First of all, I want to thank everyone for their condolences and well wishes for my pal, Sweetness. He's had a tough go of it recently and every bit of encouragement helps.

With the U.S. markets closed tomorrow, we all have to be on the lookout for some Cartel Craziness between now and Tuesday morning. The Jackals have been utilizing some of these three-day weekends recently to wreak havoc on our precious metals so be on the lookout for all types of shenanigans, especially in light of the European credit downgrades that were announced late Friday.

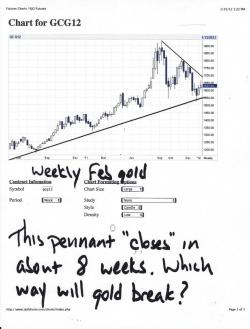

Let's head straight to the weekly charts. First up, as usual, is gold. Note that gold remains firmly entrenched in its long-term UP channel. This is the trend that began at the onset of QE back in 2008 and it continues to this day. Knowing this, can you see why I hold fools such as Gartman in such low regard? To proclaim "the bull market in gold is over" when gold is still so clearly in its channel is either complete foolishness or stupidity. Into which camp Gartman and his ilk fall, I'll let you decide.

To answer the question, which way will it break, remember the following: The long-term trend almost always wins out in the absence of a change in fundamentals. Will the fundamental story for gold change in the next eight weeks? I doubt it.

Next, let's look at silver where we find, not surprisingly, a similar chart. However, there's an obvious, major difference. Note that when silver broke through its long-term channel, it tested the top of the channel about 12 weeks later and then, after that level held as support, it catapulted from $30 to $50 in about 3 months. (Notice that when the same breakout occurred in gold last summer, it failed to hold above the channel and was subsequently forced back down.) Silver is now knocking back on the top of the channel again. Can it break through? Whether or not it does will go a long way toward determining just how far and how fast silver will rise in 2012.

In silver, also note that the only time we've had two, consecutive UP weeks has been during rallies. The fact that we just finished a second, consecutive UP week bodes well for the next several weeks of price.

Here are two other charts that we'll certainly be watching this week.

OK, here is your reading list to help you pass the time while the U.S. markets are closed:

First, the situation in the Persian Gulf continues to deteriorate:

https://www.debka.com/article/21652/

Next, a great article from ZH that shows how one can profit from simply being long gold overnight in the U.S. and short gold during the day. As if this surprises anyone around here...

Here's some fresh, red meat from Eric King:

Another interesting article from Jeff Nielson:

And here is a great story on the demise of The Pig from our pal, Jim Willie:

https://news.goldseek.com/GoldenJackass/1326306021.php

And that's all for now. Enjoy your Monday but be sure to keep a close eye on the PMs. TF