We were all over this yesterday and ZeroHedge has brought it to everyone else's attention today. However, instead of dwelling upon the here and now, I'd like to give you some history to consider.

Here's yesterday's Vault thread discussing the ongoing shenanigans: https://www.tfmetalsreport.com/blog/7043/comex-august-gold-deliveries-heat

And here's today's ZH article on the movements within the JPM gold vault: https://www.zerohedge.com/news/2015-08-06/jpmorgan-helps-comex-avoid-gol...

However, for this particular post, I'd rather focus on something from the past instead of the present...

For a couple of years now, we've been monitoring the peculiar trend to list perfect and precise deposits within the Comex gold vaults. A "normal" movement of something as precious as gold would/should require very precise assaying and measuring...and the Comex/CME usually lists these changes all the way out to three spots past the decimal point. For example, a deposit or withdrawal might be 13,142.085 troy ounces.

However, about two years ago, we took notice of a new trend...perfect and precise deposits with nothing but zeroes to the right of the decimal point and we've written about it several times including here: https://www.tfmetalsreport.com/blog/5182/more-deception-comex and here: https://www.tfmetalsreport.com/blog/6272/information-deemed-be-reliable

Some were quick to rush to the defense of the fractional reserve bullion banking system and claim that there was simple explanation. The argument was that these deposits were simply factory-fresh gold kilobars. These bars were so brand new and perfect that the Comex vaults had no need to measure and assay them. Just simply book them in as perfect and precise and make no notations to the right of the decimal point.

That explanation seems a bit of a stretch and, at the time and up to this day, we still call BS. The Comex vaulting system is a sham and fraud based upon paper warehouse receipts and unallocated metal. In our view, these perfect and precise "deposits" provide color to the deception.

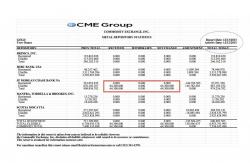

Which brings us back to the present. The last week has seen some unusually heavy activity within the JPM Comex vault. As noted yesterday, there was a massive reclassification from eligible to registered, ostensibly to cover a slug of 2,750 deliveries that the house account of JPM issued back on Tuesday. Note that this adjustment was 276,049.092 troy ounces. Additionally, last Thursday, the JPM vaults saw a huge, outright withdrawal. Again, note that the listed size was 200,752.608 troy ounces. The corresponding CME Gold Stocks reports are below:

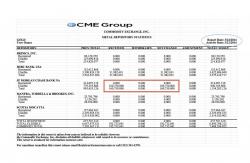

Now here's where a guy like me, with a decent memory and a knack for recall, gets into trouble. You see, if we go back over the past two years, we find all kinds of perfect and precise vault deposits. In fact, though I'm sure I missed a few along the way, check out the fourteen reports below. From October of 2013 through just the end of June this year, these 14 reports alone show an accumulation of a whopping and massive 44 metric tonnes of perfect and precise "deposits", totaling 1,414,600 troy ounces of gold.

Go ahead, call me "crazy" and a "gold bug". Call me a "conspiracy theorist", if you like. However, doesn't it strike you the least bit odd that JP Morgan can book in 44 perfect and precise metric tonnes of gold but, at crunch time when that gold is demanded for delivery, 15 metric tonnes flow back out measured back to three spots to the right of the decimal point?

Perhaps the best explanation still lies with the disclaimer that the CME suddenly began including in 2013. (https://truthingold.blogspot.com/2013/06/the-comex-confirms-that-its-gol...) Lawyers at the CME, recognizing that these reports could/might be a fraudulent distortion of the truth, felt they needed to add the disclaimer in the hopes that they won't one day be indicted/prosecuted for fraud. We'll see about that. In the meantime, the charade of physical delivery continues with the goal of maintaining the fractional reserve bullion banking system. This current pricing control scheme will likely continue to function until the day comes when it simply fails. The resulting conflagration will be a sight to behold.

TF