...that was interesting, wasn't it? A long and crazy day but I do have a few things to add.

First of all, I thought I should re-post this in case you missed it earlier. Thank you to "Pining" for the fantastic piece of Photoshop art:

My two favorite parts are Atlee giving everyone the finger and the hot chick jumping off the bow.

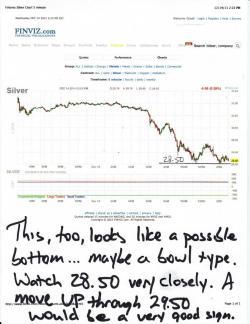

In case you missed the updated charts I posted at about 4:00, here they are again. I can re-use them because prices haven't changed much in the time since. However, I have a feeling that that's about to change.

You may have seen this earlier at ZH. Its a new technical summary from Citi. In it, they claim that gold should bottom at around 1550 but still trade to around 2300 next year. Gee...where have I heard that before???

https://www.zerohedge.com/news/citi-predicts-gold-3400-next-two-years

ZH also posted the stock market section of the same Citi report. It included this vehwy scawey chawt. Yikes!

Next....Never fear, the CFTC is here! What a Cartoon Corral these morons are...

https://www.reuters.com/article/2011/12/14/us-mfglobal-cftc-idUSTRE7BD20L20111214

Ole Eric King was hard at work during the downdraft today. First, he interviewed Santa and then he tracked down Egon von Greyerz. Both will be required listening when they are finally posted in their entirety. Until then, here are links to partial transcripts:

Jeff Nielson has chimed in with a terrific column that discusses negative lease rates and Libyan gold. I find all of the attention today to negative lease rates rather interesting as I'm pretty sure TFMR was this first place to notice them and warn of impending doom last week. Not that that's any great honor. It's kind of like being the first White Star lookout to have seen the iceberg.

Lastly, just a word or two about today's open interest numbers. (Remember, the numbers we got today reflect the changes from yesterday.) Two very important items.

- The Feb11 OI only fell by about 500 contracts. When added to the 1500 contract decline of Monday, Feb11 OI is only down 2000 contracts while Feb11 gold is down about $53. I would have expected a much greater drop in OI. What this confirms for me is that there are very few human holders of Feb11 contracts. Almost all of the Feb11 contract holders are WOPR on one side and the sub-human EE on the other. If this is true, the likelihood of finding a bottom near 1550-1560 just increased quite a bit. What I'm driving at is: I feared that the MFGRAP would permanently scare away buyers of paper Comex contracts. However, if the spec long position is almost entirely WOPRs, they'll simply flip back over to "buy mode" as soon as the technical picture improves. IF gold bottoms as I hope, we should soon be able to buy paper with confidence and expect a handsome rally.

- Dec11 gold continues to get new open interest. We added 137 brand new contracts yesterday...all in the face of a selloff? When added to Monday's gains, we've got almost 650 new contracts this week! That's amazing!! There is clearly an effort afoot to jump the queue and get some gold delivered this month and not wait for February. No, I don't think that the gold Comex will collapse from the weight of this. Not this month, at least. However, this potentially speaks volumes about the utter lack of bulk, physical gold available in the world. Very, very interesting and must be watched.

OK, that's all for now. Be on the lookout for some sharp volatility overnight and tomorrow as the metals search for a bottom. Let's see how today's lows hold up and keep our fingers crossed. Regardless, keep the faith and be happy. You have chosen to sock away savings in real, true money. Do not be discouraged by the blatant and shameful price manipulation tactics of The Cartel. The precious metals are going to have extraordinarily strong, fiat-relative performance in 2012. Soon, the pain of today will be long since forgotten.

TF