Doesn't it seem as if everything is at a bit of a standstill? Sure, the WOPRs are slowly churning away but there doesn't seem to be any real conviction anywhere to drive markets higher or lower. Yes, there's a lot of uncertainty about Europe but, for me, it all comes back to The Pig.

For neo-Turdites and as a refresher for everyone else, when we discuss The Pig, we do not mean...

Babe

or Miss Piggy.

We mean no disrespect to Porky

or Arnold.

And by no means would we ever disparage Piglet. (LT#2 would be quite irritated if we did.)

No. When we discuss The Pig around here we are always making reference to The World's Reserve Currency, the U.S. dollar. One day soon, the world financial system will restructure and The Pig will be cast aside like The Pound Sterling and the Denarius of ancient Rome. Until then, the relative value of The Pig will remain the primary determining factor of the price direction of many "risk" assets.

(There's a good one for you. The Pig is, most assuredly, doomed. Yet, hard assets such as precious metals are deemed as "risk" assets. Go figure. I guess in the Management of Perceptions, one of the critical elements is management of the language and the terms used to describe things.)

With that in mind, you need to know that we have come to a rather critical juncture for The Pig. Take a look at these two charts. Note the significance of the 82 level on the POSX weekly chart. Also note the seeming reluctance of The Pig to cross 82 on the hourly chart. Look long and hard at these two.

Now look at the daily chart. It would seem to indicate that we are at a rather important crossroads.

So, the question is: What will happen next? Will 82 fall or will the trendline from Halloween break? Hmmm. That's a good question. As you might imagine, I'm ready to hazard a guess. First, though, we must consider a couple of fundamental items.

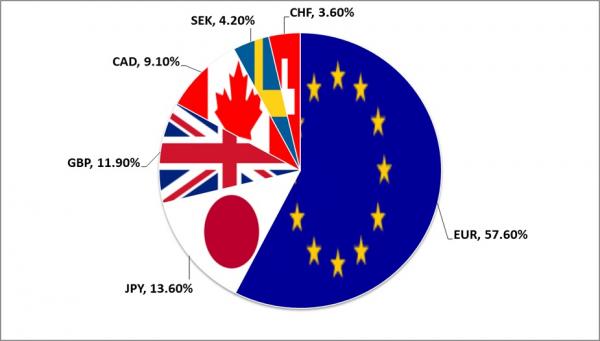

Though the POSX is a comparison of The Pig to a basket of other currencies, the primary determinant of the index is the Euro, which has a weighting of nearly 58%.

And there is already a record short position in the Euro.

https://www.zerohedge.com/news/everyone-hates-euro-eur-shorts-hit-new-record-high

So here's my guess. The Pig will break through 82 and move UP toward 84 based upon a further drop in the Euro which will suck in a few extra, new shorts. At that point, a massive short squeeze in the Euro will develop, which will cause the Euro to rally and The POSX to roll over. The implications for gold and silver of a POSX move to 84 will likely be negative. They will remain under some pressure but hopefully stay in or near the ranges depicted on the charts below. Of course, I could be wrong. Maybe the Euro short squeeze begins later today or tomorrow. If that's the case, 82 will act as a hard ceiling for The POSX and the index will begin to fall toward 80. maybe even 79. Go back up and look at the daily POSX chart again and you will see that we will soon have our answer.

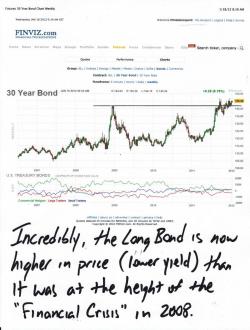

Lastly, I've noticed a lot of talk recently about the timing of the resumption on overt quantitative easing by The Fed. I don't think that it's imminent. One of the things we'll be watching here in 2012 will be the interest rate charts, specifically the 10-year note and the 30-year (Long) bond. Take a look at this weekly chart of the 10-year note. Take note of where the price was at the initiation of previous QE programsand then notice where price is now.

I think it's quite clear that a resumption of overt QE will be foretold by a topping pattern on the 10-year chart. The question is: Are we topping now? Maybe. Take a look at this daily chart. If the 10-yr begins to surge through 132, I think we'll know that QE is still on the backburner. However, if the 10-year rolls over and breaks down and out of this range, dropping through 127, I think we'll begin to sense that an announcement of QEIII is imminent.

We'll be watching the Long Bond (30-year), too. Amazingly, the price of the Long Bond is now at record levels, exceeding even those seen at the height of "The Great Financial Crisis" of 2008. What does this mean? Well, I'll let you figure that one out for yourself.

OK, that's all for now. Hang in there and have a great day. Smile, laugh and be happy.

Oink, oink,

TF