Gilbert focuses almost exclusively upon EFPs for Comex silver...as well he should as the numbers are extraordinary. However, this opaque process is not confined to just silver.

At Eric Sprott's urging, we've been keeping track of the daily totals of EFPs in Comex gold since November 24 of last year. In the 4.5 months since, the CME/Comex have transferred an incredible 1,022,095 contracts off of the exchange and "delivered" them through this process, most likely using unallocated gold in London.

At 100 ounces per contract, this equates to 102,209,500 ounces of "gold" or a whopping 3,179 METRIC TONNES. That's more than the entire world will produce via mine supply this year!

This isn't a new phenomenon as recent years have shown total EFPs between 5,000-6,000 metric tonnes. However, at this current pace, the CME/Comex is on a run rate of more than 8,000 metric tonnes. And from where do they find this "gold". It's clearly in the unallocated and hypothecated form as Ronan Manly at BullionStar reported last year that the LBMA vaults could not possibly hold more than 858 metric tonnes of unencumbered gold. https://www.bullionstar.com/blogs/ronan-manly/lbma-gold-vault-data-release/

So, with all of this in mind, please take time to read Gijsbert's excellent work. Hopefully, this will serve to increase your understanding of the hyper-leveraged precious metals markets in 2018.

TF

Guest Post: "Explaining Exchanges For Physical (EFPs)

by Gijsbert Groenewegen

EFPs (Exchange Futures for Physical) are an escape route to allow the Comex to SET the prices for gold and silver using naked or non-backed futures and not declare default!

According to CME reporting some 10,464 silver Comex contracts (each contract representing 5,000 oz. of silver) equal to 52,32 million oz., over the last 5 trading days ending April 6, were Exchanged for LBMA London physically deliverable contracts through the so-called EFP route (Exchange Futures for Physical). This means that in April alone on average some 2,093 silver contracts or 10,46 million oz. silver daily were swapped to the London LBMA through the EFP swaps because these futures holders were standing, asking for delivery.

And as we know the Comex doesn’t have sufficient registered inventories, the inventories specifically allocated on the Comex for delivery on futures contracts. The reason the Comex doesn’t support full delivery is that the authorities (Fed, BIS, other central banks and the bullion banks, such as JP Morgan) use this model so that they can easily set the paper gold and silver prices at levels where they want to have it without having to back the contracts up with physical gold and silver (they don’t have).

The so-called fractional or partly backing has one ounce of registered physical gold and silver for every say 100 to 500 ounces equivalent paper issued futures contracts. Every gold and silver paper futures contract on the Comex represents 100 ounces of gold and 5,000 oz. of silver. The reason I use the word paper contract is because the contracts represent paper or nominal (US dollar) settlement and not physical (gold or silver) settlement.

With the facilitation of the fractional backing the authorities can therefore very effortless issue numerous paper futures contracts (or so called naked futures because they are naked, they are be backed up by the equivalent physical gold and silver ounces) in order to stem the inflow of money that would otherwise drive up the gold and silver prices.

The technique they use can be compared to companies that issue shares in order to prevent their share price to rise when potential investors want to buy shares in the company and thus increase the flow of funds into a company. Basically one can look at it as the difference between keeping the number of shares the same and see the share price rise a lot following the inflow of funds or increasing the number of total outstanding shares when new money of investors is coming in thereby diluting or mitigating the share price rise. In the latter example the inflow of funds is divided not by a fixed amount of shares but by an increasing number of shares. The same happens at the Comex whereby the bullion banks issue new futures contracts when investors want to take a future on the gold or silver price development thereby slowing down the price rise in the precious metals till the buyers are exhausted.

This is a pure paper game though that is changing now because the futures investors now want physical delivery through the EFP route n’importe quai thereby circumventing the nominal settlement in US dollars and strongly reducing the efficacy of the paper game. Effectively making the paper game redundant.

EFPs were created for an emergency situation but they seem to become the rule

Traders on the NYMEX have employed EFPs for emergency situations in the past, although it should be stated that the NYMEX doesn’t allow EFPs anymore. For example in 1982 demands were made by longs for delivery of heating oil during the first three delivery days on the February 1982 heating oil contract. An oil company with a sizable short position did not have the heating oil available to meet those demands for delivery some of which were offset by EFPs with the encouragement of NYMEX staff (Apex Oil Company v. Joseph DiMauro No. 86-7898).

Exchange Futures for Physical (“EFP”) transactions originated over a century ago in US markets for grains and grain futures. As mentioned here above EFPs were originally created as a temporary solution so that a naked short (not having the physical) could deliver in an emergency situation.

Though the exception has become the rule in the gold and silver markets and these EFP “emergency measures” are now being used on a daily basis and in huge amounts! And when one reads the Exchange Rule 538 that regulates these EFPs it basically summarizes the many escape clauses to the original futures contract in my point of view. https://www.cmegroup.com/education/understanding-efrp-transactions.html

And we know when exceptions become the rule something has failed. Hence why one could argue that the Comex has materially defaulted on its ability to deliver the physical gold and silver, though for reasons as set out here above.

Putting world mine production and daily mine supply and demand in perspective

And because the Comex (THE global price setting mechanism for gold and silver) doesn’t have any inventories to deliver the physical gold and silver from the futures (multi-party or Exchange) contracts are swapped or Exchanged for bilateral or two-party contracts on the London LBMA market. The London LBMA OTC (over-the-counter) precious metal market consist of approx. 150 players, that are active in the precious metal markets, such as bullion banks, smelters, mines, transporters etc., that have agreed to adhere to and “play” by the regulations or rules set by the LBMA, London Bullion Market Association. As the LBMA says it is an association of persons/corporates and not a central standardized contract exchange like the Comex.

The futures holders that stand for delivery are issued a “deliverable” forward contract in London, with a fiat bonus, which is determined by the waiting time for their delivery. It should be emphasized that there is a huge difference having to deliver 1000 oz. of gold or 33.3 tons or 1,070,595 oz. The latter won’t be easily to source and therefore will take much much longer to get hold of.

Total world mine production according to the WGC (World Gold Council) is about 3,260 tons (see table below).

The Chinese are the number 1 world gold producer producing approximately 422 tons in 2017 and the Russians mine about 250 tons and both countries don’t allow gold export. The total “free” global gold mine production therefore is roughly 2588 tons and most of this gold gets “routed” through the London LBMA. The mining companies are for a large part dependent on the bullion banks to finance their projects hence their contingency of routing the sale of their gold through the London LBMA.

Although we know of several Chinese companies that have approached gold mines to get gold delivery directly from the mine or smelter at market price + a premium thereby circumventing the London LBMA. If we take the 2588 tons and divide that by 253 business days (UK) we get an average daily physical gold supply from the mines of roughly 10.22 tons/day. And especially if we look at the average gold EFPs from the Comex to London LBMA of some 10,708 contracts (1,070,800 oz.) daily equal to (1,070,800:32,150) 33,3 tons per day, since the beginning of March that results in a 33.3t-10.22t or 23.08 ton shortfall every day just for London!!!

Tonnes | 2016 | 2017 | Y.o.Y |

Total supply | 4,590.9 | 4,398.4 | -4% |

Mine Production | 3,263.0 | 3,268.7 | 0% |

Net producer hedging | 32.8 | -30.4 | _ |

Recycled gold | 1,295.1 | 1,160.0 | -10% |

And with gold being the inverse benchmark of the purchasing power and credibility of the US dollar, the reserve currency, you can understand the importance of keeping the gold price in check. Don’t forget that gold carries a lower leasing rate (interest rate) than Treasury interest rates!!!

EFP swaps reduces a multi-party transparent Exchange contract (Comex) to a two- party non-transparent contract (London LBMA)

Exercising the EFP swap going from an Exchange futures contract (Comex) to a contract between two parties (London, LBMA, over the counter (OTC) or parties on each side of the counter) the price discovery changes from the public domain (standardized Exchange contracts) to a two party agreement and therefore not in the public domain and therefore making it very difficult to figure out how tight the physical precious metal market in London is and what the “real” price dynamics are that have been agreed.

In other words Comex futures holders that are pursuing the EFP swap will find it difficult if not impossible to find out what the pricing, delivery times and other conditions (premiums) are between other parties that exercise their EFP swaps BECAUSE THERE IS NO PRICE DISCOVERY!! This is done on purpose by the cabal (a secret political clique or faction i.e. the Fed, BIS, BoE, the bullion banks) in order to keep the transparency of the real situation in the physical gold and silver market at bay. This way they can keep market forces under control and prevent huge price spikes when the market is very tight. As it is now!!

Next to that we also see that the trading of claims in the so-called unallocated gold pool amounts to 1,500,000 tons annually or 5,929 tons daily (on the basis of 253 business days in the UK) or 180%+ of the annual 2017 mine gold production. The claim trading is purely paper trading like the Comex futures trading and in my point of view is intended for a large part to also diminish the price setting of physical gold and silver which is a fraction of the paper trading.

It should be stated that claim holders can convert their claim from an unallocated to an allocated gold claim, which gives them the title to allocated gold. The unallocated claims are basically no more than paper claims with the value determined by the underlying gold.

Accumulated EFP demand for delivery of the physical on April 6 stands at 770.82m oz. or 89% of yearly estimated silver mine production of 867m oz.! This is simply not sustainable!

To give you an idea as to the huge amount of EFPs this month in silver: so far in April a non-active month, (In the futures market, the active month is the nearest base contract month that is not the current delivery month. For example, if the current delivery month is August, the active month is September) 52.32 million paper oz. have morphed over or swapped as EFPs to London. This represents around 6% of annual 2018 global mine production estimated to be some 867 million ounces, compared to 857 million ozs. in 2017.

From the beginning of the year until April 6 the total amount of EFPs i.e. demands for delivery of the physical stand at 770.82m oz. or 89% of yearly estimated silver mine production of 867m oz. You have to wonder with these enormous numbers of requests for physical delivery how much longer the cabal, who in general is at the short end of the contracts, can keep the silver prices from rising.

The importance of Open Interest (OI) for the direction of the silver or gold price

This strong fundamental situation of increasing demand for the physical, which should demand much higher prices, coincides with another important aspect of strong prices in general, Open Interest (OI). At present the open interest in silver at the Comex is at historic highs, with an OI of over 1 billion oz. or to be precise 1.214 billion or 140% of annual global silver production. In silver a new record of open interest at 243.797 was set on April 6th and what is even more interesting is that this has been set at a low silver price of $16.35.

Normally a record breaking open interest (the number of contracts or commitments outstanding in futures and options that are trading on an official Exchange at any one time) is an indication of record inflows of funds and high prices. The previous record was April 5th at 242,895 contracts with a silver price closing at $16.36.

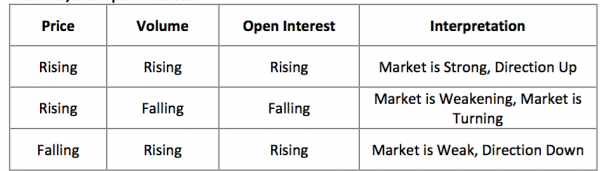

In order to illustrate the importance of these factors I will describe here below the mechanics of volume, price and open interest, which basically point out the anomaly in the gold and silver prices as quoted on the Comex with record open interest and low prices. It is the clearest factual proof of the manipulation of the Comex market by the central and bullion banks (indemnified by the central banks) that in general take the short side of the issued futures and option contracts.

Accumulation for Jan 2018 | 236.879 million oz. |

Accumulation for Feb 2018 | 244.95 million oz. |

Accumulation for March 2018 | 236.67 million oz. |

Accumulation for April 2018 | 52.32 million oz. |

Accumulation in year 2018 to date | 770.82 million oz. |

Where volume measures the pressure or intensity behind a price trend, open interest measures the flow of money into the futures market. For each seller of a futures contract there must be a buyer of that contract. One believes the price of the underlying asset will go down or will force it down (the seller)!! whilst the other party believes the price will go up (the buyer). Thus a seller and a buyer combine to create only one contract one sells the other one buys. Therefore, to determine the total open interest for any given market we need only to know the totals from one side or the other, buyers or sellers, not the sum of both.

Each trade completed on the floor of a futures Exchange has an impact upon the level of open interest for that day. For example, if both parties to the trade are initiating a new position (one new buyer and one new seller), open interest will increase by one contract. If both traders are closing an existing or old position (one old buyer and one old seller) open interest will decline by one contract. The third and final possibility is one old trader passing off his position to a new trader (one old buyer sells to one new buyer). In this case the open interest will not change.

By monitoring the changes in the open interest figures at the end of each trading day, some conclusions about the day’s activity can be drawn. Increasing open interest means that new money is flowing into the marketplace, so to say the cake is getting bigger. The result will be that the present trend (up, down or sideways) will continue. Declining open interest means that the market is liquidating and implies that the prevailing price trend is coming to an end. Knowledge of open interest can prove useful toward the end of major market moves. A leveling off of steadily increasing open interest following a sustained price advance is often an early warning of the end to an up-trending or bull market.

The following table summarizes the relationship between the prevailing price trend, volume, and open interest.

Anyway with these record open interest positions the silver price should be at new highs, above $50/oz. instead of $16.35. Especially in the light of a huge open interest in silver totaling 243.797 contracts (243.797 x 5,000) or 1.219 billion oz. and a huge annual EFP's issuance equal to 2.9 billion oz. or 330% of silver annual production of 867m oz.

The Commercials, central and bullion banks, have covered their short positions in silver! Is suppression finally coming to an end?

Though in the end it will be the demand for physical delivery that will break the distorted and seriously manipulated fractional (not backed by the physical) paper (futures) precious metal markets. The Commercials, the bullion banks and Fed, BIS and BoE, who basically determine the direction of the precious metals, currently happen to be the most bullish on silver in history, with their lowest short position ever, breaking the all- time record from two weeks ago. One can explain this historical very small short position in two ways. Either the Commercials have covered their short positions so that they can go short again or they have covered their short positions, although it should stated we haven’t seen that translated in much higher prices, because they know that the paper game, keeping the silver prices suppressed, is coming to an end and they don’t want to be at the wrong end of the bargain.

Record Short Covering In Silver!

Paper/Physical ratio is 20x (or 5% backing) for silver and 129x (or 0.7% backing) for gold

Taking into account the silver OI of 1.219bn oz. and registered inventories of 59m oz. (CME figures) the paper/physical silver ratio for the Comex is 20x or 5% backing. This silver ratio is much lower than the paper/physical ratio for gold which is 498.776 contracts x 100 oz.= 49,877,600 oz. divided by 385,923 registered gold oz. = 129x or a backing of 0.7%. You tell me what will happen to the price of gold or silver when the dollar tanks and investors in futures don’t want a nominal or dollar settlement for their futures but physical delivery with a serious shortage of physical gold and silver on the Comex and the LBMA! See how on the US dollar index chart here below how the death cross (50dma crossing the 200dma downwards) is forecasting further weakness.

This failure to being able to deliver the physical knowingly is a massive fraud: the central and bullion banks cannot supply any metal to the Comex longs but they are quite willing to supply massive non-backed gold (and silver) paper whilst they are fully aware that they have no metal to satisfy the longs. London is now severely backward in both gold and silver and we are witnessing delays in actual gold deliveries of 13 weeks.

According to some industry sources what is alarming is that the EFP's that are being transferred to what are called serial forward contract obligations at the London LBMA are contracts with duration of less than 14 days. The reason for this is that anything longer than 14 days must be recorded to the Comptroller of Great Britain to monitor the inherent risk to the banking system. This is an ominous sign! This again could be a clear indication that people are getting nervous that “the system is getting too stretched and unstable”. Pay attention!

Conclusion

The hallmark of an EFP is that the futures leg of the trade is not adequately executed (physical delivery) in the Exchange’s centralized competitive market. And thus a multi- party price discovery market place is replaced by two-party tailor-made fixed price agreement. As mentioned here above there is no price increasing effect from third parties at the London LBMA OTC market because it is an over the counter agreement or differently said an agreement between two parties. Parties in a bilateral agreement don’t disclose their terms whilst an Exchange contract is standardized and transparent, whereby all the terms are known to the public and the price forming happens through the participation of many participants.

As indicated here above the EFP route was meant as a temporary solution so that a naked short (not having the physical) could deliver in an emergency situation. Though the exception is becoming the rule in the gold and silver markets and these EFP “emergency measures” are now being used on a daily basis and in huge amounts!

So far in 2018 some 770.82 million oz. or 89% of yearly estimated silver mine production of 2018 has been EFPed from the Comex to London!! This not sustainable!!

Next to that the OI for silver is at all time highs, in other words there is more and more money flowing into the Comex futures silver market, which should be bullish for the silver price. And last but not least the Comptroller in the UK wants to know of every forward contract in gold with a duration longer than 14 days. That is telling me that situation is getting very tight which is also confirmed by the fact that the silver and gold market in London are in backwardation (spot price higher than futures price). Apparently the gold market is 13 weeks in backwardation!!!

Everything points to a massive breakout for gold and silver. The flattening of the yield curve, the difference between the 2y T (2.27%) and the 10y T (2.77%) is only 50 bp, in combination with the trade war that is filling the headlines physical gold and silver and their mining companies might be THE investment going forward. Remember the central banks can increase interest rates only so much before the global debt at $230trn is going to collapse with all the interest rate derivatives, totaling some $750trn, in their wake.

April 8, 2018

© Gijsbert Groenewegen

Silverarrowpartners

g.groenewegen@silverarrowpartners