Today is October option expiration and Friday brings the end of the month and quarter. Therefore, we should not be surprised by the level of abject and overt price manipulation and chart-painting that is being done this week.

As we discussed late last week, below is the most important chart for this week. We suspected that The Banks would intervene in order to keep price from a new monthly high AND below this long-term trendline. The LAST thing The Banks want is a breakout and rally just as Q3 ends and Q4 begins as this would almost certainly inspire new 2016 highs and a virtuous cycle of even higher prices.

Therefore, what you are witnessing today should come as no surprise. And how do we know that this is a direct Bank price manipulation event? Three things.

- Check the open interest versus price. Once again yesterday and just as suspected, open interest rose while price was falling. Given the technical structure, I can assure you that that this was NOT new Spec shorting driving OI higher. Instead, these are The Banks meeting every bid and then some with new naked shorts. Open interest in gold rose by over 6,000 contracts on yesterday's paltry $2 gain. For the two days of Friday and Monday, where price almost inexplicably was a total of -$1, total OI was up over 13,000 contracts.

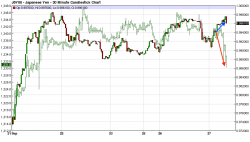

- Check the action versus the known HFT drivers. Is the gold "price" still coupled and linked to USDJPY and bonds, as we've seen for months and years? Hmmm. See below. Note the divergences on these five day charts.

3. Check the moving averages. The Banks also know that they'd prefer to get some help in this effort so we must check to see if an effort was made to break a significant moving average. As we saw just a few weeks ago, if The Banks can break the 50-day moving average, then the TA-oriented HFTs will jump right on the train and do some of the selling for The Banks. Well, see below. First, look at where gold is now relative to its 50-day at 38...it's back below. And how did it get below? With one big Cartel shove of nearly 7,000 contracts earlier today!

And, in case you're wondering, it's the exact same freaking thing in silver, which has also been rigged back below its own 50-day. And how did it get there? The exact same way...only in silver, it happened yesterday. In fact, since Dec16silver hit a post-Fedline high of .14 back on Thursday, it has been nothing but straight down in a deliberate attempt to keep silver from generating the momentum that would take it back toward the 2016 highs.

And check this chart below. Do you think this is pure coincidence? Where else but in the Cartel Bank-controlled paper derivative silver market would you get such identical chart patterns? As we discussed in yesterday's podcast, this is overt and shameful...but it's not like the CFTC or anyone else actually cares. Note the identical 4-day rallies followed by identical 4-day smashes (presuming this current smash finishes up tomorrow). After bottoming near .50 two weeks ago and .80 last week, I guess we should expect a bottom tomorrow near .10.

Look, I wish I had better news but you all know by now that The Banks remain (mostly) in control of their Paper Derivative Pricing Scheme and will remain so as long as The Scheme persists. Though we know how this all eventually ends, in between it's extraordinarily painful and frustrating to watch. In the end, all you can do is attempt to minimize your trading exposure so that you don't get crushed along with all of the other unwitting dupes. The correct strategy is to hold physical metal and..maybe, if so inclined...a high quality and diversified portfolio of mining shares. Other than that, you must recognize that The Banks will ALWAYS look to screw you because you are their enemy. The price action today and since last Thursday only serves to once again prove this point.

TF