At some point, I guess I've got to stop and decide whether or not it's just wishful thinking.

About two weeks ago, I gave you this:

https://www.tfmetalsreport.com/blog/2658/rally-cometh

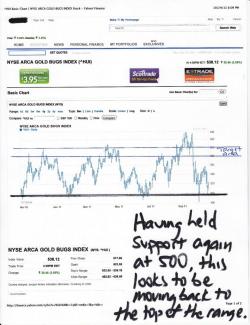

I'd been itching for a gold rally but, until now, it hasn't developed. In the post above, I called for a rally in the HUI to 560-580 and it made it to 560 before falling back to 500 last week. A sharp rally has it back to 538 tonight and it still looks like 580-600 is in the cards. That would be about a 10% rally from here.

But what's got me really worked up is the latest CoT survey. Remember how I always say that the only consistent way to make money trading the metals is to sell when all looks rosy and buy when all looks dreary? The tough part is to get yourself to actually follow that discipline as it goes against basic human nature. Put a different way, history has shown that you want to buy with the banks when the specs are selling. Additionally, you should sell when the specs are strongly buying. Now, back to that CoT survey. Note these week-over-week changes:

Large Specs long: -3901 contracts

Large Specs short: +3623 contracts

Small Specs short: +1878 contracts

The speculators (those consistently wrong) continue to rotate away from long to short.

Commercials (banks) long: +2592 contracts

Commercials short: -6733 contracts

The commercials (those consistently right) are covering shorts to and some are even going long.

Now, chew on this for a moment. The dreaded and evil BoA puts out a report that warns of further U.S. credit downgrades before year-end.

Hmmm. Do you recall what happened from 8/7 to 9/6? How about a $250 gold rally, primarily caused by massive bank short-covering, all of it following the initial U.S. downgrade from S&P. Think of that CoT survey again. Could the banks be trying to front-run the next downgrade?

So, let's just go ahead and put it on the record: I'm expecting a 10% rally in gold before 12/1/11. This gives us a minimum target area of 1780-1840. Let's split the difference and call it 1810 or about 10% UP from where we stand this evening. That type of rally corresponds with where we are on the charts, too:

Soon, we will burst through the tough resistance around 1700 and begin mounting this assault on the backs of continued bank buying as well as the short-covering of the misguided specs. If December plays out similar to Decembers past, gold will then finish the year somewhere between 1750 and 1800, continuing the trend of 20-25% annual returns.

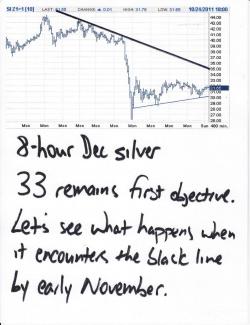

I wish I could be as enthusiastic about silver but I'm not. Though I still expect a stellar 2012, the remainder of 2011 will find silver continuing to struggle with high margins and a pit bully named JPM that doesn't appear ready to begin covering its massive short position just yet.

So, there you go. Once gold closes above 1705, my confidence in this forecast will grow considerably. At that point, I'll look to buy some Dec11 calls. Maybe buy some outright or spread some 1700s vs some 1800s. We'll see. I'll keep you posted.

TF

9:50 am EDT UPDATE:

WOPR is in charge this morning as the PMs are being sold because of this headline:

https://www.zerohedge.com/news/ecofin-meeting-cancelled

Down goes euro. Up goes dollar. WOPR sees dollar up. WOPR sells gold and silver. Yawn.

Perhaps some human buying will emerge soon. At around 1630-35, the hourly chart holds the promise of a little reverse H&S bottom of off last week's test of support near 1600.

Hang in there and enjoy the ride. More later. TF