Usually when I write in this blog, I try to look at some aspect of the gold market, or silver market, in which I have expertise, and at the same time that thing, or fact or theory is not well known or talked about among the readers of the blog. In short I attempt to bring something fresh to the table of discourse on the subject of gold investing.

This week I considered mining stocks. There are many other people who talk or write about mining stocks, so I appreciate that adding information on this is entering a crowded space. One way to freshen things up is to bring some market history into the conversation. History has a tendency to repeat from time to time, and somehow surprise everybody when it does so. But not all that many mining companies have a long history what with the limited lifespan of their mines, takeovers, mergers and so on.

Newmont Mining is an exception though. It was founded in 1921 (wikipedia says 1916 but I take Newmont's own date of 1921 ) by William Boyce Thompson and consequently, this year Newmont is 96 years old. My first encounter with this stock came about 1989 when Corporate Raider billionaire Jimmy Goldsmith - using a stake generated from swopping ownership of Cavenham Forest (the 5th largest timber corporation in the US) tried to take Newmont over and break it up for resale as parts. Newmont resisted and survived these attacks. It also fended off unwanted advances from Consolidated Goldfields, Hanson Industries and T Boone Pickens about that time.

Newmont is big. I thinks it's the second biggest gold producer, after Barrick Gold Corp, and it's the only gold mining company included in the S&P 500 Index. Last quarter Q1 2017 it produced 1.23 million ounces of gold.

The above attempts to take ownership of Newmont took place during the nineteen year long 1980's gold bear market following the gold price high during 1980. Newmont is a stock that billionaires have historically become attracted to when it was down after a general gold bullion market decline.

This long history and large capitalization means there is liquidity in the stock of Newmont. Liquidity is something I look for when beginning to analyze a financial asset. Liquidity is one of the glues that hold cycles together, and cycles is one thing I look for.

Are there cycles in the price of Newmont? Let's see what I can find.

Here is Newmont relative to the HUI Index:

That's three and a half years of outperformance there. This is one to watch.

So what if any cycles did I find? I decided to look for larger swings first. So I chose a monthly timeframe.

This is using a double logarithmic plot. And it looks cyclical, doesn't it?

If you count along either the highs or lows in the above chart it becomes apparent that, for the last thirty years or thereabouts, Newmont has made highs to highs and lows to lows from seven to nine years apart.

So I ran an algorithm to test for such cycles. In monthly 7 to 9 years would be 84 to 108 months. The results were disappointing. There are not many repetitions of such long cycles, I have data since 1983, and as a result the cycles had not built up a strong track record. Also the length keeps changing from 7 to 8 sometimes to 9 and so on. So reliability is a problem.

So to get around this I looked for smaller nested sub cycles that might add up build into to a 7-9 year "parent" wave and this is what I found:

Length of Hypothetical cycles in months:

5.64, 6.79, 12.52, 17.79, 68,98, 72.60

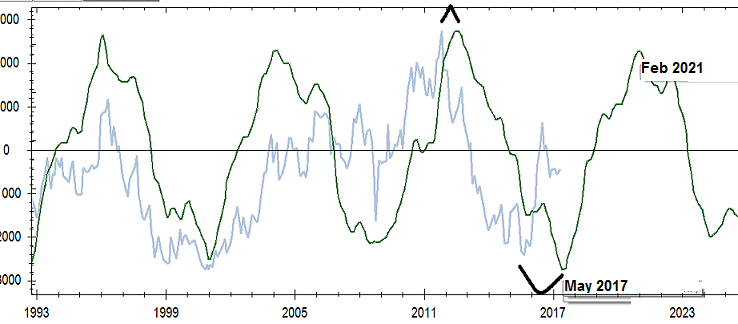

Here is what these look like (synthetic cycle composite in green):

It is an intriguing fit, isn't it?

I added the dates of the forecasted turns in black. But I do not expect that forecast to work.

If you look, you can see that during the period since 2011, the price of Newmont has already been departing from the forecast made by these cycles, and not only that, but the difference between the forecast and reality is increasing. So i wouldn't trust it.

The reason I show it here is that there could still be a use for this faulty analysis. If I stand back and take the broadest result, and avoid taking the details I can say this:

Since 1993, Newmont has made a low every 7 to 9 years on average, this period varies each time, and is a tendency that may already be gone completely or it may just be changing again.

What can this do? The last low was October 2008 so if I add 7 to 9 years onto October 2008 I get late 2015 to late 2017.

So look at this chart of Newmont:

So I am, based on these cycles, looking for a low between 2015 and 2017. The low at end of 2015-early 2016 fits this nicely.

But what about the errors so visible in that "idealized cycle" chart? My thinking on this is that I don't trust that chart! But regardless of that it did do one thing. It made me go looking for a possible 7 to 9 year variable pattern. And that is enough. You see, there is a nine and a quarter year cycle in the bond market. So if the central banks have a 37 year cycle in their minds, and their published research papers show that they have, then 9.25 is a quarter of that, a nested sub cycle of a 37 year cycle in interest rates. So this is a second, external reason why there might be a nine year swing up and back again in gold. The price of gold, and the inflation adjusted rate of interest on bonds are closely correlated. And the price of gold should have correlations with the price of a big producer like Newmont.

This gives me a great interest in trying to identify the next low in the price of Newmont. Because the 2016 low may be the low. But if it wasn't, then the next low will be it. So buying the later of such a set of lows would be safer than buying the earlier low if you see what I mean. In theory!

In which case a downtrend line can be put over the recent highs in Newmont, and if price breaks it that is one thing. I don't buy things after they go up, rather after they go down! But if price should decline under such a trendline to a lower level, say between now and 12-18 months from now - then a break to the upside of that downtrend might be a good entry for what would follow. Of course there would also have to be other signals and triggers to buy, and levels to set stops off to limit risk, but that's always the case.

It's all a scenario. A construct, or an idea. But it interests me for obvious reasons.

Like all stock market ideas, only time will tell if it has any value or not. It stimulates the brain synapses to wonder about these kind of possibilities. Exercises the old gray matter. And without exercise we lose our abilities. So debating these scenarios should be a good thing in itself, whichever decision we eventually come to about them.

Best regards,

Argentus Maximus

.

The author posts daily commentary on the gold and silver markets in the TFMR forum: The Setup For The Big Trade. More information about the author & his work can be found here: RhythmAndPrice. The author advises that he trades and holds market positions in accordance with his own opinions.