In physics class back in the day when I was but a wee lad, I was fascinated by the concept of units of measurement, or more precisely their definitions and structure. The laws of physics are the same in any language, culture or measurement system – but the units used to measure things like speed, force and distance are especially elegant in SI.

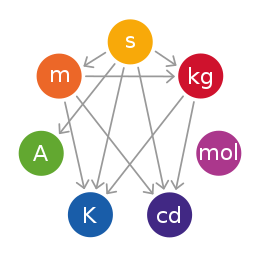

The seven SI base units and the interdependency of their definitions. Clockwise from top: kelvin (temperature), second (time), metre(length), kilogram (mass), candela (luminous intensity), mole (amount of substance) and ampere(electric current). The second of time, kelvin and kilogram are defined independently of any other base units. The metre is defined in terms of the speed of light, so depends upon the definition of the second. The definitions of the other base units are more complex.

I have long had a quibble with calling the mole (or mol) a UOM, as it is merely a number constant (6 x 1023 or so, as I remember). Current is really electrical charge/time, and so seems an odd choice as a ‘base’ metric. But the rest of them are beautiful in their simplicity – and their power. I will focus on just the TRULY basic ones: mass (kilograms), time (seconds) and especially the seemingly easiest one to measure: length (meter).

metre1 US, meter [ˈmiːtə]

n

1. (Mathematics & Measurements / Units) a metric unit of length equal to approximately 1.094 yards

2. (Mathematics & Measurements / Units) the basic SI unit of length; the length of the path travelled by light in free space during a time interval of 1/299 792 458 of a second. In 1983 this definition replaced the previous one based on krypton-86, which in turn had replaced the definition based on the platinum-iridium metre bar kept in Paris Symbol m --- The Free Dictionary

This seemingly simple, humble measurement has enormous impact, when fully applied:

Density of matter: kilograms / meters3

Area: meters2

Volume: meters3

Speed: meters / second

Acceleration: meters / second2

Force: kilograms x meters / second2

Pressure: kilograms / meters x second2

Power: kilograms x meters2 / second3

Energy: kilograms x meters2 / second2

This last bit was always my favorite, for when I learned it, it finally made some sense of E=mc2. It does, however pose a conundrum – speed of light is measured in meters/second. Yet a meter is defined as the distance light travels in vacuum in a given infinitesimal time period – which leads to the true but nonsensical statement that the speed of light is equal to the speed of light. This will have more relevance in a few minutes.

But I digress. Before mankind was able to accurately and repeatedly measure the path traveled by light in a vacuum in 1/299,792,458 of a second, the metric for distance had a fixed, physical ‘yardstick’: an 'X'-cross-section 90% platinum 10% iridium bar. National standards bureau representatives from around the world would travel to the Pavillon de Breteuil in France to take measurements, and construct replicas of their own – but the centrally held ‘official’ bars were deemed to serve as the reference point worldwide. Incidentally, the site enjoys extraterritorial rights, like an embassy. A physical cylinder of metal was made on the same principle for the kilogram.

Image cannot be displayed

Keeping these images and concepts in mind, let us consider an altogether different unit of measurement. There is a unique one that comes to mind, one that – similarly to the measurement of distance in physics – is central to the definition and measurement of many, many things in the world around us. Certainly a significant portion of things considered to be part of modern society. I am, of course, talking about the reserve currency.

- Oil, gas, coal and their components and derivatives: priced (measured) in USD

- US Treasuries (debt issued by the Treasury to ‘back’ dollars): denominated in USD

- Other sovereign and State/municipal bonds: prices calculated based on comparative premium or discount to UST – priced in USD

- Metal ores, refined raw metals – both base and precious: USD

- Agricultural commodities: USD

- Cost of capital: Inter- and Supragovernmental Loans, Mortgage Loans, Commercial Loans, Retail Loans, Credit Card Loans, Payday Loans, Loanshark ‘loans’ -- calculated based on comparative premium or discount to UST – which is, of course, priced in USD

- As a result of the above, the following are all GLOBALLY directly affected or determined by USD:

- Cost of Housing

- Land Values

- Cost of food

- Cost of fuel and ALL alternative forms of energy

- Cost of Manufactured Goods

- Gross Domestic Product of all countries around the world: denominated in USD

- Foreign currencies: priced (to a great extent) in terms of their cross-exchange rate with USD

- USD index: determined by the cross-exchange rate of a basket of currencies, with some (Euro) weighted more heavily than others. (Note the circular definitions arising from #2 and #9-10. )

It surrounds us and penetrates us; it binds the global economy together. There is no escaping its reach. It IS what it IS -- it is defined by itself, yet also defines all else. It is the ultimate serpent biting its own tail. Like the speed of light, it is considered to be a physical constant -- from which other measurements can be defined, since it is constant.

We know all this, you might (rightly) say – so what? Well, through the use of the ‘financial innovation’ that has brought ‘unparalleled prosperity’ to the Western World, esp. in the last 20 years or so, the nature of the USD is not what it once was. The markets, structures, definitions and ‘standards’ above came into being before or just after the closing of the gold window.

“Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.” BSB, 2002 -- it seems he really wasn't kidding about the positive inflation part, anyway

Just like the wonderfully creative, innovative, and socially responsible megabanks created and propagated their instruments of financial innovation **COUGH** (which dwarf in size the entire global economy and ‘real’ financial system as represented by ‘traditional’ money and assets), the central banks have also been busy cooking up their new and improved formulas:

“The world today faces both short-term and long-term challenges. In the near term, the highest priority is to promote a global economic recovery. The Federal Reserve retains powerful policy tools and will use them aggressively to help achieve this objective.” BSB, 2009 -- again, at least the last sentence of this paragraph is true.

“The decrease in purchasing power incurred by the holders of money due to inflation imparts gains to the issuers of money if the rises in the price level are due to increases in the quantity of money. The increases in the price level reveal to some extent the real resources acquired by the issuers of money through the expansion of money.” Charlotte E. Ruebling, FedResBank of St. Louis, February 1975 (it took a while to find the full quote and original source of this oft-quoted truism -- the full paper is worth a look)

The brilliance of our current monetary masters lies in the fact that they have overcome this ‘limitation’ of ‘earning’ money through the hard, painstaking work of JUST money creation. Like true vampire squids*, they are able to make a vig off EVERY movement in the currency supply, through every transaction, through every malinvestment, through ALL activities, whether inflationary or deflationary.

The dollar is but a tool, an instrument, the tailor’s cloth, the potter’s clay. It is to be shaped, molded, cut, chiseled and amended as the current goals of its owners dictate – depending on the circumstances. Its size/length/dimension/color/composition subject to constant adjustment and change – both by the central planners at the CBs, and by the banks through which monetary policy is implemented (but I repeat myself). The resulting metric always ends up favoring one side: the side controlling the currency. Which brings us back to the iridium-platinum bars, specifically formulated for their durability, immutability, resistance to change and imperviousness to heat – to serve as a standard of measurement worldwide.

Imagine these sticks being housed in a huge vault enclosing a metals foundry, where they can be shortened, lengthened, thinned, bent or diluted with metals of different elasticity characteristics IN REAL TIME, but behind closed doors. All the world would see would be the readouts from instruments attached to the perfectly straight, perfectly long and perfectly even-shaped 'metre stick' on a screen -- while in reality it looks more like this

This manipulation of the base unit of measurement of the global economy has massive impact on the real world – just as manipulating that (rather expensive) yardstick in Paris would have done, in its day. If the standard measure of length were to fluctuate over time as much as the USD, how would we measure Force, Energy or Area? What would happen while trying to build skyscrapers? Or high-precision aeronautical equipment? Or microelectronics? Roads? Transoceanic cables?

Why, the same things that are happening in the global economy recently. Some regions were better able to recognize and take advantage of this phenomenon than others. The distortions of development, the transfer of wealth were and are universal, however – along with the instability of the massive financial empires towering over societies. The intricately complex structures of interlocked derivatives are no less vulnerable than equivalent physical constructs to arbitrary changes to the units underpinning their creation. Beyond simple mispricing of assets, labor, resources and time, the manipulation of the unit of account fundamentally (and presumably intentionally/selectively) alters the very fabric of and relationships in the economy.

But by and large much of the world (and certainly the issuing country and its Western cohorts) are going to almost COMICAL lengths to pretend that that meter is still THE meter. Inflation is mild to moderate, and its rate is carefully integrated into economic modeling. Nothing to see here, move along. Ignore the shrinking packaging and item counts, the price of energy, food, education and healthcare. And hundreds of millions, if not BILLIONS of people still firmly believe that the measuring stick truly IS a stick that can reliably measure. Headlines such as this (were they to appear) might not really raise eyebrows :-) (thanks, Wizard):

Markets In Turmoil As Price Of Money Skyrockets To $90 A Dollar

How much stretching, bending and heat can that platinum bar take, before ultimately succumbing to forces greater than its tensile strength? How long, before this Schrödinger currency is finally directly observed, thereby dying? In a way, the recent ’legislative’ events can be seen in one of two ways (that perhaps come to the same thing in the end):

- We, the representatives of the People have decided that the TOTUS has the wisdom, the authority, the balls – aw, what the heck, the God-given right to determine the length of the yardstick.

- Yardstick?! We doan need no steenkin’ YARDSTICK!

Is there a new, brighter, shinier yardstick waiting in the wings? To be offered by the current stage managers, or by the rest of the world? Will it take more time, and if so is there a Plan B for what might happen should events accelerate? It certainly looks like we are a fair mile further down the road towards that event. We have in many ways become accustomed to the landscape blurring by, it no longer conveys the sense of speed it used to at first. We are all careening in a car whose components have tolerances that are now approaching or far below the variance of their unit of measurement. The car’s speed is undetermined and indeterminable, the speedometer might as well be an Infinite Improbability Drive. The road may or may not hold the car’s weight, as the asphalt’s density and weight tolerance may or may not match that of the car. Perhaps the car will simply run out of gas and stall, or break down in a non-cataclysmic way by the side of the road. But jumping out at this speed would result in wicked road rash (if not painful death).

I still prefer to continue working on my own Plan B to try to leave the car, using my own set of measurements. At least these are extensible only at the rate of actual wealth acquisition as a result of work… (Alas, I am no good at stealing.)

And the upside? With other parameters unchanged, for each incremental decrease in mass caused by passengers leaving, the kinetic energy of the car should decrease. Regardless of the length of the yardstick.

* DISCLAIMER: I realize Vampyroteuthis Infernalis are harmless saprophytes, and in all honesty should have every reason and right to be outraged at being compared to banksters. See better alternative in comments below.