It's been a crazy day. Sorry that it has taken me this long to update but the first chance I've had.

First of all, I hope that all of you saw this from last night's post. For simplicity's sake, here's a C&P:

"First, read this:

https://www.gata.org/node/10746

One of the things we failed to notice prior to the unexpected beatdown in gold in September was that lease rates had moved significantly into negative territory prior to the attack. One of the articles we referenced back then was this one, linked below:

https://ftalphaville.ft.com/blog/2011/09/14/677021/why-gold-forward-rate-inversion-is-important/

Anyway, here's the point. At -0.5%, lease rates are again near the level they were when gold was savagely attacked last September. One could say that the current, European dollar funding shortage is to blame. Maybe it is and maybe this is just a temporary phenomenon that will not impact the short-term price of gold. However, maybe its a precursor of another big selloff. The banks on the other end of the lease can use the borrowed gold to flood the market with sell orders. I took a bit of grief for not accurately predicting and warning of the September massacre. It gold crashes again over the next few days, don't say you weren't warned this time."

As if on cue, the PMs were savagely beaten today. Gold is off about $50 from its intraday high. Silver is down about $1.50. Is this the next stage of the same, coordinated, central bank, negative lease rate selling like we saw in September? Apparently, I'm not the only one who thinks so:

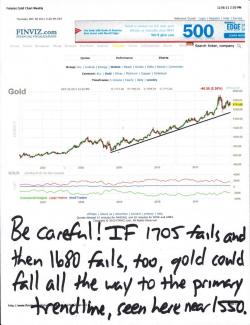

Look, I know that I just gave you a rather optimistic forecast for December. That was based, however, on what we knew at the time and the current position of the charts. Listen to me now: BE VERY CAREFUL. If you are foolish enough to be trading leveraged, paper metal on the Comex, trying to make some Christmas fiat, BE VERY CAREFUL. Gold, in particular, is in a very precarious position.

You all know of the importance I place on 1705-1710. Well, now that level also corresponds with the lower trendline of the pennant from the September lows. IF 1705 gets taken out overnight or tomorrow (which appears highly likely), buyers will pull bids and gold will rapidly drop toward 1680. IF 1680 fails, gold could fall all the way to 1550. If you are long futures or even something like the UGL and gold falls $150, you're going to get your ass kicked. So, let me say this again for emphasis: BE VERY CAREFUL and watch the 1705 level VERY CLOSELY.

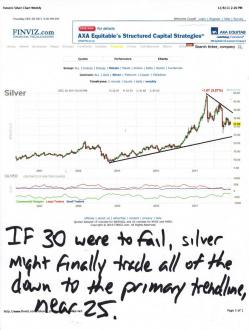

Silver is on pretty shaky ground, too. At this point, I can't imagine it not going to 31 and, if 31 fails, it's going to test the lower end of its range near 30. IF that happens and 30 fails, we may finally see the drop all the way to the long-term trendline that we discussed off and on for the past several months. A drop of this magnitude would take silver all of the way to $25. Again, BE VERY CAREFUL.

OK, onto some other important stuff.

One of the reasons I got behind schedule today is this:

https://silverdoctors.blogspot.com/2011/12/jim-willie-jp-morgan-crashed-mf-global.html

I read this and thought...well, screw it, I'll call Jim myself. We finally connected a few hours ago and we spent a little over an hour discussing current events. Like Santa, Jim is very concerned that the MFing Global situation is going to cause a system-wide crash of epic proportions. This idea of "rehypothecation" MUST BE STOPPED! If it is allowed to continue, a precedent will have been set that enables creditor firms to raid and steal your assets.

Let me explain. Recall that the bankruptcy law changes of 2005 reordered the subordination of creditors. It used to be that bondholders were the most senior of creditors in a bankruptcy. Now, derivative holders are the most senior...senior even to bondholders! If there was ever a more devious, pro-WallSt law created, I'm not sure I've seen it. Anyway...if a firm comingles or "rehypothecates" its assets with clients assets and then uses these funds to buy CDS, the derivative (credit default swap) holder (counterparty) can lay claim to the brokerage or clearing firms assets if that firm declares bankruptcy. Not just the firm's assets but their clients' assets, as well. This is the justification that JPM is using for stealing the MFing Global clients' funds.

If this is allowed to stand, the next time a firm fails (think BoA or Wells or Citi or any bank, broker or mutual fund company), a company like JPM or whomever is the counterparty on the bankrupt organization's CDS, will have precedent to step in and keep (steal) client money to settle their claims. THIS IS OUTRAGEOUS!

I mentioned above that the conversations that Jim and I have are off the record. He did allow me this one quote, however: "If you have money invested anywhere, leave only the amount of money in the system that you are willing (or intend) to lose." Your ultimate risk is that you may wake up one day and find that your life savings have simply vanished.

Look, I could be all wrong about this. Maybe everything will be OK. Maybe this rehypothecation thing is no big deal at all. Please don't take my word for it and then act in haste. Do your own research. Draw your own conclusions. I'm just someone who has been given access to people and information that I never in a million years would have dreamt I'd have. I have a duty to pass along to you what I think. Consider this information but do your own homework, too.

Lastly, I must touch upon the Iran drone thing. We all heard last weekend Iran claimed to have shot down an unmanned, U.S. spy drone.

Then, earlier this week I read this:

https://www.debka.com/article/21545/

I was incredulous. Could Iran really have been able to electronically "hijack" a U.S. spyplane? No way! Well, sure as shit, they did! Take a look at this:

https://www.usatoday.com/news/world/story/2011-12-08/iran-drone/51744902/1

First of all, for those who claim that debka is unreliable and full of shit...maybe not! I've always maintained that debka gets their info directly from sources within The Mossad. Therefore, the site must be read daily. Next and more importantly, the hijacking of a U.S. spy drone is extraordinarily bad news for the U.S. First, just the fact that it actually happened is bad enough. Then, the realization that U.S. military technology infrastructure can be so easily compromised is frightening. If you can hijack a drone, can you launch a missile? Lastly, I fear that this realization will force the U.S to retaliate, either directly or through the allowed action of Israel.

The point is...MENA war continues to get much closer to reality with each passing day and a war between the U.S., Israel and Iran would have serious, global implications.

We often talk about "when the shit hits the fan". Well guess what, between the euro crisis, rehypothecation and MENA war, the shit is hitting the fan right now. Whether or not it all grows into a massive, global shitstorm this week or this month, is irrelevant. It has started. We are in it right now and it's only going to get worse. Continue to prepare accordingly.

TF