It's the first Friday of the month so we were once again treated to another edition of The Shill, The Coug and LIESman this morning. Truth be told, I couldn't stand to watch. I flipped on CNBS at 8:29 and turned it off at 8:31.

Here's an approximation of what I missed:

"Blah, blah, blah....payroll numbers...blah blah blah...manufacturing...blah blah blah...private sector....blah blah blah...seasonal adjustments...blah blah blah...public sector...blah blah blah..." Joe Kernen trying to look professorial. Michelle Cabrera trying to look sexy. Rick Santelli trying to look interested. All the while, the LSHI reached a peak of about a 7.

Look, here's all you need to know. No sense in me repeating. Just click the link:

And you wonder why we call it the "BLSBS Report"?

And while we're at it, go back to ZH and read this. Please take your time as you read it as it is critical that you understand the general thesis:

Now, the next time you hear a bank analyst, or any "analyst" for that matter, try to tell you that "financial stocks are undervalued" or that "the banking sector is healthy", remember what you just read. Knowing what you now know about the ongoing balance sheet shenanigans of the TBTF banks, you are only able to draw one of two possible conclusions:

1) The analyst is completely clueless and should be ignored.

2) The analyst is deliberately attempting to mislead you about the health of the banks and the U.S. economy, in general.

While we're at it, remember the two reasons that the TBTF banks are even still functioning:

1) Politically-forced FASB accounting changes in 2009 allow banks to value worthless securities as if they actually retain their original value.

2) To fund The Great Ponzi, TBTF banks borrow unlimited funds from the Fed at 0.00%. They then "invest" this free money into treasuries at 2-3%. They book the risk-free, taxpayer-supplied spread as "profit". They have used these "profits" in the charade of "paying back TARP". Additionally, this process allows the Fed to mask their quantitative easing efforts by having the TBTF banks do the dirty work for them. The process of QE2 and POMO was just an overt process of funding the U.S. government while at the same time injecting massive amounts of capital directly into the Fed's primary dealer banks.

But don't just take my word for it, The Wicked Witch explained this to you months ago:

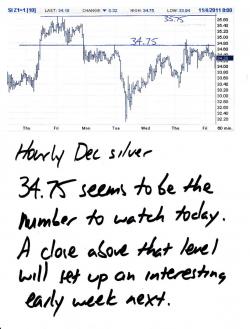

Ah, screw it. I better stop there. I'm getting all worked up and I don't have the time to continue. Maybe we can discuss this scheme in greater detail over the weekend. In the meantime, here are your charts with the levels to watch as we go through the morning:

Speaking of the weekend, I will have another podcast for you tomorrow. A slightly different take this time as its about 25 minutes with an author who has made some interesting projections about where this all is headed. I think you'll enjoy listening and you'll likely end up wanting to read his book.

Keep the faith and hang in there. Turd out.