Do you ever have one of those days where there is so much swirling in your head that you don't even know where to start? Where you're frustrated, a little angry and out of patience. And it seems like I've missed so much by being out Monday to Wednesday. Well, here goes anyway...

First of all, can we find a bottom to this latest price disaster? I believe so, yes, but perhaps not yet. Do you recall last week when we were so closely watching crude, copper and platinum? I mentioned then that all three seemed to be at critical junctures and, if they weakened, the selling would undoubtedly spill over into the PMs. Well, I'm not going to attempt to solve the chicken vs egg thing here but clearly this is all connected. Looking now at the damaged charts, all three look like they have a bit farther to go, too.

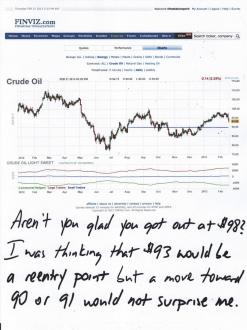

We'd discussed at length the virtue of dumping crude at $98 and waiting for a pullback toward $93. Now that we're there, crude looks like it may want to jab a little lower still. Maybe $91 or even $90. And isn't it convenient that, just as U.S. gasoline prices were staring at 4 bucks a gallon, crude got jammed lower in....ummm...let's just say "suspicious" circumstances? https://www.zerohedge.com/news/2013-02-20/did-someone-intentionally-try-crash-crude-contract

Maybe you think that crude is simply falling because the economy is "soft"? Hmmm, of course, that's the reason that copper is sinking like a stone, too! (No wait a minute. Crude and copper are falling because the U.S and the global economies are "soft". Yet, one Fed Goon after another is being marched out to proclaim an early end to QE∞ because he economy is so rapidly improving! Which is it?)

Could it be that everything is centrally-planned now? That every single market is manipulated into painting a MOPEd picture that buys time and forestalls the inevitable collapse? Back on January 31, I told you to soon expect a string of Fed Goons and euro-negative headlines because the POSX had reached a critical support point near 79. What has happened since? What did you expect??

And then there's Sylvia. Unleashed earlier this year, she ran from $1525 to $1750 in little over a month. On the verge of a breakout that would have had an undeniably positive effect on gold and silver, it has since been hammered back almost 10%.

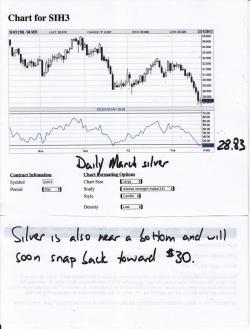

So what does all this mean? Well, if crude, copper, the euro and platinum all appear to have a little more weakness ahead and the POSX looks like it could rally further, then the PM smashdown likely isn't completed yet, either.

Not that they don't look like they potentially bottomed...they do...look at the RSIs for the love of Pete! However, at this point, I'm expecting one more jab down. Maybe break gold down briefly under $1550 and silver under $28, with nice little hammers or tails or wicks or whatever you want to call them hanging down off of the candles...just like the bottoms we've seen in the past.

And now just some random stuff...

I give old Clive a rash of sht from time to time but he sure nailed it this time. Gotta give credit where credit is due.

But you've got to respect Santa, too. He'd been warning us all for the past two weeks or so that this carnage was coming...and he was right. But he's been emphatic that the rebound in March would se spectacular. I guess we'll see.

And if you haven't yet, you need to check this out. The guy running this forum thread is relatively new to Turdville and he warned me when he joined that he had a lot of good info to share. After reading through the thread, you'll see that that was an understatement. https://www.tfmetalsreport.com/forum/4460/setup-big-trade

In case you didn't notice, the GLD shed an amazing 20.77 metric tonnes yesterday. This means that, year-to-date, 50.73 metric tonnes have been withdrawn. That is 1,631,000 troy ounces or 4,078 London good delivery bars. If you were to stack them on a pallet in layers of 40, the stack would be 102 bars high or, roughly, 9.5 feet tall. <edit> (And another 8.88 mts got yanked out today 2/21. This makes the YTD w/d 59.5 mts or nearly 5% of total "inventory".)

I promised you a "hot, explosive and historic" summer last year and now we find ourselves all the way back at last summer's lows. It sucks and it's hard for me to describe the anger and betrayal I feel almost every day because of it. Your regulators, your...public servants...have chosen, for six months, to do nothing. All the while, the Evil Ones they protect have been allowed to, once again, fleece the investing public by selling naked shorts into a rally and then contriving a selloff in order to cover and profit. You know...<sigh>...I've tried to hold the despair at bay. Since my "awakening", a part of me has always hoped that maybe, just maybe, it wasn't all as bad as it seems. That the banks and other corporations don't actually control the machinations of power. That "government of the people, by the people and for the people" still actually existed. And then you get the CFTC and you begin to realize that things truly are as bad as they seem.

The folks that show up here to criticize me for being "wrong 100% of the time" crack me up. I'm simply doing my best and, if you'll recall, I'm out of the trading business anyway. To compensate, last April I was able to line up for you the legendary Andrew Maguire. Andy only offers his services to huge sovereign and hedge funds but I was able to get him to cook up a retail service, just for you! And yet, only a handful of you have subscribed, choosing instead to go it alone. And then ridicule me and my increasingly useless charts when you lose money. Oh, I know...it costs too much. Really? And how much money have you lost in the past week alone by attempting to do it all yourself?!?

And then there are the European socialists that always show up during the corrections and blast away at me for being "greedy" and "only in it for the money". One of them actually claimed yesterday that I was conflicted because I have advertisements. This in contrast to KWN which "has no ads or sponsors". Really?? Are you freaking blind and deaf? Maybe we should change your username to HelenKeller? Have you never heard Eric's 60-second intro to each interview in which he extols the virtues of such-and-such miner? Do you think he does that out of the goodness of his heart?

And why the heck can't I run ads? Do I not deserve to be compensated for my time? In the time-honored tradition of European socialism, I guess not. I've sunk about 40 grand of my own money into this site and, after expenses, the ads help it to run a "profit" each month of about $2000-3000. All of this for my non-stop, incessant worry, stress and work, to the tune of about 60 hours per week. By my math, that's about $10/hour or so and far less than what the average socialist worker gets paid in Germany, Austria or France. So cut me some freaking slack, OK?

So what I guess I'm building up to is this: Today I have made the financial commitment to begin changing this site. The changes will be gradual but will be increasingly apparent within the next 90 days or so. If it sucks and I blow the whole thing up, then so be it. However we can't continue on this way. Do you realize that this site is #42,176 in the world in terms of traffic? It is also either #4 or #5 in the PM blogosphere yet it is essentially a sole proprietorship. I do it all...the content, the moderation, selling ads, answering questions. Everything. My hope is that, with a little help, I can devote more time and energy to the charting and analysis that brought you here in the first place. I have a vision and a plan for making this site more fun, more interesting and more troll-free. We are here to learn and help each other and these changes will advance both causes.

And that's it for now. More selling is likely overnight and again at the Comex open tomorrow. Maybe we'll get the final dip. Maybe not...we'll see. More tomorrow.

TF