If anything, today's BLSBS reveals that the average US citizen is now working multiple, part-time jobs in a desperate attempt to make ends meet. And this "robust economy" that is "near full employment" is the supposed rationale for the Federal Reserve to raise the Fed Funds rate as soon as next month. What a perverted lie and scam this all is!

But we all knew there wasn't going to be a rate hike in November anyway and December is at worst 50/50. Today's "jobs report" only confirmed that: https://www.zerohedge.com/news/2016-10-07/fed-whispererr-hilenrath-kills...

However, let's get back to the internals of the BLSBS because I want you to stew on this for a while. We're told through and endless barrage of analysis, punditry and jawboning that The Fed will soon embark on a series of FF rate hikes...primarily because the US job market is so strong that it is near full employment. The thought goes that this will increase pressure to raise wages and, thus, spark inflation.

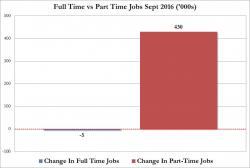

But below are the two most-important charts you'll see all day. Taken from the BLSBS data, note that the number of US citizens working multiple jobs is at the highest level since 2008 and that the only "growth" in jobs is coming from part-time positions.

This means exactly what you think it means. The Average Joe/Josie, having lost a high-quality full-time job due to downsizing or Obamacare or whatever has been forced to work multiple, part-time jobs just to make ends meet. AND THIS IS THE ROBUST US ECONOMY THAT DEMANDS A RATE HIKE! If anything should prove to you that:

- Fed policy since at least 2008 is a complete disaster

- The Fed does NOT work for the average citizen

- The Fed, instead, does what its owner Banks want

This should do it! What more do you need to know? The lying, criminal Bankers DO NOT CARE about you, you neighbor or anyone outside of their Cabal. All that matters...and all they base their decisions upon...is what is the best course of action for the profitability and sustainability of the owner Banks! Period. End of story.

To that end, the Central Bankers seek to manage and manipulate ALL "markets" worldwide. Given the near impossibility of this task, the so-called regulators that work as pawns of this system look away as impassive, unconcerned observers as HFT the Central Bankers need instead dominate and destroy nearly everything. As an example, last evening the British Pound fell 5% in 5 seconds:

Why? How? That's easy. Again, with HFT, market depth and liquidity appears to be a mile wide. However, in reality, it's only one inch deep and bids or offers can be pulled at the speed of light. The result? Flash crashes...just like we saw last evening in the GBP.

And it is this same HFT that have led the exodus from paper gold and paper silver over the past 10 trading days. Once the 50-day MAs were taken out, the HFTs began to sell all rallies and bounces. Then, once the 100-day MAs were smashed, the outright dumping and liquidation began. Since Tuesday, September 27, when The Banks raided price to smash it through the 50-day, gold has fallen over or about 7%. Over the same time period, total Comex gold open interest has fallen by 89,000 contracts or about 15%. Do you see how this works?

So now, if you want paper gold and silver to go back higher, you need the HFTs to start buying those derivatives again. What will inspire them to do that? The same old, same old...falling interest rates and a sinking USDJPY. Though this trend in those two key inputs will, NO DOUBT, re-assert itself soon, in the meantime, we're left with no choice but to deal with the ongoing fallout of the recent "correction".

Since Tuesday's smash of the 100-day, the only thing we've cared about is whether or not price will manage to hold and close above the 200-day later today. After reaching a post-BLSBS high of 67 earlier, "gold" is back to 57 as I type. And where is the 200-day moving average for the Dec16 contract? It's near 61. See below while asking yourself if it really matters:

So, here we are again. We all get excited when the HFT-discovered, Comex-derivative, US dollar-priced gold print goes up...and we all get depressed when it gets smashed back lower. But why does it even freaking matter at this point? Oh sure, for some of us, the impact this has on "investments" like mining shares is quite detrimental. However, in the long run, do the past two weeks of HFT and Cartel Bank bullshit somehow make gold and silver less valuable for the protection/security reasons for which you bought them in the first place? OF COURSE NOT!

Look, EVERYTHING now is based upon lies, bullshit and illusions. EVERYTHING. Your choice is to either get caught up in the nonsense...like believing that the daily movements of the paper-derivative "gold price" are somehow directly related to the value and fundamentals of physical gold...or you can use your wisdom, understanding and experience to your advantage. Can you take what you've learned here and parlay this knowledge into an even greater level of protection and security from the events that are still, most assuredly, coming? And it's not just financial protection! This site also offers you a community of like-minded people who can educate you on personal and family protection, too. This is all advice that needs to be heeded! A world that is built upon a foundation of dishonesty, fraud and outright LIES cannot and will not last.

And again, just how pervasive is the criminality? Here's just your latest example. Jon Corzine stole nearly B from account holders at MFGlobal five years ago when he used customer funds in a desperate attempt to stave off bankruptcy due to his mismanagement of the company. For this CRIME, Mr. Corzine has never been prosecuted nor has he served any jail time. Instead, today we learn that Corzine is in talks to settle his liability with "the government" for just ,000,000. Now that's a lot of money to me and you but it's peanuts for someone like The Criminal Corzine. How does a scoundrel like this skate and escape the arcane notion of "justice"? What's that they say about a picture and a thousand words? Well, here are 2,000 words:

So, we'll continue to monitor the paper price as we search for opportune times to add to our personal stacks of wealth. But, please, you must understand that the world is not what you're led to believe and the current financial system is rigged in favor of The Bankers at your expense. Until this system collapses under the sheer weight of the accumulated fraud and deceit, your only winning move is opt out of the paper games and continue to prepare accordingly for the day of reckoning that is, without question, headed our way.

TF