We'll continue our trip down memory lane in a moment but, first, some charts...

A very interesting rebound occurred yesterday. While global equities traded sideways to down, gold rallied $20 or so and silver exploded higher, reaching as high as $33 for a few moments. Why was this you ask? Primary driver #1 had to be the news that Eric Sprott is planning to add about $1.5B worth of physical silver to PSLV. At $30, that's 50,000,000 ounces or, roughly, 10,000 Comex contracts. Hmmm. That's interesting. That's almost the same amount of contracts that JPM is short. Coincidence??? (Recall that The Turd does not believe in coincidences, particularly in the PMs.) The article below sums things up rather nicely:

https://www.beaconequity.com/“holy-jeepers”-sprott-to-buy-1-5b-of-silver-bullion-2011-11-22/

Yes, this is extremely positive, fundamental news. No, it does not mean that the coast is clear, as you can plainly see in the price action this morning. After being repelled from its old nemesis of $33, silver is back down today to $31.69 as I type. Over the past week, it has become quite clear that there are some BoS who are very interested in silver near $31. Will they emerge again today if price approaches that level. We'll see. IF silver can bounce again there and IF silver can then move through $33, it will THEN be time to get excited. Not yet, however.

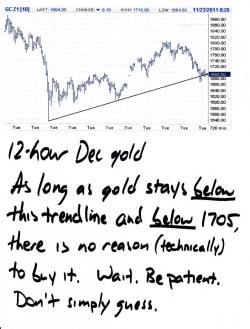

Gold is in a somewhat similar position. Though it's tempting to buy it here, what's the rush? As long as its below 1705, there's a distinct possibility that it could head lower, perhaps all the way to 1600. Why risk it? Give it a few days. If gold can claw back above and move away from 1705, confidence will rise that this latest suppression battle is over. Until then, I'm sitting tight.

OK, back to the archives we go. I recall being rather fond of this post last year. Though we haven't seen hyper-inflation just yet, it is undeniable that prices are considerably higher this year than last.

https://www.livescience.com/17129-thanksgiving-dinner-rising-cost.html

At any rate, the advice is the post is still valid...particularly the part about the pinot noir.

WEDNESDAY, NOVEMBER 24, 2010

Absolute Advice For Relatives

If you're like The Turd, you will most likely get peppered tomorrow with questions from pseudo-intellectual relatives regarding the current world/market environment. Your over-educated yet under-informed cousin or brother-in-law will seek out your current "wisdom" on investing, politics, etc. He or she will then feign interest while you speak but you will feel certain that, in the end, they just don't "get it" as your absolute conviction overwhelms their status quo mindset. You could probably talk for hours about the failure of Keynesianism, Quantitative Easing, the criminal political class, the fallacy of TBTF, POMO and the PDs, the infallibility of gold, etc...but why even try? Your cousin's husband doesn't understand any of this anyway and your show of intellect will only make him feel threatened. He'll quickly tune you out and run off to the family room to watch the Cowboys.

So what do you talk about tomorrow when someone asks? What kind of simple advice can give someone to prepare them for what is certain to be a very challenging year ahead? I plan to dial it back a bit and talk about one thing...inflation. And not just any old, run-of-the mill 3% inflation but serious inflation. I'm talking 20-30% inflation. Milk to $5/gallon kind of stuff. That is what's coming and its a topic most folks can actually get their arms around. Even the fuzzy-headed new boyfriend of your divorcee sister understands inflation and he might even be able to understand why its coming if you explain it well. (This is a chance for you to show off some of your worldly knowledge, too.)

Most folks with a high school-level understanding of economics (this includes your Fed governors) only understand and recognize demand-pull inflation. This is the classic demand side, Phillips Curve inflation that says rising wages, employment and wealth cause economic expansion which leads to more money chasing a static amount of goods. New, excess demand "pulls" prices up and the result is price inflation. Pretty simple stuff. What is coming in 2011, however, is the forgotten beast of cost-push inflation. This type of price inflation is caused by producers and merchants being forced to pass along through higher prices the rising cost of inputs to their products. Consumers, particularly the lower-and-middle income, bear the brunt of the pain. Your income isn't rising to keep pace with rising expenses and you get squeezed. Hard. And its not luxury items that are going up in price, its the staples. Bread, milk, gasoline, clothes, eggs, meat...the basics that no one can realistically live without. It's going to hurt and 2011 is going to be a mean year.

Why will input costs go up? Simple, they are all dollar-dominated and with our Fed now engaging in their final policy option, "QE to Infinity", all dollar-dominated assets are going up in price. Significantly. Your crazy uncle Henry may never take your advice to sell his stocks and buy precious metals but he just might take your advice to stock up now on essentials, before the prices skyrocket. Tell him that if he's going out to buy a new pair of pants, he should buy two. Tell your sister that instead of just buying her kids' winter coats for this year, she should buy coats for next year, too. Tell your cousin that instead of buying groceries every week to, instead, buy a whole dressed-out cow and put it in the freezer along with all the other dried and canned goods she can store.

Still, most crazy relatives won't listen but at least, come next Thanksgiving, they'll remember that you were right. One down side, however. Because you'll end up being the only member of the family that will have prepared and, most likely, the only one with affordable food to eat, you'll probably have to host everyone at your house next Thanksgiving. Oh well, there's a cure for that, too. Wine. Lots and lots of wine. Keep a couple of good Pinots on reserve and you'll be able to handle just about anybody.

I'll leave you for now with another blast from the past. Have a great day. Be happy and joyful. TF

1:30 pm EST UPDATE:

The action today was certainly encouraging. Both metals were placed under some extreme pressure and both rebounded off of higher lows. On the surface, this portends good things for Friday. However, caution is still warranted. Last year, The Forces of Evil seized upon the light volume of Black Friday to attack and send the PMs lower.

https://tfmetalsreport.blogspot.com/2010/11/black-friday-shenanigans.html

Happy Thanksgiving everyone! TF