As the new-and-improved Comex delivery charade continues for April, additional details are being brought forth to assure the world that there is plenty of gold available for immediate delivery. That's nice. What's always left out, however, is how many separate entities believe they own each and every ounce. 20? 50?? 100???

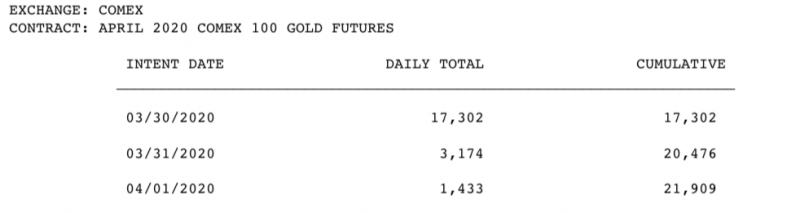

So let's begin today with another check of the Apr20 gold "deliveries". As of last evening, the total has reached 21,909 contracts for 2,190,900 ounces of gold.

And check all of the "reinforcements" that were added to the vaults yesterday. Yep, that's a cool 20 metric tonnes for both JPM and Malca...allegedly flown into Kennedy airport on a direct charter from London and then driven directly to the vaults where it was quickly weighed, assayed and verified.

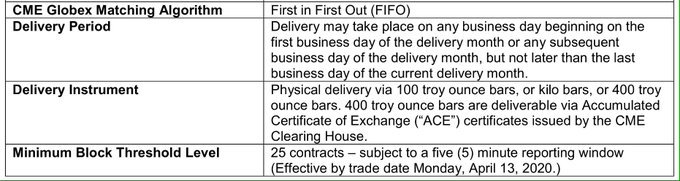

RRRRrrrriiiggghhhttt. It's all bullshit. Just like the "pledged" and "enhanced" garbage that has been used to distract for the past several months. What's really going on? Let's have the CME themselves explain it to you:

QUOTE: Physical delivery via Comex bars (of which there are obviously none), kilo bars (of which there are very few) and London bars...which are only deliverable through a a book-entry certificate called an "Accumulated Certificate of Exchange".

"Trust us", says the LBMA. Take delivery of a Comex contract and we'll hold your gold in London in certificate form: http://www.lbma.org.uk/_blog/lbma_media_centre/post/joint-message-from-c...

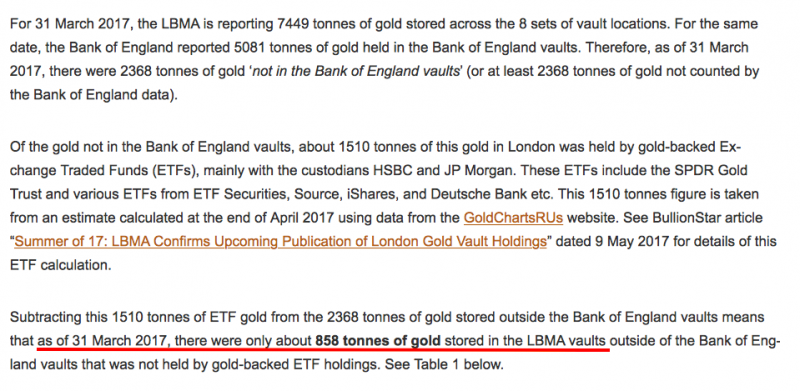

Remember, of the alleged 8,000+ metric tonnes of gold in the LBMA vaults, over 5,000 belong the Bank of England and nearly 2,000 are pledged to the ETFs. So it's an obvious and deliberate misrepresentation for the LBMA to claim that thousands of tonnes stand available for immediate delivery.

Screenshot below from this link: https://www.bullionstar.com/blogs/ronan-manly/lbma-gold-vault-data-release/

Unfortunately, I'm sure that most in the world will continue to fall for this scheme. At least the charade of all this is beginning to sink in for some people. Here's "Bond King" Jeff Gundlach warning investors to stay away from the sham/fraud/scam GLD: https://www.bloomberg.com/news/articles/2020-04-01/gundlach-sounds-alarm...

But, whatever. The London Gold Pool worked for seven years and, right up to the last day, it operated as if nothing was wrong and all was well. Until it wasn't. The day of reckoning for the LBMA/CME Gold Pool is coming, as well.

<This post excerpted from the daily TFMR subscriber update of April 2, 2020>

Recent Comments