As we begin another Spec rinse cycle on The Comex, we thought it best to remind everyone once again of the fraudulent nature of the short selling that takes place there.

The central component of any futures market is the physical asset that backs the exchange. Though we can't be certain of exactly how much gold is in the Comex vaults (recall the disclaimer added in June of 2013: https://truthingold.blogspot.com/2013/06/the-comex-confirms-that-its-gol...), we can be certain that it is nowhere near the amount needed to settle the thousands of paper claims written against it.

And it is the unlimited ability of the "market-making" Bullion Banks to create these paper claims that lies at the heart of the matter.

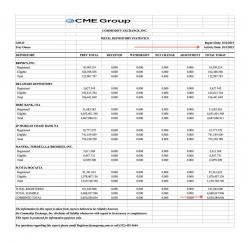

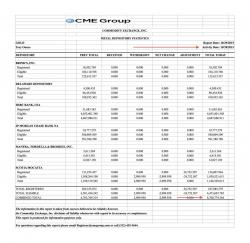

Your latest example of Bullion Bank price manipulation and suppression through the use of this unlimited leverage has occurred this month. First, let's look at the CME Gold Stocks data as supplied by the CME Group. Note that the two reports below are dated October 1 and October 28:

The most important item to note: On October 1, the total amount of gold shown to be in the Comex vaults was 6,850,580 troy ounces. As of October 28, this amount had fallen to 6,700,799 troy ounces for a total decline of 149,781 ounces.

In a fair market, this decline in the total amount of the asset backing the paper contracts would force an equivalent decline in the number of contracts available on the exchange. Let's assume two things for the sake of creating a more fair futures market:

- That all gold MUST be readily deliverable. No more of this registered/eligible nonsense.

- Of course, not every contract holder will demand delivery but this does NOT grant the "market makers" the ability to create infinite amounts of derivatives, either. So, let's set a fair leverage and multiplier at 5X. This means that, for every physical ounce backing the exchange and shown in their vault, a Bullion Bank can create five "paper" ounces of derivatives.

Under this formula, and assuming that all 6.7MM ounces of gold currently shown in the Comex vaults is for sale/delivery, this sets the maximum number of contracts available at 335,000.

6,700,000 X 5 = 33,500,000

33,500,000 divided by 100/oz per paper contract = 335,000 contracts

Without the Bullion Banks having the unlimited, infinite ability of creating new contracts each day, the price of gold would have to rise and fall to reach an equilibrium where equal amounts of buyers and sellers exist...much like how the market for individual equities operates (https://www.tfmetalsreport.com/blog/7214/inherent-unfairness-comex).

In this "fair" system, the only way that The Bullion Banks (market makers) would be allowed to create new contracts was IF they deposited more metal (collateral) for potential delivery. If JPMorgan wanted to issue 1,000 new Dec15 contracts to meet demand, they would first have to deposit an additional 20,000 ounces of readily-deliverable gold.

20,000 ounces with 5X leverage = 100,000 ounces of paper

100,000 ounces of paper at 100/ounces per contract = 1,000 contracts

BUT THAT'S NOT HOW IT WORKS ON THE COMEX!

As noted above, between Oct 1 and Oct 28, the total amount of gold shown to be held in the Comex vaults FELL by 150,000 ounces. Theoretically, this should have restricted The Banks' ability to create new leverage. Instead, this decline in the amount of collateral backing the exchange didn't matter at all!

Again, using the data generated by the CME itself, we can go back and review the total amount of contracts (open interest) on the Comex exchange over the same time period.

October 1 total Comex gold open interest: 419,016 contracts

October 28 total Comex gold open interest: 470,525 contracts

This means that while available gold (collateral) was declining by 150,000 ounces, The Bullion Banks were free to create over 5,100,000 new ounces of "paper gold".

470,525 - 419,016 = 51,509 contracts

51,509 contracts X 100 ounces/contract = 5,150,900 ounces of paper gold

AND THIS IS THE INHERENT UNFAIRNESS OF THE COMEX PAPER DERIVATIVE PRICING SCHEME. In fact, it's hard to understand how this doesn't constitute criminal fraud. Why? Let's look at the definition of "fraud": https://legal-dictionary.thefreedictionary.com/fraud

Fraud must be proved by showing that the defendant's actions involved five separate elements: (1) a false statement of a material fact,(2) knowledge on the part of the defendant that the statement is untrue, (3) intent on the part of the defendant to deceive the alleged victim, (4) justifiable reliance by the alleged victim on the statement, and (5) injury to the alleged victim as a result.

So, let's see....

- "A false statement of material fact." Is it a "material fact" that The Banks have an unlimited ability to leverage the available gold collateral that backs the exchange? Was the CME Group attempting to protect themselves in this point by adding the Gold Stocks disclaimer in 2013?

- "Knowledge on the part of the defendant that the statement is untrue". In this instance, the "statement" in question is the implied representation of physical gold behind each contract. The infinite creation of paper contracts would certainly seem to fit this part of the definition.

- "Intent of the part of the defendant to deceive the alleged victim". Without question, this is the case. The Banks deceive investors and traders through the creation of paper contracts that have no physical asset backing.

- "Justifiable reliance by the alleged victim on the statement". This one's a little fuzzy. Can it be "proven" that all of the momentum-chasing Spec trading funds only trade paper contracts based upon their "reliance" that the exchange operates freely and fairly?

- "Injury to the alleged victim as result". Well, this one's easy. Continuing below...

The "injury" is financial and we are once again watching it play out in real time. After the FOMC statement of September 17, sentiment in the gold "market" began to turn from bearish. After the September NFP employment report of October 2, sentiment got downright bullish. Over the course of the next 3.5 weeks, the paper price of gold rallied from an October 1 close of $1114, to an intraday high if $1192 on October 15 and a Comex close on October 28 of $1176.

As noted above, over this same time period, The Bullion Banks created over 5.1MM new ounces of paper gold in order to meet the demand coming from the now-bullish trading and managed money funds as well as individual investors. Without this unbacked (fraudulent?) new supply of paper, how much higher would have prices risen? We'll never know but it's certainly fair to say that prices would have peaked much higher than just $1192. These are gains that the speculators were never allowed to realize, thus, the alleged victims were in fact "injured" as a result.

So, there you have it. Does this meet the criminal definition of "FRAUD"?

Finally, conspiracy to commit fraud often also includes a plan/intent by the perpetrator to cover up their crime and it appears that we are seeing that once again this week.

On Wednesday, the latest FOMC statement was issued after the Comex had closed for the day. The low-volume selling that occurred on the Globex after-hours exchange drove the price of gold down over $20. By the time the Comex re-opened on Thursday, Spec stop-loss orders were immediately triggered. This drove prices down even further and the Spec selling allowed The Banks the ability to buy back and close some of the very same Comex contracts that they had deceitfully issued in the previous weeks. In fact, the final open interest data for Thursday shows that, while prices fell $29 from Wednesday's close, total open interest also fell by over 12,000 to 458,800 contracts.

In summary, do you now see how this works? The Bullion Banks issue paper contracts backed with gold that they do not have. In doing so, they cap price and stall momentum until a news item comes along that sends price lower. As speculators flee back out of the "market", The Banks use this selling to buy back the ill-gotten paper contracts that they should never have been allowed to create in the first place.

The only remaining question is: Does this constitute criminal fraud? Perhaps an industrious young prosecutor at the Lower Manhattan branch of the U.S. Attorney's Office would be willing to take a look? Instead of a civil case involving the difficult-to-prove notion of "market manipulation", maybe a criminal case using the CME's own easily-verifiable and public statistics would be possible? I don't know but it's worth a shot.

In the meantime, as in the movie "War Games", the only winning move is not to play at the Comex "casino". Anyone crazy enough to wander into this Den of Vipers (https://www.tfmetalsreport.com/blog/7110/den-vipers) will soon prove again the old idiom regarding "a fool and his money". Your best option remains the consistent stockpiling of physical metal, fully allocated and outside of the Comex and Bullion Banking system, as you await the day this fractional reserve derivative pricing scheme finally collapses.

TF