Just because I've always wanted to post this.

But before we get to "Hammer Time", a couple of other items first.

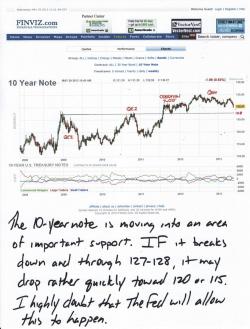

Two weeks ago, we characterized the April NFP #s as the gift that keeps on giving, just like The Jelly of The Month Club. https://www.tfmetalsreport.com/blog/4713/it-edward More evidence of that has appeared over the past few days as the 10-year note has completely fallen out of bed.

Once again, this move in rates can be traced to the BLSBS report of Friday, May 3. Since then, the note has fallen four points and now rests near support at 130, which corresponds to a rate of about 2.15%. This level may hold but I suspect that it will not. More likely is a drop to what appears to be critical support near 127-128.

But here's the deal. There is no way, no how that The Fed is going to allow support to fail, thereby letting 10-year rates back up to 3%+. Not happening. Besides the detrimental impact higher rates would have on the U.S. budget deficit and debt, higher rates would also crush any nascent economic recovery.

Already we are seeing things slow down in the U.S. (Even that statement is nonsense because "slow down" implies that previously things had been really cooking.) Check this headline from ZH just this morning. https://www.zerohedge.com/news/2013-05-29/cash-and-tarry-mortgage-applications-plunge-fastest-rate-2009 And, as discussed last week, if the economy was booming and housing growth was robust, demand for inputs such as lumber would be soaring and soaring demand would lead to higher prices. Right? Right?? Apparently not. Here's an updated chart of the cost of lumber.

So here's what's likely to happen in the weeks ahead:

- The 10-year note may fall a bit farther but then it will bounce and begin to rebound

- Signs that the U.S. economy is weakening will get more mainstream press coverage

- This will likely begin with a May NFP next Friday that comes in "weaker than expected"

- A continuation or even increase of QE will shove stocks even higher

- Gold and silver will finally stabilize and begin trending higher, the start of a summer rally

But first, Hammer Time. Now don't get all freaked out. I'm not talking about another big drop. However, recognizing that all of this silly "tapering" talk will soon be a thing of the past, the metals will likely be shaken out one last time over the next week or so. How much? I would not be at all surprised to see gold trade down toward $1350 again and perhaps bounce off of there a couple of times. Silver could see at least a drop to $21.50 if not a double bottom near $21.

The most interesting thing about the two charts below is the contrast. Gold and silver almost always trade in tandem, tracing out nearly identical chart patterns. But look below. Gold is in an "ascending triangle" while silver is in a "descending" one. Isn't that odd? Looking at these, I'm guessing that the bottom will soon drop out for silver and we'll get the drop toward $21.50, and maybe $21, that I mentioned above. Hammer time.

So, anyway, we'll see. The nice thing for me about predicting a drop in price is that, when I'm wrong, no one is pissed off. Maybe I should do this more often?

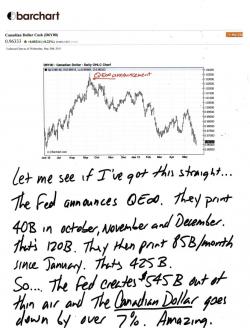

One last thing, someone mentioned yesterday something about the CAD and how it's down since QE∞ began. I read that and thought, "you know, that IS pretty funny". So here it is, in all it's glory. If ever there was a chart that showed you how utterly FUBAR the current markets have become, it's this one. Since the time that The U.S. Fed embarked on a printing regime where they are actively creating from whole cloth $85B/month in new greenback, The Canadian Dollar (which is not being actively devalued) is down over 7%! HOLY REALITY DISCONNECT, BATMAN! I know that I shouldn't be laughing. I have a lot of Canadian readers and I should have some sympathy but this is just incredible.

OK, that's all for now. Have a great day!

TF