We watched intently as July Comex silver deliveries spiked to unusually high levels. Now, with August Comex gold in delivery, we're starting to see some of the same demand. No, it's not a "run" or a potential "default". It may, however, be another indicator of extremely tight global wholesale precious metal supply.

For a refresher of the unusual delivery pattern in July silver, click here: https://www.tfmetalsreport.com/blog/7031/wrapping-july-comex-silver-deli...

As noted in silver, the number of contracts of gold delivered over the course of a delivery month NEVER exceeds the amount standing at contract "expiration" or on First Notice Day. Never, ever have I seen this happen. Below are the stats for the previous four delivery months so that you can see for yourself how this usually works:

Dec14: 11,507 open at contract "expiration". 3,381 total deliveries for 29.4%

Feb15: 8,455 open. 1,174 total deliveries for 13.9%

Apr15: 7,348 open. 2,801 deliveries for 38.1%

Jun15: 8,380 open. 2,959 deliveries for 35.3%

Aug15: 9,215 open.

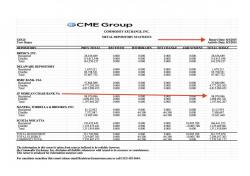

And here's where it gets interesting...and it's only August 5. Last evening, the CME posted the delivery totals for yesterday. Here's a screenshot of the cumulative deliveries so far in August:

Note that after a whopping 2,828 deliveries yesterday (more on that below), the total amount of deliveries made so far in just four days is 3,171. If we plug that in versus the total number of contracts still open when the contract went off the board on July 30, we already have a delivery percentage of 34.4%. So, for August to "look like a normal month" of deliveries, gold deliveries would have to stop right about here.

However, they're not going to stop right about here? Why? Because, as of yesterday, there were still 6,593 August gold contracts still open. THIS BRINGS UP ALL SORTS OF INTERESTING ISSUES.

- If just half of the remaining 6,593 contracts get delivered, August gold will see something like 6,500 total deliveries versus a standing total of 9,215 for something like 70%. That in itself is noteworthy considering recent history and what happened in July silver.

- But that's not the most interesting part. Let's do some math! As noted, there were 9,215 contracts still open at "expiration" and 8,295 still open at the close on First Notice Day last Friday. Today, the CME shows 3,171 total deliveries made and 6,593 contracts still open. If we add those together we get 9,764. Holy smokes! Have we already seen 550 contracts "jump the queue" for immediate August delivery?

- And where is this deliverable "gold" coming from? When August deliveries began late last week, the CME Gold Stocks report showed only 351,519 ounces in the registered (available for delivery) category and now we've already seen 317,100 ounces delivered.

And this is where all of the lies, deceit, fraud and warehouse receipts start to unravel. For clarity, let's focus on yesterday alone.

The CME delivery report for yesterday is posted below. Note the primary "issuer" of the deliveries:

Yes, good old JPMorgan allegedly delivered 2,750 contracts of August gold yesterday. Keep in mind that:

- That's 275,000 troy ounces

- All from the House or proprietary account

- The stated position limit for the front/delivery month is 3,000 contracts (https://www.cmegroup.com/market-regulation/position-limits.html)

- And, as you can see below, as of yesterday JPM only showed 98,971 ounces in their entire registered vault.

So are we going to see all sorts of adjustments and other book entries over the next few days? Will several metric tonnes of gold suddenly move from eligible to registered in order for The Banks to make August deliveries?

Or will we see any "gold" move at all? Instead, will the CME simply continue to maintain the charade of physical metal clearance by posting disconnected data and hoping that no one will notice?

What about the House Account of JPMorgan? Will their total deliveries exceed the 3,000 maximum as mandated by Comex position limit rules? And if it's not JPM delivering upon the remaining 6,593 contracts, which Bank will? Will HSBC turn around and deliver back out some of the same "gold" they just stopped yesterday?

CAN'T YOU SEE WHAT A GIGANTIC FREAKING SCAM THIS IS??? And the only reason the paper derivative price can claim any relevance at all is because of the alleged physical delivery that backs the exchange where the price is derived. This delivery fraud then allows the charade to keep going, while price is manipulated lower and the CME collects all of their trading and assorted other fees.

Just as in July Comex silver, we'll continue to closely monitor these developments as we move through August with gold but don't expect any "change" or "bank runs" or "defaults". Unfortunately, you must expect more fraud, lies and deceit as the current fractional reserve bullion banking scheme grinds toward its eventual demise.

TF