Do you ever dance with the devil in the pale moonlight?

Helicopter Ben Bernanke made the decision to dance with the devil in March of 2009. After four years of false prosperity and stability, The House That Ben Built is shaking at its foundations.

Simply put...When you intervene in a market...any market...you are playing with fire. All markets are made up with equal parts buyers and sellers. An equilibrium is reached at a point we call "price". For decades, Western Central Banks and the Bank of International Settlements have played the dangerous game of attempting to "centrally plan" nearly every market in the world. They've attempted to manage currency markets, fixed income markets and equity markets, and, of course, the currency crosses of gold and silver.

After The Great Financial Crisis of 2008, the Federal Reserve Bank of The United States made the disastrous mistake of embarking on a policy of Quantitative Easing. This of course, regardless of what The Bernank wants to call it, is the direct monetization of the ongoing debt and deficit of the U.S. federal government. The market for treasuries has since been distorted by this near-constant Fed intervention. The buying of treasuries and treasury futures was encouraged by creating the appearance of a riskless trade. The mindset was this: "Why worry about falling prices and rising rates? The Fed has your back. They will not allow bond prices to fall."

How and why anyone expected this to end any differently than what we are currently seeing is beyond me. The Fed has so completely distorted the risk dynamic of the treasury market that the trade is left without any connection to reality and that "equilibrium" stated above. Hence, when suddenly The Fed suggests that sometime in the near future they will NOT have your back, everyone heads to the exits at once.

We saw this play out in Japan over the past 6 weeks. Prime Minister Abe had promised unlimited Yen, devaluing the currency in an attempt to spur growth through inflation. This drove the Nikkei to nearly double in six months from November to May. However, all of this BOJ intervention crushed the value of the Yen. This led to a complete breakdown of the Japanese bond market which, in turn, led to a very sharp correction in the Nikkei which continues to this day. In short, by messing with the equilibrium, the BOJ so distorted the markets in Japan that they subsequently lost control. Instead of orchestrating and centrally planning their markets, the BOJ is now forced to react and play a game of financial whack-a-mole, desperately trying to regain control.

In what should not be a surprise, The Fed is now in the exact same position. Years of direct debt monetization and money-printing have driven the S&P 500 from 666 to 1666 while interest rates plunged to historic lows. The yield on the U.S. treasury note traded all the way down to just 1.40% late last summer. Ahhh but look at what has happened since.

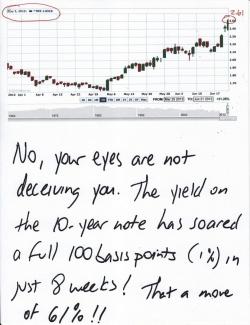

Faced with no option but to continue direct debt monetization, The Fed announce QE∞ last September and, instead of seeing rates drop and stay down, rates have risen. Not much at first...eight weeks ago, the yield on the 10-year note was still just 1.60%. But then what happened? The arrogant Fed, which for years had thought they were the "maestros", planning and playing the markets like a Stradivarius, was shown to NOT be in control. Take a look at this chart below:

You may think: "What's the big deal, Turd. Rates have moved up 1%. So what?" If so, you're looking at it all wrong. Rates have actually moved 61%...from 1.63% to 2.63%. That's a lot. And, so, the question really is, what's going to happen next?

Frankly, that's impossible to say with any certainty. However, the most likely scenario is that the idea of a Fed "taper" will soon be dismissed in the same manner as the "green shoots of economic recovery". If The Fed does nothing and actually goes forward with a plan to "taper", the direct consequence will be a further acceleration of treasury selling and even higher interest rates. As detailed last week, not only do higher rates exacerbate the ongoing deficit and debt, they're like Round-Up to those green shoots of economic growth. (https://www.tfmetalsreport.com/blog/4786/terminal). Ultimately, this implies that the next step for the Fed is not to taper. Not only will QE∞ continue, it will most likely have to be increased. Why? Because the central planners must regain control and to do so, they are going to have to try to drive rates back down.

But here's the rub: It may not work. It looks increasingly like "the cat is out of the bag" or "the genie is out of the bottle". Just as in Japan, the world may have come to realize that The Fed has lost control and that there is no going back. In this scenario, rates may not be controlled and driven lower outside of The Fed completely taking over and monopolizing the treasury market. It's where this was all headed eventually but "eventually" is a long time. Instead, we may be headed there NOW. Not like next Thursday "now" but sometime in the next 3-12 months "now".

This is, of course, the hyperinflation endgame we've all been expecting. Those who have taken the time to read up on The Weimar Republic will soon find that this was time well spent.

TF