Usually, the "Greater Fool Theory" applies to fools chasing the momentum of a hot stock. They bid it up, hoping to unload it onto a "greater fool" at a higher price, sometime in the near future. This same process is currently playing out again though, in this case, the fools are short and the instrument is silver.

I cannot stress strongly enough the unprecedented quality of what we are seeing. Nearly two months ago, on February 5, the price of silver closed at $31.94. On that day, a Commitment of Traders survey was taken and it showed that the Large Speculator (managed money, hedge funds, HFTs) category was:

Long 42,449 contracts AND

Short 6,588 contracts.

This gave us an unusually high and bearish LSpec net long ratio of 6.44:1.

So here we are, seven weeks later, and a new CoT was released back on Friday. With price last Tuesday night at $28.68, the new Large Speculator breakdown was:

Long 37,548 contracts AND

Short 26,144 contracts.

Immediately, you should notice three things:

- The Large Specs have reduced their net long position by 24,457 contracts.

- The Large Spec net long ratio has fallen to a remarkably bullish 1.44:1.

- In just seven weeks, the gross amount of Comex contracts that the Large Specs are short has quadrupled, from 6,588 to 26,144.

It is in point #3 where we will find the fools and the greater fools.

And what have the banks, pit locals and Silver Cartel members been doing over these same seven weeks? Buying longs and covering shorts, that's what.

Seven weeks ago, the silver commercials were already gross long a record amount of contracts at 46,293. As of last Tuesday, that amount had grown to 55,564. Up another 20%. And the Forces of Darkness were gross short 98,239 contracts on 2/5/13. As of last Tuesday, that number had declined to 79,605. A reduction of 19%. And all of this buying and covering has dropped the all-important Cartel net short ratio back to an extremely bullish 1.43:1.

The only other time I can recall seeing that ratio lower was on 12/27/11. With price near $26.50 and on its way to $37 over the next two months, the Silver Cartel net short ratio was 1.34:1.

So, how does The Greater Fool Theory end? How does this play out? It's simple, really. Eventually, you run out of fools. And we are very, very close to that point in silver.

And keep this in mind: At price tops, when The Cartel is short a massive amount of contracts, they at least have the ability to lay their hands on some physical silver to deliver into the market. The Large Specs have very little, if any, physical silver. When they are short, they really only have one option: Cover.

In the end, The Silver Cartel and commercials win once again. They have managed to buy all the way down, while painting the tape and sucking into the short side an extraordinary amount of spec shorts in an unusually short period of time. The silver market (and also gold) is primed for another exceptionally strong rally. Though picking the absolute bottom is nearly impossible, buying silver and buying time here is an almost-certain winning trade.

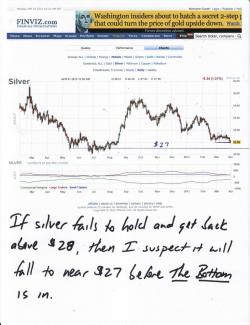

As predicted on Thursday, we are seeing quite a bit of price shenanigans today. Expect this to continue. In fact, even though I just laid out for you the extraordinary case for buying silver, I will not be surprised one bit if price falls toward $27 sometime this week. If silver can be jammed down and closed below the $27.92 low of March 1, more weakness will materialize as a new crop of even greater fools parade into the short side. Given the near certainty of the impending, sharp rally, perhaps we should all be rooting for this to happen. I mean, buying at $27 is even better than buying at $28, right?

So, go forth, relax and be happy. April is going to be a very exciting and fun month. It's now springtime and though last summer was HOT, it wasn't nearly as HOT as I'd expected. And, of course, like any other forecaster, I can't control the weather, I'm just the weatherman. That said, the forecast for April is HOT, leading to an even HOTTER May. So, grab your sunscreen and your Speedo. The party is about to begin again.

TF