We've known for years that the Comex derivative pricing scheme was a fraud, where market-making Bullion Banks create unlimited amounts of paper gold in order to soak up speculator demand. Then these same banks shuffle warrants and warehouse receipts back and forth to create the illusion of physical delivery. But now, even the price "discovered" electronically on this exchange has become completely useless.

Look, I recognize that we've plowed this ground so many times already that you probably think that we've run out of things to write about. Let me assure you that that's not the case and that there is a serious purpose behind this post. First, though, please be sure to review some of the work we've done in the past on the subject of Comex illegitimacy. First, here's an article on the inherent unfairness of the ability of The Banks to simply create new derivative contracts from thin air whenever speculator demand for paper gold increases:

And we've recently spent considerable time documenting the fraud of Comex "delivery". Here are two links that summarize and detail the problem:

- https://www.tfmetalsreport.com/blog/7115/comex-delivery-charade

- https://www.tfmetalsreport.com/blog/7420/connecting-comex-dots

This circular charade of delivery continues in February. Recall that back in December, the proprietary (House) account of JP Morgan stopped or took delivery of 2,021 of the total 2,073 gold contracts that were allegedly settled. The primary issuers of this gold were the House Account of HSBC at 818 contracts and the House Account of Scotia at 699.

And what has taken place so far in February? The House Account of HSBC has stopped or taken delivery of 1,181 contracts while the House Account of JPM has issued 651 back out? Do you see how this works?

So, we've established that:

- The Comex, by design, is inherently unfair as the market-making Bullion Banks have the unfettered ability to issue as many paper derivative contracts as "the market" desires whenever there is speculator demand.

- The Comex can only claim legitimacy in discovering price if there is actual physical delivery made at said "discovered" price. However, there is no physical delivery at Comex. Instead, it's just a bi-monthly circle jerk where Banks make and take delivery on a rotating basis. Therefore, the only price discovered is the price of a Comex contract, NOT the price of gold.

The object of this post is to draw your attention to the third spoke of Comex illegitimacy...the price itself.

Much has been written over the past three weeks about the "renewed bull market in gold". Price began the year at $1061 per ounce and it reached an intraday high of $1263 last Thursday. That's a 19% move in six weeks and certainly something that all of us in the gold community should be excited about. However, since this price has been found in large part through trading on the Comex and other electronic exchanges, is this really the price of gold?

Yes, there are physical exchanges of metal that have been made all over the planet based upon this Comex price. Right now, you can visit any of our site's sponsors, affiliates and advertisers and they'll gladly sell you an ounce of gold at the current Comex price plus a small premium. But, again, is the price discovered on Comex really a price of gold, itself? The point of this post is to contend that it's not.

Here's just a sample of a few headlines this morning. Gold has fallen back to near $1200 and, as you can see, there's much hand-wringing regarding what may happen next:

- https://news.goldseek.com/GoldSeek/1455721920.php

- https://agmetalminer.com/2016/02/15/gold-is-officially-in-a-bull-market/

- https://www.safehaven.com/article/40487/has-gold-entered-a-new-bull-mark...

- https://www.investing.com/news/commodities-news/gold-prices-sink-below-$1,200-as-safe-haven-buying-dries-up-384825

The financial media, financial analysts and brokers will all tell you that the Comex derivative price of gold really is a proxy for actual, physical gold. The news articles all reference this price and contend, to varying degrees, that this price is influenced by:

- "Investors" seeking the safe haven of gold

- Traders sensing the growing momentum of the trade

- Hedge funds buying or selling based upon technical factors

Media, analysts and brokers all watch the "price" rise and fall and reach conclusions regarding the overall market and where it's seemingly headed. "Is this a bull market or a bull trap?", for example.

But what if I could show you that the price discovered on the Comex and other derivative exchanges isn't influenced by "investors" at all? What if, instead, this "price" was simply determined by the whims of the HFT computers...machines that take their trading cues from signals completely unrelated to the fundamentals of gold, itself? And what is the single most important trading cue for the HFT algos? Changes to the relationship between the U.S. dollar and the Japanese yen, commonly referred to as the trading pair USDJPY.

Well, we've written about this before, too. We first noticed this phenomenon back in September of 2014. Here's just one example of what we wrote back then: https://www.tfmetalsreport.com/blog/6346/even-more-gold-yen-link

ZeroHedge soon picked up on this, too, and they wrote about it in November of 2014: https://www.zerohedge.com/news/2014-11-12/did-boj-quietly-peg-yen-gold

Our friend, Paul Mylchreest, noticed the same correlations and he added this terrific piece in December of 2014: https://www.tfmetalsreport.com/blog/6425/new-paul-mylchreest

And it is this correlation that has driven the "price" of gold higher in 2016, nothing else. Oh sure, it's nice to hear anecdotal stories about increased physical demand and "lines around the block", but those fundamental factors have had little to no effect on "price". Instead, it's all about the rapidly increasing value of the yen or, expressed inversely, the rapidly declining value of the USDJPY.

Below is a chart of the past two months of trading action. In candles, you see the value of the yen versus the dollar. In bars, you have the "price of gold":

But let's zero in a little bit and look even closer...

Last Thursday, gold shot higher by over 5% in a move that left many analysts claiming that "the paper markets were breaking" and that "a new paradigm for gold was beginning". But was this the case or was the "price of gold" simply reacting to an historic, 10% move in the USDJPY that culminated with an early Thursday plunge all the way to 111, down from 121 just two weeks ago? Below is a chart of the five days Tuesday the 9th through yesterday, Tuesday the 16th. Again, the yen is in candles and gold is in bars:

So, did the "price of gold" move based upon fundamentals, physical demand and the emergence of a new bull market?

OR

Did the "price of gold" simply adjust based upon the whims of High Frequency Trading computers, which "saw" the rapid rise in the relative value of the yen and bought "gold" according to their pre-programmed algorithms?

Obviously, the answer is the latter and it is extremely important that you understand this significance of this. Why? Because the dollar-based "price of gold" has been largely determined by this sole factor for nearly 3.5 years now. See the next chart, again with yen in candles and gold in bars:

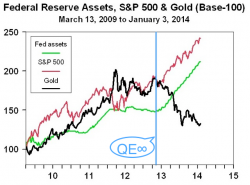

The chart above explains the charts below. Why has gold moved counter-intuitively since the onset of QE3 in October of 2012? How was the long-standing relationship between US debt, the Fed balance sheet and the price of gold severed? The answer lies in the total market domination of High Frequency Trading as well as the willing participation of The Bullion Banks to cap all rallies in order to maintain downward momentum.

In the end, what does all this mean? Simply put, the "price" discovered via electronic trading on the Comex and the Globex is NOT a reflection of the price of gold at all. Instead, it's primarily just a reaction of HFT computers to changes in the USDJPY. There's no new "bull market" based upon "investors seeking the safety and certainty of physical gold". Instead, any new bull market in the paper derivative price will simply be a reflection of the continued rally in the value of the yen versus the dollar. That's it and that is all.

What's fun is that the Bullion Banks have unwittingly sewn the seeds of their demise through their participation in this scheme. This uneconomically discovered price is being used by the Chinese, the Russian, the Indians and wise investors globally to drain The System of its remaining physical gold. Soon, the stockpiles of The West will be liquidated and, once no more physical gold remains, this entire fractional reserve pricing scheme will collapse under its own weight. When might this happen? It's impossible to say however, as this great article from Koos Jansen points out, the West's finite supplies are indeed dwindling: https://www.bullionstar.com/blogs/koos-jansen/london-was-bleeding-184t-o...

So, what do you do with this information? Well, first of all, you don't get caught up in the hype. Now that you know what really affects "price", you should be able to control your emotions both on upticks and downswings. Additionally, here at TFMR, we do quite well at recognizing inflection points and trends in gold and the USDJPY. Forewarned is forearmed, they say, and subscribers to The Vault use this knowledge to their advantage. But most importantly, recognize this:

The "price of gold" as reported by the media and repeated by analysts and pundits everywhere is no more proxy for the actual intrinsic value of gold than is virtual reality a proxy for real life. You're told that it's real and it may look real but it's not. Not by a longshot. In the end, your best strategy is to mimic the Chinese, Russians and Indians. Recognize the value inherent in the fraudulently-determined "price" and act accordingly by continually converting your paper currency reserves into sound money...while you still can.

TF