Wow! What a fun month! And whodathunkit? Back on 12/31, everyone was depressed and nervous. Here we are, just a scant 31 days later and the PMs are rolling again. Where will we be on Feb 29? Hmmm. I smell another "Hat Contest"!

OK, so here you go. February 29 is a Wednesday. Perfect. Let's give away two hats. One for the closest prediction for the Comex closing price of gold that day and another for the closing price of Comex silver that day. If any lucky Turdite can accurately predict both, not only will that person receive two hats, I'll throw in one of my old "Silver Keisers" for good measure. Three things:

- We need someone to keep a spreadsheet of all the entries. "H", you out there?

- The entry deadline is 6:00 p.m. EST tomorrow.

- Use the comments section of this thread to record your entry.

What a crazy day we had today. Just when gold and silver looked like they were going to break out of their current ranges, The Pig caught a bid and everything reversed. Unfortunately, yours truly did once again prove prescient as I warned everyone last night that a Pig bounce was possible today:

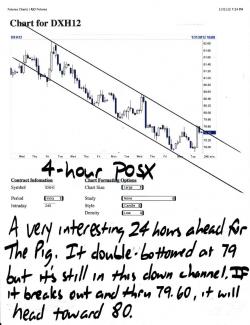

"We all should be watching The Pig rather closely. I keep anticipating some headline-induced bounce but it hasn't yet materialized. Pigatha has been in this nasty down channel for two weeks now with no end in sight. We must watch 79 very closely, though. It may try to double-bottom there and then move up with an attempt to break out of the channel."

And here was the chart from last night:

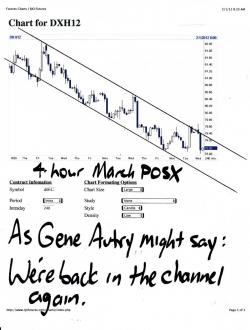

Here is the updated chart:

What concerns me in the short term is that that bottom looks pretty solid. I suspect that the POSX will continue to bounce and rally some overnight and into tomorrow. It could easily rally to 80 or even 80.20. This would have a negative impact on PM prices for those currently long. On the bright side, those of us looking for a dip in price to get long would probably welcome a little Pig rally.

So, if Pigatha does continue to perk up a bit, where might be the opportune point to buy in an attempt to pick up a little extra fiat? Fortunately, the charts are pretty clear, at the moment. Let's start with gold. Note the channel that is present on the daily chart. Gold has been in this channel for the entire month of January and it appears that it will stay there quite a bit longer. This is good. However, on the negative side, I still expect stout resistance in the area between 1750 and 1760. (We certainly got our first taste of it today!) Gold could conceivably stay within this channel yet move sideways for the next two weeks as it tries to overcome this area. Those looking for an entry point will plainly see one on the 2-hour chart. A little more Pig rally and we'll likely see gold dip toward 1723-1730. That sure looks like a good spot to me.

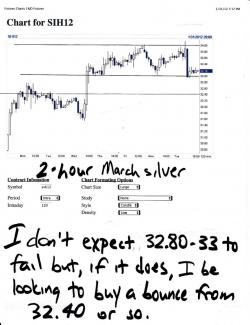

Silver looks similar and, if I had to pick one to buy on a dip, silver would be the one. You can see the same, month-long channel on the silver chart but the main resistance I see is still almost $2 above the current price. If a dip develops to 32.50 or so, the main resistance moves to $3 above. That might make silver tradable. We'll see. A dip to 32.50 is going to have to develop first and that is most certainly not a sure thing at this point. The area around 32.80-33.00 has been, and will continue to be, very solid support. Let's see what happens overnight and take another look in the morning.

Just a few more items before I call it a day:

- The Baltic Dry Index continues its unprecedented decline. It fell again overnight by 3.13% to a level of 680 and for 2012 the index is down well over 50%. Additionally, the lowest history I can find in the past five years was a reading of 663 on 12/5/08. Clip another 3% of off this baby overnight and we'll blow right through there. Lots of debate about the significance of this but you'd have to put the spin machine into overdrive to try to make a drop of this magnitude sound bullish.

- Gold lease rates remain neutral.

- Jeff Nielson has posted part III of his latest series: https://www.bullionbullscanada.com/index.php?option=com_content&view=article&id=23901:exposing-silver-mythology-part-iii&catid=49:silver-commentary&Itemid=130

- I'm not a big fan of Fleckenstein but he raises some pretty important points in this interview with KWN. https://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/1/31_Fleckenstein_-_Get_Ready,_Public_to_Enter_Gold_%26_Silver_Markets.html

- Here's some interesting news in one of my favorite silver miners: https://www.reuters.com/article/2012/01/31/endeavoursilver-idUSL4E8CV6I220120131

- And, finally, I leave you with this. Very sweet and very special:

Have a great overnight. TF

9:50 am EST UPDATE:

Yes, we're back in the channel again. After threatening to bottom and break out of the channel, The Pig has reverted back to itself and has fallen back into the down channel it's been in for over two weeks. (I continue to bat .500 when attempting to predict what it will do which, again, is why I don't trade Forex.) The main thing, though, is that Pigatha has rolled over again. What does this tell us? Will the BLBS report on Friday really send it tumbling? We'll see...

Once the POSX turned last night, the metals rallied. Unfortunately, another day of Cartel and EE capping has kept price below 1750 and 34. I expect this to continue. With market participation so low and OI and volume so abysmal, it will likely take another "event" to shove things higher. Two weeks ago it was supposedly Mr. Sprott that caused the shorts to panic. Last week, it was The Bernank. By Friday, will it be the BLSBS that does the trick? Perhaps. Watch the POSX for clues.

Lastly, our buddy Gonzalo has written an interesting new piece. Click the link below and read it.

https://gonzalolira.blogspot.com/2012/02/perniciousness-of-zirp.html

TF