Yes, what we are about to show you is simply a collection of anecdotal data points. Taken separately, perhaps they can all be written off and marginalized. Taken collectively, however...well, maybe there's something to consider here.

This site has been around for over five years now and, for most of that time, we've preached about how fractional reserve bullion banking is a scheme that is destined to fail. By pricing a physical commodity upon the oversupply of paper derivatives, shortages become inevitable. The market recognizes the value of the mispricing and drives up demand. At the same time, the lower price affects supply as producers of the commodity limit or shut down production due to the economics and declining/negative margins.

What eventually happens is a physical supply shortage that manifests itself in smaller global stockpiles. This is evident in the increasing abundance of stories about the tight global gold market, particularly in London. This has also become apparent in silver as, just this week, Thomson Reuters GFMS released their latest Silver Interim Report, which projected the third consecutive year of a global shortfall in the supply of physical silver. Check these links for details:

- https://www.cpifinancial.net/news/post/33686/mine-production-stagnates-a...

- https://srsroccoreport.com/official-release-world-silver-deficits-12-yea...

- https://smaulgld.com/silver-coin-and-bar-demand-2015/

As we all know, the global "price" of physical gold and silver is largely derived by trading on highly-leveraged futures exchanges such as The Comex in New York. On these exchanges, a modern form of alchemy has been perfected, whereby a relatively small amount of metal can be leveraged multiple times in the creation of paper metal derivative contracts. If after five years we are, in fact, seeing the first real physical cracks in the global paper metal bullion banking scheme, logic would compel us to expect those cracks to appear at The Comex first.

And that may be what we are seeing play out in real time. Below are those "anecdotal data points" mentioned above. Consider them independently but also take time to view them collectively, as well.

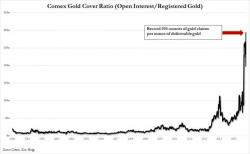

COMEX BANK LEVERAGE AT RECORD LEVELS

This site and others have been documenting this trend for weeks. What we're talking about here is not margin leverage. Instead, this is The Banks' ability to lever their existing supply of readily-deliverable gold. On the Comex, this is gold classified as "registered" and it is this registered stockpile that has been at record lows for over two months. As of Thursday, the amount of gold shown in this category was just 151,384 troy ounces. When you divide this amount of available gold into the total amount of "paper gold" outstanding...as measured by a total open interest of 424,000 contracts (100 paper ounces per contract)...we get a historically high and unprecedented leverage ratio that is nearing 300:1. We've repeatedly written about this here and you can also see this displayed on the chart below from ZeroHedge: https://www.tfmetalsreport.com/blog/7249/bullion-bank-leverage-soars-nea...

TOTAL COMEX GOLD STOCKS

However, it's not just registered gold on The Comex that is dwindling, it's also the total amount of gold held in the bullion bank vaults. The chart below was published yesterday by Dave Kranzler, at his excellent site called Investment Research Dynamics: https://investmentresearchdynamics.com/did-greshams-law-invade-jp-morgan... Note that over the past five years the total amount of gold held within the Comex vaulting system has declined from over 12,000,000 troy ounces to yesterday's new low of 6,436,404 troy ounces. Of course, this hasn't limited The Banks ability to create paper metal to meet occasional speculator demand, but that's a topic for another day. https://www.tfmetalsreport.com/blog/7214/inherent-unfairness-comex

THE GOLD HELD BY JP MORGAN

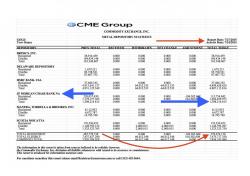

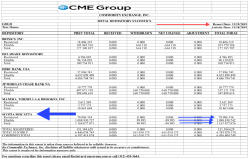

But let's dig even deeper and look at the gold held by individual Bullion Banks within the Comex vaulting system. Every day, the CME puts out a "Gold Stocks Report" which attempts to show the total amount of gold held within the Comex vaults, though the CME added a major disclaimer to the report back in 2013 (https://jessescrossroadscafe.blogspot.com/2013/06/caveat-emptor-another-...)

On the Gold Stocks report below, dated July 27 of this year, note that JPM reported a total vault of nearly 1,398,215 ounces. In that vault were 115,755 ounces categorized as registered and 1,282,460 ounces listed as eligible.

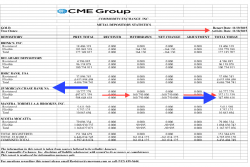

Next is a chart from about two weeks ago. Note that JPM's total vault has been more than cut in half. Total registered gold has fallen to just 10,777 ounces and total eligible gold was shown to only be 657,721 ounces. Hmmm.

But now look at what has transpired in just the past week. The total amount of gold held in the vaults of JPM has been cut in half again! As of Monday, JPM showed a total of 668,498 ounces of gold in their Comex vault. After two separate withdrawals of nearly five metric tonnes, JPM's vault was down to just 347,898 ounces as of yesterday:

So, after including the massive withdrawals of just this week, the total amount of gold held by JPMorgan in their Comex vault has fallen by 1,050,317 troy ounces...or 32.7 metric tonnes...that's a cumulative 75.1%...in just the past four months.

SCOTIA MOCATTA'S GOLD AND SILVER VAULTS

And if you're beginning to feel as I do...that all of these points are connected...then what is going on at The Scoshe might be the most important as the Canadian bank, Scotia Mocatta, is the "oldest" gold dealer and bullion bank in the world.

One might think that, as the world's oldest bullion bank, The Scoshe is pretty well wired into what's going on in the global gold market. Additionally, you don't get to be the longest-tenured bullion bank without recognizing/anticipating change and then positioning yourself for future profits...and, as importantly, avoiding current losses.

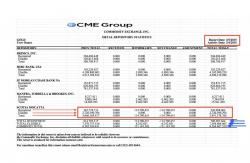

We've detailed what appears to be a slow-burning "bank run" that is ongoing at Scotia Mocatta's Comex vault. We most recently wrote about the trend here: https://www.tfmetalsreport.com/blog/7170/comex-bank-run-scotia-mocatta Note that The Scoshe (or their clients) almost appears to be exiting the Comex system...similar to what we're now seeing at JPMorgan. As you can see on the report below, back on March 5 of this year The Scoshe allegedly held 3,066,169 troy ounces of gold in their Comex vault. (You might also note the total amount of gold held by all six banks at that time and compare it to the 6,436,404 ounces reported yesterday.)

Now let's look again at the CME Gold Stocks report from yesterday. Notice that The Scoshe currently shows just 79,096 ounces of registered gold and about 1,008,831 ounces of eligible gold for a total vault of 1,167,927 troy ounces. This means that, over the course of the past 8+ months, Scotia Mocatta has lost 77% of its registered gold and 60% of its eligible gold. As measured by its total vault, the drop has been 1,898,242 troy ounces...or 59.4 metric tonnes...that's a cumulative 61.9%...in a little over eight months.

And here's where the intrigue regarding The Scoshe gets even deeper. They're losing (moving?) silver, too.

Below is a CME Silver Stocks report from September of 2013. Note that the total amount of silver held with Scotia Mocatta's Comex vault was well over 22MM ounces or about 695 metric tonnes.

By May of this year, Scotia's silver vault was down to about 15MM ounces or about 468 metric tonnes:

And after yesterday's posted withdrawal of over 1MM ounces, Scotia's Comex vault held only 5,148,700 troy ounces of silver.

So, measuring from September of 2013, the drop in Scotia Mocatta's Comex silver vault has been 17,188,272 troy ounces...or about 535 metric tonnes...that's a cumulative 76.9%...in about 26 months.

SUMMARY

Again, we'll leave it up to you, the reader, to decide if something significant is happening behind the scenes OR if what has been displayed above is simply a collection of disparate data points. Maybe ponder these questions over the weekend, though:

- Is the world's most important bullion bank (JPMorgan) moving gold away from a Comex system that is leveraged to a degree not seen before in its history?

- Is the world's oldest bullion bank (Scotia Mocatta) relocating gold AND silver away from and out of the same Comex vaulting system?

- If they are doing so, are these banks signaling that they, too, understand that the days of the current fractional reserve and derivative-based pricing scheme are numbered?

- As gold and silver exit the Comex system...and as reports continue about physical tightness in London...and as the world continues to run physical silver supply deficits...it at safe to conclude that the system's ultimate collapse is, at a minimum, an eventuality?

I don't know about you, but I think I'll buy some more gold and silver today...and take immediate delivery. The current pricing scheme may not collapse next week or next month (as stated above, we've been writing about this for over five years), but it's not going to last forever, either. And when change does come...and a new system emerges that determines price on the trading of physical and not synthetic metal...I'm quite confident that the prices "discovered" are going to be a little bit higher than $1100/ounce for gold and $14/ounce for silver.

Prepare accordingly.

TF