Boy, oh boy. Lots of wailing and grinding of teeth this morning. Look, I know it's hard to see paper gold at 1610 and paper silver under 30. Frankly, it sucks. Again, though, I must ask you: Which fundamentals have changed? Additionally, why on earth would you sell your metal here and convert it back to fiat? However, I know it's hard and many of you feel like Clark Griswold. (Substitute Jamie Dimon or Jon Corzine for "Frank Shirley")

Again, things can change and we must be mindful of the possibilities. I think paper gold at 1550 and paper silver at 25 are extraordinary buying opportunities BUT, IF PRICE CONTINUES TO DECLINE, THROUGH 1500 AND 23, we'll need to stop out any new trading positions and seriously re-assess where we go from here.

Lastly, many have asked how I could successfully warn you of this debacle a week in advance. Like most things around here, it's not complicated. Take a look at this chart of gold lease rates:

Again, the "lease rate" is the net rate of interest a bullion bank like JPM pays to a central bank like the Fed to borrow gold. The bank then takes the gold and sells it on the LBMA or the Comex. After painting the tape and initiating the beatdown, the bank can then cover the new short position, thereby reclaiming the gold it borrowed for return to the central bank. With one-month lease rates at -0.5%, the bank actually gets paid interest by the lender to borrow the gold. Its a win-win for JPM et al. They make interest (which they like) and prop desk trading profits (which they like even more).

After a lease rate-induced selloff such as this, the key to confidently calling a bottom will not only be technical price levels, but a lessening of negative lease rates, as well. IF, by later this week or early next, we see gold at 1550, silver at 25-26 and one-month lease rates back up to -0.3% or so, we'll be able to call another bottom similar to January. Stay tuned.

So there you have it. As I wrap up, we're down to 1602 and 29.10. Looks like the 200-day isn't holding. No big surprise there. Keep the faith. TF

3:55 pm EST UPDATE:

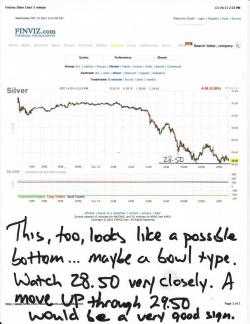

Searching for a bottom? I think we're pretty close. These charts tell the story:

And if you haven't read this yet, you should do so now. It might put a smile back on your face. You'll likely recognize many of the price targets listed in the report. (Full disclosure: Though I did work for Smith Barney for a few years back in the 90s, I did not write this report. )

https://www.zerohedge.com/news/citi-predicts-gold-3400-next-two-years

A full update later today. TF