Just when world markets were seeking assurance, our esteemed and supremely qualified leader uttered this:

"Markets will rise and fall, but this is the United States of America. No matter what some agency may say, we have always been and always will be a triple-A country," Obama said.

Nothing quite like living in FantasyLand. I hear it's particularly beautiful at this time of year.

How are you feeling about your gold and silver today? Let's see...Dow is down 506. The S&P is down 66. Crude's at $80. Copper and the grains have been pummeled. I know that silver is pissing you off but, considering the absolute demolition of everything that isn't gold, you should actually feel pretty good about it.

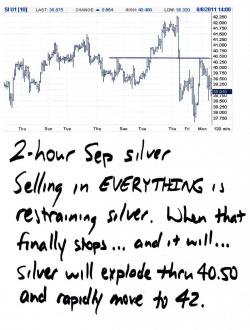

Speaking of silver, here's a 2-hour chart. When the selling of everything finally relents, silver will rally sharply. It will carry through 40.40 and it will move rapidly toward the highs of last week near $42.

However, gold is your clear, hands-down winner on the day. I have a last of $1714, up an amazing $62. There's more to come, too. First up, here's your 2-hour chart. It shows another "stair" higher.

More significantly, I've tried to recreate Trader Dan's weekly chart. Notice the clear breakout of the three-year channel. If it can hold in this area and extend gains...and it's hard to see why it wouldn't...a breakout of this magnitude is extraordinarily bullish. I can see why JPM came out with their "$2500 gold by year end" prediction today.

https://www.zerohedge.com/news/shocker-jpm-sees-gold-2500-year-end

Three years is an awful long time so we must be careful. Gold could easily fall back into the channel and give us a "false breakout". However, the fundos are so strong at present that it may very well stay up and begin a rapidly accelerating extension higher. Watch this very closely as we may be about to be given a once-in-a-decade opportunity to make big fiat, real fast.

Lastly, I did switch a few things around today in order to take maximum advantage of what I see coming. In silver, I eliminated my Sep spreads and am now simply long the $42 calls. In gold, I dumped my October 1700 vs 1800 spreads and went long just the straight 1800 calls. I'm still long my December 1700 vs 1800 spreads, though.

Thanks to all who entered the new contest. If you haven't entered yet, you must pick the Comex closing price for this coming Friday in the September11 gold contract. Use the previous thread to post your guess. No entries submitted later than 5:00 EDT today will be accepted. Btw, if someone has a few extra minutes, would you please help The Turd by compiling all of the entries onto a spreadsheet? Thanks in advance to anyone who can help.

That's it for now. Keep the faith! TF

5:10 pm EDT UPDATE:

As the Globex closes, gold is back to $1722. I can't imagine that it won't make new highs overnight, particularly when Asia is in full swing at around midnight to 2:00 am EDT. For your comic relief, I present below something I just received from a friend. It's the opening paragraph of a "SPECIAL BULLETIN", just released by MSSB. What absolute fools these people are. They can't even spell "committee" correctly! If you are currently working with a traditionally-trained "financial advisor"....well, you know what they say about a fool and his money.

| Image cannot be displayed | ||

| ||

| Latest Report from the Global Investment Policy Comittee: Downgrade . GIC Special Bulletin: Impact of US Credit Downgrade on Markets | |

11:25 pm EDT UPDATE:

These late nights are wiping me out. Holy cow, gold is up another $42 as I type at $1755! The S&P is down 28. Crude is down another $4. The grains and copper are getting smoked. At least silver is hanging in there at 39.12.

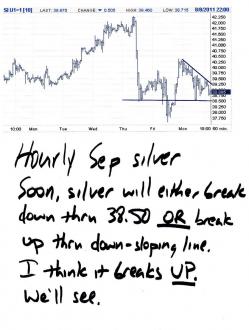

Two things. Watch gold overnight. Santa's number of the final frontier is 1764. For whatever reason, his numbers usually pan out and he's maintained for weeks that 1764 would be defended by The Cartel. In silver, watch this triangle play out. Silver could collapse through 38.50 and head toward 37 but I doubt it. I expect silver to instead charge through the down-sloping line overnight and begin heading higher. We'll see. Anything can happen. Have a great overnight. See you in the a.m. TF