I described certain significant political cyclic effects in precious metals prices in previous blog essays.

(If you missed them: Gold & 2nd Term US Presidents ; War Cycles and The Price of Gold ; An In-Depth look at a Major Cycle in Spot Silver ; Silver Market Cycles )

In particular for those contributions I focused on the 2 year cycle which corresponds to congressional electoral process. I also looked at and emphasized the 4 year cycle which corresponds to US Presidential elections. A third period that I looked at carefully is the seven to eight year cycle which corresponds to the cycle of duration of reelected US presidents. This cycle, in it's eight year version may correspond to a model used by Martin Armstrong which he classifies at 8.6 years and considers to govern or to track general economic confidence.

Among large cycles which I have not covered in this series of articles is a seasonal effect in pretty much all financial markets, and that could be described alternatively as a 1 year cycle, if one wished to do so, and that would be an accurate characterization of the seasonal effect.

Another cycle which I like to keep track of is a central bankers' cycle which tends to come in at approximately five years length. Precious metals traders will be able to come up with some of the banking organizations five year deals, agreements, or plans. It is also common for sovereign states to operate economic plans and targets with this timespan, and large corporations are candidates too.

I thought I might show a picture of this 5 year cycle today, and also put several cycles together to see how they all interact with each other during Q4 2014.

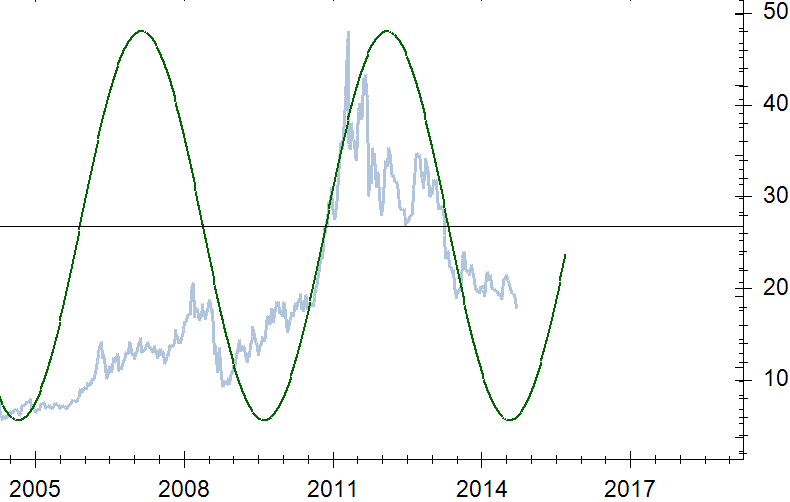

So let's take the five year swing to see what it does:

Now in order to be straight up about this, the existence of a five year cycle is a debatable point, and statistically it has a weak score. So this is an alleged cycle, or a possible cycle in the price of silver. You take a look, do your own examination of the facts, make up your own mind. I merely provide an illustrated interesting direction in which you might focus your gaze for a while to see whatever you can see.

Of course there a a lot of possible cycles in silver, so a question that regularly comes up is what are the others saying?

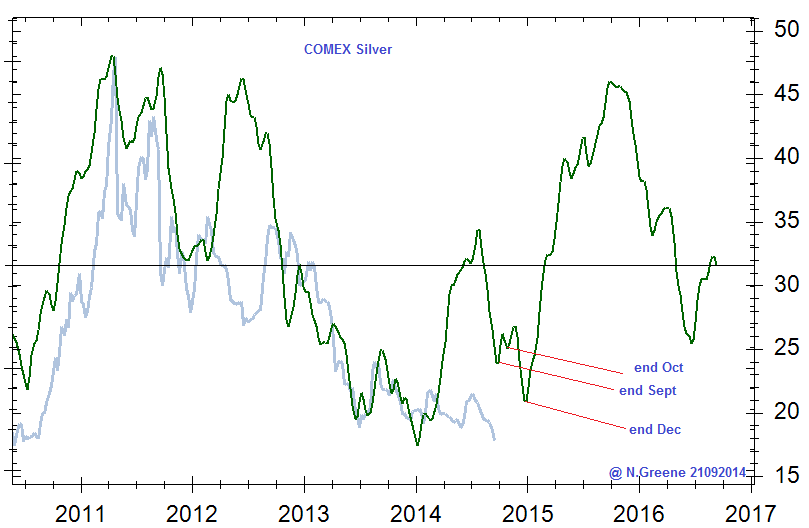

Here is a chart showing a collection of cycles in silver. It's not the top scores, nor the best documented by researchers. This is just my subjective choice of some cycles that I consider pretty active around now, so it's my selection chosen for relevance today:

Interesting, right?

I should say that there is a middle low in the above chart which other techniques suggest will be the "main" low. Whereas this chart places the weakest spot at December. And if it slots into the notch located at end of September we are already almost there! But the general thrust might be that Q4 2014 is a time of great possibilities for buyers of silver.

So since this is a scan of the longer term swings, what about the 8.6 year cycle? Well if you take 8.6 years it looks like this:

As you can see, if it's running at that length it exerts a depressing effect on silver down until Q2 next year.

However if this cycle is running in accordance with a dual term US presidency we can look more to a gap of 8 years since the last low. Actually there are reasons to assume that a second term president gets into the saddle faster, and that cycle might be closer to 7 and a half years. My preference is 7.8. I think Tom McClellan of McClellan Oscillator has written on this and it might be mentioned on his website but I can't confirm it, but I know that he and Sherman McClellan have worked on it.

So here are the two scenarios for this swing. First I'll show it at 8 years exactly and you can judge the fit if any for yourself:

That looks quite interesting, doesn't it?

Now if it is running shorter it would match the silver price action more like this:

That doesn't look so good if you are substantially long silver. But's it's the best fit if the cycle is running that period currently.

So the interesting question is: do we have an 8 year cycle plus a 5 year cycle producing their footprint, or it it all just a 7.8 year cycle? I have given the likely fundamental underlying cause for these swings, if they are dominating other economic effects, so everyone can decide for his or herself.

Also the volatility recently seen in the precious metals prices should be compared to the same period of time at the same stage of previous waves as this can sometimes make it easier to decide which one we are in and where we are in it.

By the way, the above charts are produced using logs of price which makes the vertical axis a percentage or ratio scale, so if it looks different from your chart that is the reason why.

Cheers

Argentus Maximus

The author posts daily commentary on the gold and silver markets in the TFMR forum: The Setup For The Big Trade. More information about the author & his work can be found here: RhythmNPrice.