With a move yesterday by JPM to reclassify 104,000 ounces of gold from registered to eligible, the total Comex registered vault has fallen to the lowest level in recent memory.

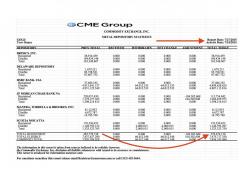

Now, I can show you any number of CME Gold Stocks reports from the last few years that purport to show a total registered Comex vault of 600,000-800,000 ounces of gold. That yesterday's report shows only 378,476 ounces is remarkable and interesting but not the point of this post.

After last week's carnage, there was all sorts of reporting about how "gold has lost its luster" and how "demand was falling". Is that true? Is that why the paper Comex price fell so dramatically? Or, instead, did the paper price fall because a collection of hedge funds and banks were able to short Comex futures with impunity and with no recognizable limit to the amount of leverage they're able to use?

Remember, the only reason that futures markets exist is to give producers of a commodity a marketplace where they can manage risk by buying and selling forward. Taking the other side of these trades are the speculators who make bets on the future direction of price. Physical backing of the paper price is what gives these "future" prices legitimacy.

But what level of physical backing must be present in order to ensure a fair and accurate price? If an exchange has 1,000,000 bushels of corn on hand, can they issue paper contracts for 5,000,000 bushels, thereby creating leverage of 5X? Maybe that's too low and the level of leverage should be 10X? The exact amount of appropriate leverage is hard to pin down but I think we can all agree that 20X or 50X has the effect of artificially stretching the distance between price and economic reality.

And this leads us to gold on the Comex. The CME open interest report for Monday showed a total Comex gold open interest of 440,550 contracts. As shown above, the total amount of registered gold held in the Comex vaults is just 378,476 ounces. Keeping in mind that each paper contract represents 100 troy ounces of gold, we can find the exchange's leverage by dividing 44,055,000 troy ounces of paper obligations by the 378,476 available and delivery-ready registered ounces. And what do we get?

116X

So the question becomes: Is this "fair" and does this market discover an accurate representation of price when it uses a leverage of paper to physical at 116X?

And this is where this is all just one, big scam. With no boundaries or limits placed on The Bullion Banks which issue these paper contracts, what's to stop them from extending the leverage to 200X? Maybe 300X? How about 500X? What's the difference? So long as the world recognizes these fraudulently-determined prices as legitimate AND so long as The Banks can find physical metal to deliver at the paper price, the charade will continue.

The point of this post is simply to remind you of what a fraud this all is. Paper derivative transactions made at the speed of light between momentum-chasing hedge funds should not be the basis for a global price which ultimately effects real people with real jobs and real savings. Let's hope that sanity and fairness someday return to the global precious metal pricing structure. In the meantime, all we can do is continue to force The Banks' leverage even higher by removing physical metal from their system and placing it out of their collective reach.

TF