I managed to save enough money for a down payment on a starter home in an acceptable locale just before the height of the RE bubble, 2006. Due to circumstances at the time, I chose to rent for the time being. Somehow, it seemed imprudent to take out a 20-30 year mortgage, and incur the transaction/tax/repair costs associated with a purchase at a time when I knew I would have 30 days to leave the country if my employment were to end for any reason whatever.

As the months and years rolled on, I actually did not (at first) pay much attention to the ‘bubble hype’. I really wasn't even too exposed to it – if anything my immediate surroundings (including neighbors and friends, as well as the house listings) were telling me the prices had gone too high – rather than that they could only go higher.

As the end of 2008 finally came around, I unwittingly became an ultra-savvy investor – having preserved my capital by NOT buying a house. As events sped up, I attempted to learn as much as possible about monetary/fiscal/economic history and current conditions. In the early phases of this, I did not at first understand/immediately foresee the re-inflating strategy undertaken by TPTB, or the effects of ZIRP would have in the medium and longer term – I fully expected the housing price to decline or bounce along the bottom.

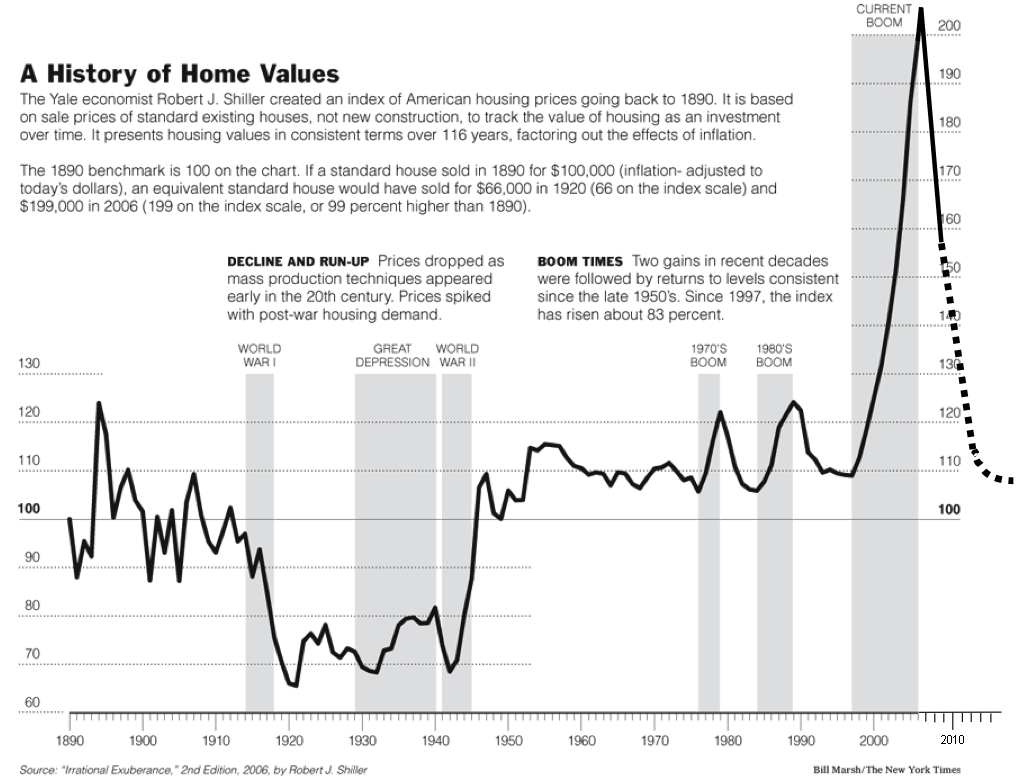

And bounce along it did for a time – while I STILL did not buy, for I anticipated the eventual cross-country move to my current location. We all saw charts like this one (Shiller / Ritholtz virtual collaboration):

There were also some learnings along the way (I did not simply idly sit by, I researched and scouted the area where I lived, and actively sought an affordable but decent home 2009-2011):

- Housing prices never declined as much, and have already rebounded in many of the areas where I am likely to find employment in my profession (large economic/technology centers)

- San Francisco, Boston, NYC, Seattle, Portland, Houston, etc.

- Bidding wars for suburban homes in these areas are already underway. My neighborhood sports a fresh growth of 3-3.5K sqft faux stone-covered McMonstrosities that sit literally within the locally legal allowable proximity of the next identical house (though I am sure it’s more, I swear it looks and feels like 3 ft). You can open your kitchen window and shake hands with your neighbor who does the same. Price: starting at $800K

- Rents, while relatively stable for a while (2008-2010? 2011?), are rising substantially this year.

The reality of the market turned out somewhat different from the expectations implied by the bigger chart above:

Image cannot be displayed

(from the National Association of Realtors)

There is now a ‘comforting drumbeat’ of stories about renewed confidence by homebuyers, realtors, economists, bankers – you name it. The average house in the UK is appreciating at a rate of £50 per DAY, and apparently the real estate investment trusts and large hedge funds who bought distressed properties in 2009-2010 at firesale prices are now flipping them:

“Britain's biggest building society said the acceleration in house prices had been "surprisingly quick", with the annual rate of growth now running at 5% nationally and 10% in London – in both cases the strongest figures since 2010. As recently as May this year, the UK annual rate was just 1%.

The figures were published as it emerged that the Treasury is to give the Bank of England a key role in monitoring the impact of its flagship Help to Buy scheme on the housing market.” – Guardian

For a rather egalitarian-minded treatment of the same topic in the US, you can check out this NYTimes post:

“Now, five years after the start of the financial crisis, the housing market has come back, and many of these investors are cashing in. According to tabulations by Redfin, an online real estate listings site, banks have already sold about 1.5 million of the nearly 2 million homes that were foreclosed on during the past half-decade. […]The boom-bust-flip phenomenon is just one of the most obvious ways that research suggests the financial crisis has benefited the upper class while brutalizing the middle class. Rents have risen at twice the pace of the overall cost-of-living index, partly because middle-class families can’t get the credit they need to buy.” -- NYTimes

Housing bubbles in the other 2 larger Commonwealth nations also have yet to pop (Canada & Australia).

So, what IS one to do? Obviously, no relief or reset has come from the exposure of title and mortgage fraud. It is unlikely (at this point) that any such thing will occur under current paradigm. Mortgage rates – despite the (alarmingly) rapid rise in Treasuries recently -- remain low compared to historical standards. As higher debt service load levels are untenable for the government, interest rates CANNOT be allowed to rises substantially (see PIMCO boss’s thoughts on the matter recently). Repealing the income tax credits for mortgage payments does not look imminent.

Image cannot be displayed Image cannot be displayed Image cannot be displayed

Despite their zombified state, the government loan guarantees afforded by Freddy/Fannie are still around, exerting influence and buying up loans.

Theoretically, all of these bode for a continued rise in housing prices in the near-medium term.

While sort of a non-sequitur, here is a bonus snippet of our friend Benny promising low inflation, a scaling back of extraordinary monetary measures, reduction of the Fed balance sheet and why it's perfectly natural and healthy that banks should get free money for parking reserves at the Fed. It is a beautifully honest, prescient forecast for the 4 years that followed:

(note the date: Feb. 22, 2009)

It's good that we can count on our monetary policymakers and macroeconomic forecasting experts to unwaveringly guide us to prosperity through these troubled times... My only gripe is WHEN will flash trading FINALLY be introduced for single-family residences so we can have efficient, real-time, computer assisted price discovery and sufficient, constant liquidity in this market, finally?

So how DOES one approach a house purchase with the knowledge of the above, but in light of the ongoing end of the G(reat)K(eynesian)E(xperiment)? What is the calculus for possible prospects under a variety of potential future scenarios:

- Continuing stagflation (persistent financial repression, manipulated/centrally controlled prices for EVERYTHING without any significant economic growth or structural reform -- but also no collapse)

- Deflation (actual and acknowledged default cascade destroys capital and results in cascading reduction of monetary base)

- Inflation (FedRes raises inflation targets, claiming ‘necessity to address persistent unemployment’ and the need for continuing response to exigent economic circumstances) – but as BB promised all those years ago – moderate, controlled inflation

- Repeat of 2008, only writ even LARGER

- True economic ‘recovery’ – through a miracle of science, technological innovation or a race of aliens who want to trade purified hydrocarbons and pure oxygen, in return for CO2, radioactive waste/fuel/corium and iPads

- Hyperinflation

- More than one of the above in the next 12-18 months.