus pools.

The good news is...Like all fraudulent schemes that distort the laws of supply and demand, this pricing structure will eventually come to and end. For me, it can't happen soon enough.

POINT #6

Just for fun, let's explore one other option....and this is pure speculation and conjecture.

- What if the twenty metric tonnes of gold deposited into JPM's eligible vault over the past two months really is 20,000 Kilobars, of the 999 fineness variety?

- Why would JPM be holding, at a minimum, 20 metric tonnes of Asian Kilobars in their NY vault?

- Could these have been acquired for a big Asian client (China)? If so, does this give credence to the idea that JPM's client is China and, by extension, China is the big NET LONG on the Comex, converted from NET SHORT after successfully driving price down by over 30% in the past year? Lots of folks think this is possible and why not? Our buddy Koos Jansen pegs Chinese imports this year alone at 2,500 metric tonnes.(https://www.ingoldwetrust.ch/shanghai-gold-exchange-physical-delivery-eq...) If you were buying that much gold and had easy access to smash the price first, wouldn't you do it that way?

- I've often stated that JPM's verifiable NET LONG Comex gold futures position is a market corner and it gives them the ability to break and take control of The Comex at a time of their choosing. If this position is actually China's...well, that certainly changes the dynamic a bit, doesn't it?

- And now JPM (China) is stashing away 2 metric tonnes per day of Asian-standard Kilobars?

- And a Chinese company just purchased One Chase Manhattan Plaza in New York City? (https://www.bloomberg.com/news/2013-10-18/jpmorgan-tower-sale-sets-recor...)

- And One Chase Manhattan Plaza is the building which has, at it's sub-9 grade level, the largest precious metals vault in the world (https://www.zerohedge.com/news/2013-03-02/why-jpmorgans-gold-vault-largest-world-located-next-new-york-fed), directly across the street from the NY Fed vault?

- And, just last year, the London Metal Exchange (LME), the world's largest market for industrial metal futures, was purchased by....wait for it...Hong Kong Exchange and Clearing Limited. (https://www.bloomberg.com/news/2012-07-24/lme-shareholders-poised-to-vot...)

So the question (thought experiment) becomes...Is China planning a takeover/buyout of The Comex? It would seem that The Chinese are readying themselves to dominate metals trading in the 21st Century...They own the LME already and Shanghai is supplanting London as the world's largest volume precious metal delivery hub. Why not take global control of precious metal futures, too?

IF that were to happen, what would this mean for price? With "control" of precious metals futures pricing and trading, would The Chinese perpetuate the manipulation or would they eliminate it? If The Chinese are moving toward the eventual backing of the yuan/renminbi with gold and/or silver, would it benefit them to have higher prices or lower, once they have physically taken control of the majority of the world's gold?

Whoa. That's some heavy stuff. I've been mentally compiling this post for about a week and then physically typing it for the past three hours. Can you now see why it has taken so long? Anyway, welcome to my world! Please roll this information and these ideas around in your head for a while. Let me know what you think. Once again, maybe old William of Ockham provides the best answer....Newly-minted, American-made Kilobars, temporarily stored in JPM's New York vault, on their way to wherever. Then again, maybe not...

TF