For a fair and honest market, the latest developments might be significant and noteworthy, perhaps even troublesome. But remember, we're not talking about a fair and honest market, we're talking about The Comex, instead.

As the "delivery month" of December begins on the Comex...and before we begin another exercise detailing what a sham, charade and illusion this all is...please take a few moments to review the links below. This is hardly the first time we've tried to draw attention to all of this and it likely won't be the last:

Again, the only reason that the Comex price for gold (and silver) has any relevance whatsoever is the alleged physical delivery that takes place at the price "discovered" through the trading of paper derivatives. Without physical delivery, the only "price" that is being discovered is the price of the paper derivative contract, itself. Thus, physical delivery is what gives relevance to the paper derivative price.

So, what happens when the Comex "delivery" process is exposed as a fraud, an illusion and a charade? Does this mean that the Comex paper derivative price can no longer be the basis for physical pricing worldwide? YES IT DOES! That, my friend, is the reason we so diligently chronicle this stuff month after month. And, boy oh boy, it sure looks like December 2015 is going to be a doozy.

The actual delivery phase of the December Comex gold contract began back on Friday when the Dec15 futures contract "expired". Though it still trades through December, as of today (Monday) any entity still holding a Dec15 contract had to supply 100% margin for the full cost of the contract or about $107,000. Why? Because, as a long holder of a contract in its delivery period, you are subject to having the metal delivered to you at any time and, at a price of $1070/ounce, 100 ounces will cost you $107,000.

But the Comex market isn't about delivery, it's about paper derivative trading. So, by the close of business last Friday, nearly all traders had liquidated their Dec15 contracts and rolled them into the next "front month", which is the Feb16. However, some contracts always remain open at "expiration" and a few of these actually look to "stand" and "take delivery". For Comex gold, here's how it has played out in 2015:

CONTRACT MONTH TOTAL OPEN AT EXPIRATION TOTAL DELIVERIES MADE

DEC14 11,507 3,381 or 29.4%

FEB15 8,455 1,174 or 13.9%

APR15 7,348 2,801 or 38.1%

JUN15 8,380 2,959 or 35.3%

AUG15 9,215 5,113 or 55.5%

OCT15 3,092 950 or 30.7%

DEC15 7,849 ?

Note the outlier and dramatic dropoff of total deliveries back in October. This was likely due to the fact that October is typically the lowest volume delivery month of the year. However, recall that total Comex registered gold has been falling to new alltime lows as 2015 progressed, too. Could this be having an impact?

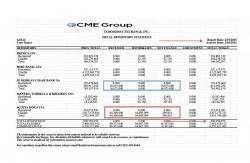

Here are some random CME Gold Stocks reports. Check the date and the amount of gold listed as registered and available for delivery.

This from December of last year. Enough gold for 7,378 deliveries (if deliveries were actually made):

This from February of this year. Enough gold for 8,099 deliveries:

This from last April. Enough gold for 6,031 deliveries:

This from August. Now only enough gold for 4,888 deliveries:

And, uh-oh, this from October. Only enough gold for 1,616 deliveries. Good thing only 3,092 stood and just 950 total deliveries were made, huh?

So now here we are. The biggest and typically busiest delivery month of the year (December) is upon us and, at expiration last Friday, the Comex still had 7,849 contracts open and standing. And how many ounces of registered gold are currently available within the Comex vaulting system? As of today, total registered gold has fallen to a new all-time low of 134,877 ounces or enough gold to physically settle just 1,348 contracts!

See what I mean? What a conundrum! IF The Comex truly was a free and fair market and IF actual physical metal deliveries were taking place to "back up" the paper derivative price, The Banks and The Exchange would be in a bit of a jam. From where would they find the gold needed to physically settle all of those seeking delivery?

Ah, but no worries, I'm sure that the month of December will pass without any issues. There will be some small journal entry movements of gold back and forth between the categories and between The Banks. But no real gold will move and no real crisis will emerge. Instead, it will just be business as usual and CNBS, BBG et al will keep reporting the Comex paper price as the true "price" and "value" of gold.

And this draws us back to the questions posed at the beginning of this post:

- So, what happens when the Comex "delivery" process is exposed as a fraud, an illusion and a charade?

- Does this mean that the Comex paper derivative price can no longer be the basis for physical pricing worldwide?

The answer earlier was an emphatic "YES IT DOES!" and that's still the case. You, as a gold investor, need to understand this important point. One day soon, this current paper derivative and fractional reserve bullion banking pricing scheme will fail. Maybe not this month and maybe not in 2016, either. But fail it will. That much is a certainty. And when it does, gold will have to be priced based upon physical availability at the offer. Call me crazy, but I suspect that physically-discovered price is going to be considerably higher than the one discovered through the current paper derivative system, a scheme that levers physical gold into paper at a ratio of nearly 300:1. How much higher will the new price be? Hmmm...well let's just say that it's not going to be $1070/ounce, that's for sure.

Therefore, prepare accordingly.

TF