Turd back. Turd refreshed. Turd ready.

After giving the printer, the Sharpie and the ruler a few days off, The Turd is back with a vengeance. As you might imagine, I could lay all sorts of charts on you this morning but time limits me to these six. I will certainly have a more comprehensive wrap-up over the weekend.

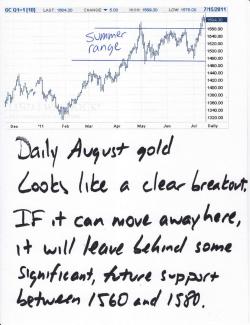

GOLD

Looks terrific. First up, on the daily chart, you can clearly see how it has broken out of the "summer range" I had laid out. It is still susceptible to falling back into the range so it needs, now, to make another leg higher. I'll feel extremely confident that the doldrums are, in fact, over when gold moves past and closes above yesterday's intraday highs near 1595.

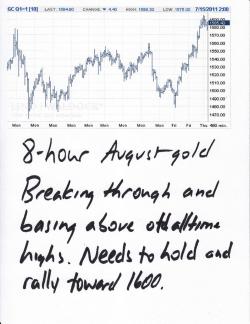

On the 8-hour chart, you can see the breakout past the early-May highs. I mentioned yesterday that a pullback to near those highs would be a good buying opportunity. It was. So far, so good.

And this 2-hour chart is very interesting. Longtime Turdites will note the familiar, "swiss stair"-type accumulation seen here. This is a compellingly bullish chart and indicates more advance to come. The next leg will take gold to 1600+. You'll know the formation has ended and consolidation has begun when the chart breaks down and through the previous stair's high. In this case, we'd want to watch for gold to trade down through 1575. Note that it stopped right there earlier.

All in all, gold looks great. It's poised to tackle 1600 and move on toward Santa's long-awaited 1650.

SILVER

It's almost time to get really excited about silver but I can't blame you if you already are. First look at this 8-hour chart. As you know, I've maintained for quite some time that silver must perform 3 steps before we can get aggressively long again. First, it had to get through the down trendline off of the peak in late May. Check! Then, it had to get through the down trendline off of the recovery high of 39.45 set on 5/11. Check! Lastly, it has to get through and close above that 39.45 level. Not yet but soon?

If you ever wanted to see a classic, textbook bottom, you have one here on this 2-hour silver chart. A steep decline and sharp reversal off of the second bottom at 33.50. A rally to 37 with a sharp pullback that stops right at the level of the top between the two bottoms, near 35. Then, a powerful rally. Like gold, silver pulled back almost exactly to the point I'd mentioned yesterday as a good entry spot. I hope you were able to take advantage of the opportunity. If not, don't despair. More opportunities await.

Let's watch silver very closely here. Once silver closes above 39.45, it will move very quickly toward $40. When it begins printing numbers that begin with "4", open interest will explode as big money will rapidly return to the pit. Once this happens, I expect silver to rapidly advance toward 48-50.

CRUDE

Just wanted to throw a bone to all of the crude-watchers. It is trying to form a reverse H&S but needs to be watched closely. Just as we need crude to rally again and get back above $100, it also needs to avoid slipping back below 94. Keep a close eye on this one.

OK, that's it for now. Thanks again for your patience in allowing me a little Turd downtime. Have a great day! TF

p.s. Be sure to check out Santa's latest: