As we've been monitoring all year, the total amount of gold allegedly "delivered" through the Comex has soared in 2016. This is simply another anecdotal datapoint of gold demand but the trend is certainly noteworthy, particularly when you see the numbers thus far in October.

We've already written about this trend several times this year. Our most recent article is linked below and I strongly encourage you to read this post as a refresher before you continue.

As noted in the post above, 2016 has seen a very unusual "delivery" pattern for gold on the Comex. Consistent with surging open interest and surging demand for gold in all its forms around the world, "deliveries" of gold through the Comex have increased as well. However, when you compare "deliveries" for 2016 versus 2015, you'll notice that the divergence and increase didn't really begin in earnest until June if this year. See below:

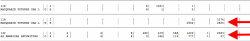

As you can see, for the first six months of 2015, the amount of Comex gold "deliveries" totaled 4,149 for 414,900 ounces or about 13 metric tonnes. Through May of 2016, total Comex gold "deliveries" were 9,683 for 968,300 or about 30 metric tonnes. As you can quickly do the math, this is over a 2X increase and certainly noteworthy on its own merit.

However, beginning with the "delivery month" of June, Comex gold "deliveries" began to explode at a startling pace. Check the charts above again and note the totals over the past four months. For the period June-September 2015, total Comex gold "deliveries" were 8,832 for 883,200 ounces or about 27.5 metric tonnes. For the same period this year, total Comex gold "deliveries" totaled 39,646 for 3,964,600 ounces or about 123.5 mts. This is about 4.5X times the 2015 amount.

And now look at what has happened during the October...a month which is historically the lightest "delivery month" on the Comex calendar. Again, referring to the charts above you can see that the total number of Oct15 "deliveries" was 950 for 95,000 ounces or slightly less than 3 metric tonnes. Through yesterday, October 21, the Oct16 "delivery" total is a whopping 9,163 for 916,300 ounces or about 28.5 metric tonnes. This is over a 9X increase versus the same month last year!

And this gets even more interesting when you drill down into the day-by-day "deliveries" and open interest...

The Oct16 Comex gold contract went "off the board" back on September 29. That evening, there will still 7,393 Oct16 contracts still open and, with First Notice Day pending the next day, all of these remaining contracts had to be fully funded with 100% margin, indicating a willingness and financial ability to take or make delivery. The October deliveries began on September 30 and total Oct16 open interest fell to 4,458 as 2,470 contracts were "delivered" and 465 contracts were liquidated by speculators unwilling or unable to make the 100% margin requirement.

A normal "delivery" pattern would then show a declining amount of open interest in the active "delivery" month as gold is "delivered" and contracts are closed. However, as you can see below, it has been a very busy month. You should also be sure to note the current total:

So, contributing to the total "delivery" number that exceeds last October by a factor of 9.5, there has been a surge of new open interest that has entered the Oct16 contract with the intention of either making or taking immediate "delivery" of gold...electing not to wait for November or the huge "delivery month" of December. The additions of open interest so far total 1,523 contracts for 152,300 ounces or nearly 5 metric tonnes.

Of course, the Comex and CME Group deliberately make it nearly impossible to discern if this is a rush to buy or sell "gold" in October. This new open interest could be a party looking to immediately unload 0,000,000 worth of gold. However, it could also be someone or something looking to buy and take immediate "delivery" of 0,000,000 worth of gold. It could also be some combination of the two...no one can say with certainty. And much of this is the usual Comex Bullion Bank Circle Jerk where one Bank issues out the warehouse receipts while another Bank stops and takes "delivery".

Total Stops: Goldman 2,936, JPM 2,095 and Scotia 819

Total Issuance: Scotia 3,100, Goldman 1,409 and HSBC 532

You can see the entire report here: https://www.cmegroup.com/delivery_reports/MetalsIssuesAndStopsYTDReport.pdf

And this is also interesting. Note the sudden involvement of two firms which had, heretofore, had very little if any activity:

More information on those two firms here:

- Macquarie Futures: https://www.macquarie.com/mgl/com/futures/about-us/about-futures

- SG Americas, a division of Societe Generale: https://ww2.sgcib.com/usa/SG_Americas_Securities_Disclosures.rha

For example, just yesterday, 608 "deliveries" were issued out of the House Account of Macquarie with 533 being stopped into the House Account at Scotia:

But I don't want to get bogged down in the minutiae as this post is not about attempting to unravel the riddle wrapped in mystery inside of an enigma that is The Comex. Instead, we simply wanted to draw your attention to the astonishing increase in the pace of Comex "deliveries". Again, this DOES NOT signal that some sort of Comex delivery failure is imminent or eventual. However, in an anecdotal indicator similar to surging ETF inventories, this massive expansion in the amount of gold allegedly "delivered" through Comex is clearly a sign of a significant increase in demand for gold and synthetic, gold-related investments in 2016. If this trend continues, you can be certain that the new bull market for price, which began early this year, will continue into 2017 and beyond.

TF